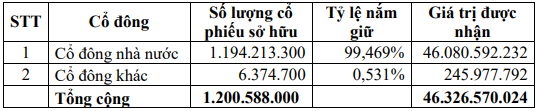

The Board of Directors of MVN has approved a cash dividend payout for 2023 with a ratio of 0.39%, equivalent to VND 39 per share, totaling an estimated amount of over VND 46.3 billion.

The ex-dividend date is set as September 27, after which the Vietnam Securities Depository (VSD) will receive the full payment for securities holders on October 7, and shareholders will officially receive the dividend on October 10.

In terms of ownership structure at MVN, the State Capital Management Committee at enterprises holds almost entirely with a significant stake of 99.469%, thus benefiting largely by receiving nearly VND 46.1 billion.

|

Distribution of MVN’s 2023 Dividend

Unit: VND

Source: MVN

|

Vinalines’ business operations have garnered notable attention recently. During the extraordinary General Meeting of Shareholders held in July, several important matters were approved, including the addition of a VND 356 billion investment portfolio for 2024 to facilitate financial restructuring at Cai Lan International Container Terminal (CICT) – a joint venture between SSA (USA) and Cai Lan Port Investment Joint Stock Company (with Vinalines contributing 56% capital).

Vinalines anticipates that CICT will turn profitable annually post-restructuring. Moreover, aside from debt repayment, CICT will have funds available for new investments to enhance discharging productivity, increase cargo throughput, and accommodate additional vessels. For Vinalines, the projected project efficiency stands at an NPV of over 20 million USD, an IRR of 17%, and a capital recovery period of 6.5 years.

In addition to the investment portfolio supplement, the Vinalines’ General Meeting of Shareholders also approved the addition of business lines and amendments to the Company’s Articles of Association.

Reviewing Vinalines’ business performance for the first half of 2024, the company recorded over VND 8,266 billion in net revenue, marking a 34% increase compared to the same period last year. Ultimately, the company achieved a net profit of over VND 1,196 billion, 1.9 times higher than the previous year’s figure for the same period.

| MVN’s Business Results Demonstrate Growth in the First Half of 2024 |

The Ultimate Guide to Vinalines’ Capabilities: Unveiling the Power for the Mega Can Gio Port Project

The Can Gio International Transit Port project is a proposed venture by the Saigon Port-Vinalines consortium, in collaboration with Terminal Investment Limited Holding S.A. – TIL, boasting a staggering total investment of over VND 113,500 billion.