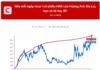

The Vietnamese stock market witnessed another positive trading session, with the VN-Index maintaining its upward trajectory throughout the day, thanks to the consensus among various industry groups, notably the strong performance of blue-chip stocks. At the close of the session on September 19, the VN-Index rose by 6.37 points to reach 1,271.27.

In line with the overall market’s bullish trend, foreign trading activities were a notable positive, with strong net buying of nearly VND 434 billion across the entire market.

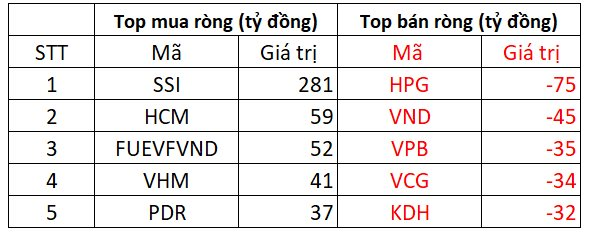

Foreign Investors Net Buy over VND 470 Billion on HoSE

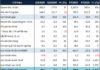

On the HoSE, foreign investors focused their purchases on SSI stock, acquiring approximately VND 281 billion worth of shares. HCM and FUEVFVND fund certificates followed, with net purchases of over VND 50 billion each. VHM and PDR also saw notable net buying, with VND 41 billion and VND 37 billion, respectively.

Conversely, HPG experienced the largest net sell-off by foreign investors, with nearly VND 75 billion. This was followed by net selling in VND, VPB, VCG, and KDH, ranging from VND 32 billion to VND 45 billion.

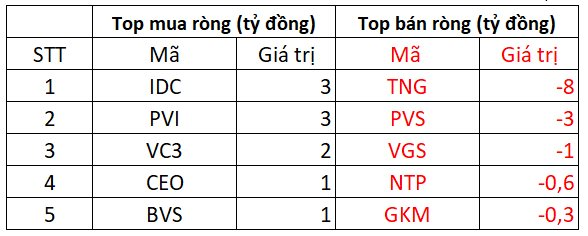

Foreign Investors Net Buy approximately VND 2 Billion on HNX

On the HNX, IDC and PVI attracted the highest net buying, with a value of VND 3 billion each. Additionally, foreign investors net bought a few billion dong worth of VC3, CEO, and BVS shares.

Conversely, TNG experienced the highest net selling by foreign investors, with a value of nearly VND 8 billion. This was followed by net selling in PVS, VGS, and NTP, ranging from a few hundred million to a few billion dong.

Foreign Investors Net Sell VND 39 Billion on UPCOM

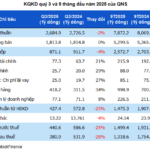

On the opposite side, QNS and BSR faced net selling of over VND 10 billion per code. Additionally, foreign investors net sold shares of ACV, GDA, LTG, and others.