“A Strong Start” to the Fed’s Rate Cut Cycle

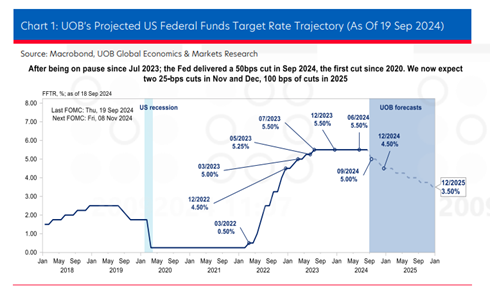

At the Federal Open Market Committee (FOMC) meeting on September 17-18, 2024, the US Federal Reserve (Fed) decided to lower the target range for the Federal Funds Rate (FFTR) by 50 basis points to a range of 4.75-5.00%. This was a deeper cut than UOB’s expectation (of -25 basis points) and marked a “good, strong start” to the Fed’s rate cut cycle, according to FOMC Chair Powell. The Fed also voted to reduce the Interest on Excess Reserves (IOER) by 50 basis points to 4.90% while keeping Quantitative Tightening (QT) unchanged.

Mr. Suan Teck Kin, Head of Research and Global Economics, UOB (Singapore)

|

Mr. Suan Teck Kin, Head of Research and Global Economics at UOB (Singapore), commented: “The FOMC’s latest decision came as a surprise compared to our forecast of a 25 basis point cut, given the relatively stable economic backdrop and easing inflation.”

Following the September FOMC meeting, UOB expects the Fed to continue its rate cut cycle in the remaining meetings of 2024, forecasting a further 50 basis points reduction in the remainder of the year (i.e., two 25 basis point cuts on November 24 and December 24). UOB maintains its expectation of a 100 basis points cut in 2025 (a 25 basis point cut each quarter).

UOB also noted Mr. Powell’s guidance that the Fed’s projections, while not a pre-set plan, still offer “a good starting point for policymakers to see what’s happening,” said Mr. Suan.

The difference in UOB’s forecast compared to the Fed’s is the final projected rate of 3.25%, expected to be reached in early 2026, versus the Fed’s longer-run view of 2.90%. But as UOB pointed out earlier, the Fed has lifted the median in the longer-run for the Federal Funds Rate in the recent dot plots, so it wouldn’t be surprising if the longer-run target rate is lifted to 3.00% in subsequent reports, thus potentially converging towards the final rate projection.

Expectations for the SBV to Maintain Interest Rate Policy for the Rest of 2024

According to Mr. Suan Teck Kin, despite the impact of the recent storm and the VND’s significant recovery since July, UOB still expects the State Bank of Vietnam (SBV) to keep its key policy rate unchanged for the remainder of 2024, as the SBV remains vigilant about inflation risks. Year-to-date through August, headline CPI rose 4.0% year-on-year, just a notch below the 4.5% target. Price pressures could intensify following disruptions to agricultural output, as food accounts for 34% of the CPI weightage.

The SBV may employ a more targeted approach to support affected individuals and businesses in their areas, rather than deploying a broad nationwide tool such as a rate cut. Hence, UOB predicts the SBV will maintain the refinancing rate at its current 4.50% while focusing on facilitating credit growth and other supportive measures.

However, the 50 basis point cut announced by the Fed in its September meeting could increase the likelihood and pressure on the SBV to consider similar policy easing.

The Golden Dream: Investors Revive Hopes for $3,000 per Ounce

Gold bar prices have soared this year, surging over 24%, with gold ETFs experiencing robust inflows for the fourth consecutive month. This has reignited predictions that gold prices could reach the $3,000 per ounce mark by mid-2025.

The Greenback Takes a Tumble: Will the State Bank Step In to Buy?

The recent loosening of monetary policy by the State Bank of Vietnam (SBV) in the context of a sharp decline in exchange rates has led to speculation that the central bank may buy USD at a higher price at the Trading Center to boost foreign exchange reserves. This move is expected to enhance the liquidity of VND in the commercial banking system, ensuring a more stable and robust financial environment.