Novaland JSC (Novaland, code NVL) has sent a document to the State Securities Commission of Vietnam (SSC), the Ho Chi Minh Stock Exchange (HoSE), and the Hanoi Stock Exchange (HNX) explaining its efforts to address the warning status according to HoSE’s Document No. 1435/SGDHCM-NY dated September 16.

According to Novaland’s document, in the first six months of 2024, the company has been simultaneously implementing multiple plans and programs to restore its business operations, including restarting projects, completing and delivering products, and providing house ownership certificates to residents, while continuing financial restructuring efforts.

As a result, the number of transactions and documents has increased significantly, leading to more time-consuming audit procedures and information collection and evaluation processes for the company’s semi-annual reviewed financial statements by the auditing firm.

Novaland stated that they have been actively coordinating with the auditing firm, PwC Vietnam, to complete and disclose the reviewed semi-annual financial statements for 2024 within the deadline. However, as of now, the final steps to finalize the reviewed semi-annual financial statements for 2024 have not been completed.

“With the support of PwC Vietnam, we will strive to complete the disclosure of the reviewed semi-annual financial statements for 2024 before September 28, 2024. Novaland commits to continue complying with the regulations and regimes related to information disclosure to ensure the interests of investors and the transparency of the company,” the Novaland document affirmed.

The NVL stock was placed on a warning list by HoSE from September 23, 2024, due to Novaland’s delay in submitting its semi-annual reviewed financial statements for 2024 beyond the regulated timeframe, falling under the case of securities subject to warning as stipulated in Point g, Clause 1, Article 37 of the Listing and Trading Regulations for Listed Securities.

Prior to this, on September 10, HoSE also placed NVL stock on the list of securities ineligible for margin trading due to Novaland’s delay in publishing its semi-annual reviewed financial statements for 2024 beyond the five-business-day deadline.

Following the suspension of margin trading, NVL stock has continuously declined and has now reached an 18-month low with a market price of VND 11,200 per share. This figure is only slightly higher (less than 10%) than the historical low recorded in mid-February 2023. Since the beginning of 2024, NVL stock has lost more than 34% of its value. Novaland’s market capitalization has also decreased to VND 21,800 billion.

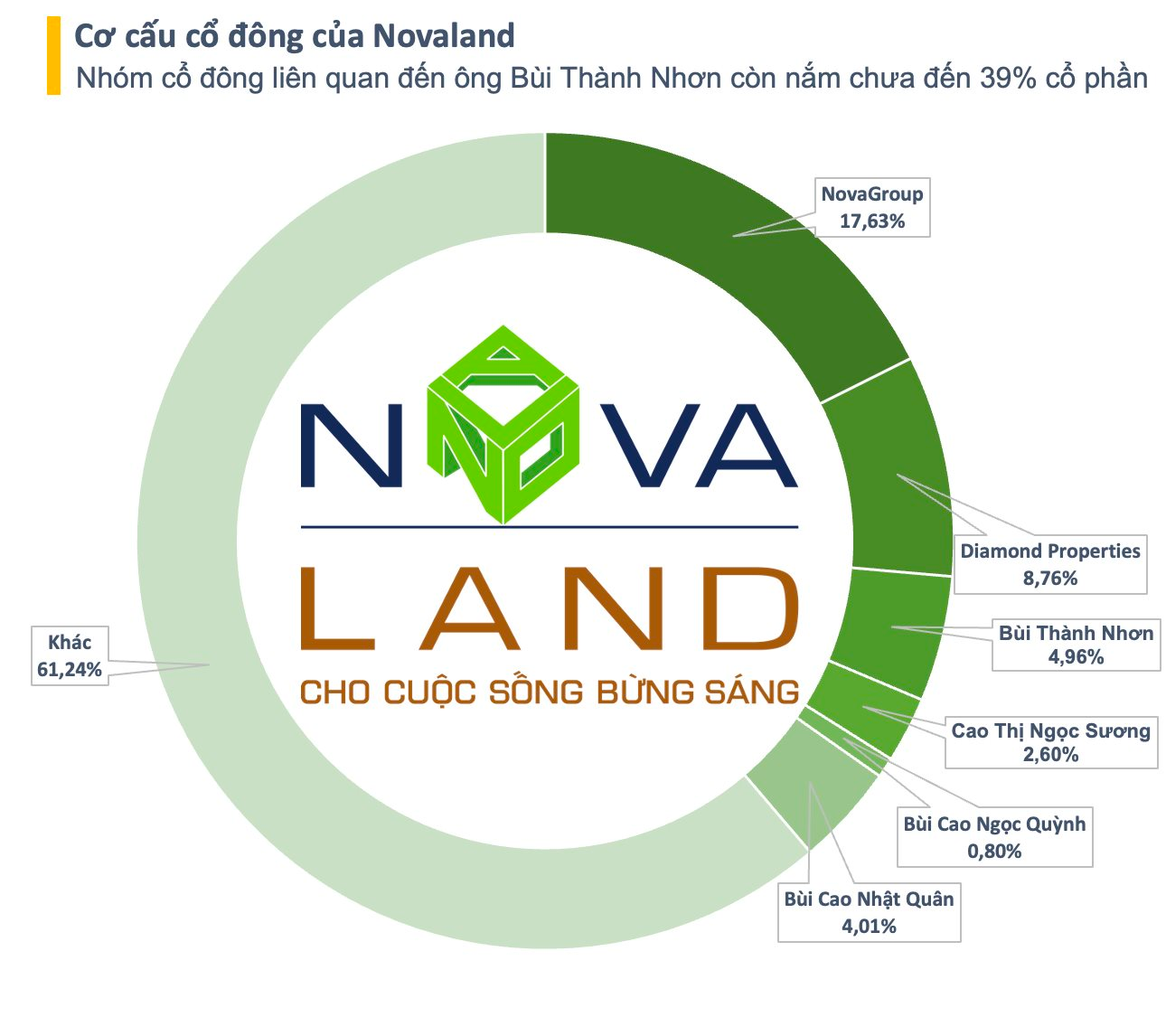

In a related development, NovaGroup recently completed the sale of 3 million NVL shares for the purpose of debt restructuring and support. The transaction was executed on September 6 through a matching order method. Following this transaction, the organization reduced its ownership in Novaland from 346.9 million shares (17.8%) to 343.8 million shares (17.6%).

As of now, the shareholder group related to Mr. Nhon holds a total of less than 39% of Novaland’s capital. With the proactive sale of shares to support debt restructuring and the ongoing forced sale of pledged shares, the ownership ratio of the shareholder group related to the Chairman of Novaland is approaching the “red line” of 36% – the threshold for veto power.

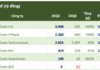

In terms of business performance, according to Novaland’s self-prepared consolidated financial statements for the second quarter of 2024, in the first half of this year, Novaland recorded net revenue of over VND 2,246 billion, an increase of 35.5% compared to the same period last year. After expenses, the real estate enterprise reported a net profit of over VND 344 billion, a significant improvement compared to the loss of VND 1,094 billion in the previous year.

The Billion-Dollar Company’s Shares Halted as All Auditors Refuse to Review

The ITA stock is currently restricted and only tradable during the afternoon session from July 16th onwards.