With an execution rate of 20% (1 share receives VND 2,000) and over 101.2 million shares in circulation, it is estimated that SHP will spend more than VND 202 billion on the remaining dividend payout to shareholders. The expected payment date is October 25, 2024.

The 2024 Annual General Meeting of SHP approved a 2023 cash dividend rate of 30%. At the end of March this year, the Company paid an interim dividend of 10% in cash to shareholders. With the final payment in October, SHP will complete the distribution of 2023 profits with a total dividend of nearly VND 304 billion.

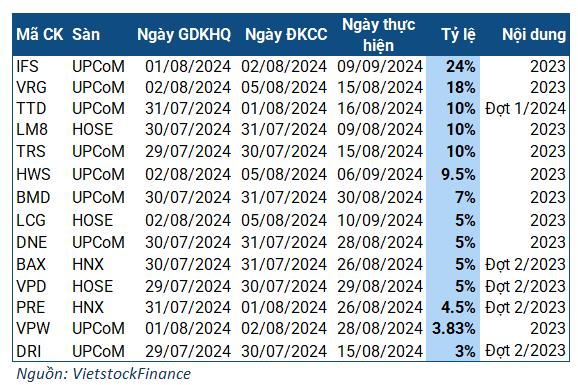

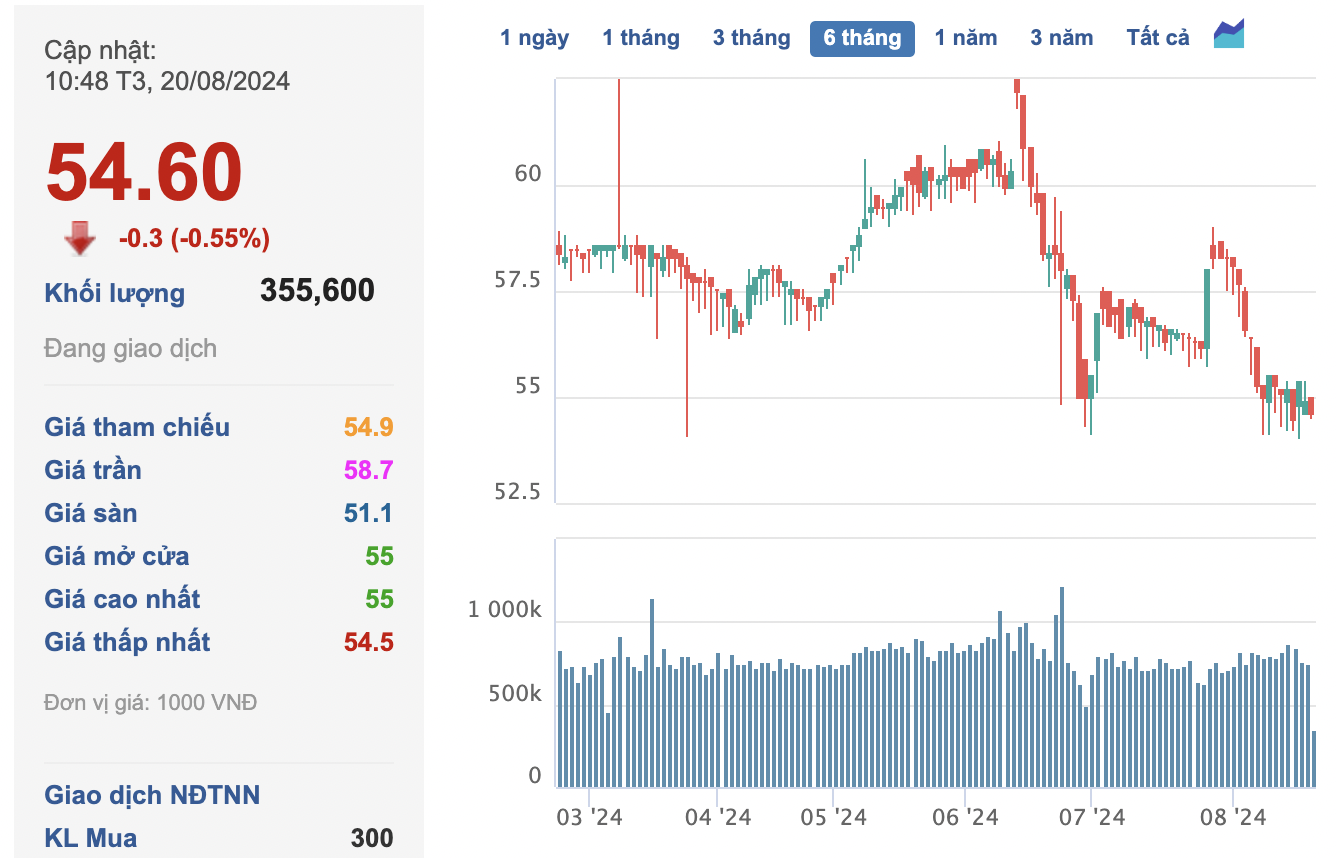

Source: VietstockFinance

|

SHP is a company that regularly pays cash dividends to its shareholders. The cash dividend ratio has been increasing over the years (2010-2019). However, in 2020, the company surprised shareholders with a cash dividend ratio of only 5% combined with a stock dividend (8% ratio). After that year, SHP returned to paying dividends only in cash, with the highest ratio of 35% in 2022.

Source: VietstockFinance

|

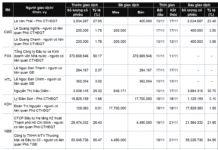

As of June 30, 2024, the Southern Power Corporation is the largest shareholder of SHP, with a ownership ratio of 48.86%. Accordingly, the Southern Power Corporation can receive nearly VND 99 billion from the above payment. In addition, the other two large shareholders are REE Corporation (HOSE: REE, owning 11.09%) and Dak Rtih Hydropower Joint Stock Company (owning 10.33%) will respectively receive more than VND 22 billion and nearly VND 21 billion.

According to the plan approved at the 2024 AGM, SHP expects after-tax profit to increase by 10% compared to 2023, reaching VND 279 billion. The cash dividend ratio is set at 25% (equivalent to VND 2,500/share).

| SHP’s Business Results for the First Half of 2024 |

The company ended the first half of 2024 with net revenue of VND 156 billion and net profit of VND 27 billion, down 28% and 56%, respectively, compared to the same period last year. After six months, the company has achieved only 10% of its full-year net profit target.

According to SHP‘s explanation, revenue and other income decreased by more than VND 63 billion compared to the same period last year due to lower average water flow into the reservoirs of the three plants this year, resulting in reduced power generation. Additionally, the average selling price of electricity in the first half of 2024 was lower than the previous year, leading to a decrease in net profit.

“Dabaco (DBC) Achieves Impressive $83.2 Million in Revenue for August 2024”

The August 2024 revenue of Dabaco surpassed 2.024 trillion VND, an impressive 11% increase from the previous month. The company’s feed and pig farming sectors remain the key drivers of this remarkable growth, showcasing their unwavering commitment to excellence and sustainable progress.