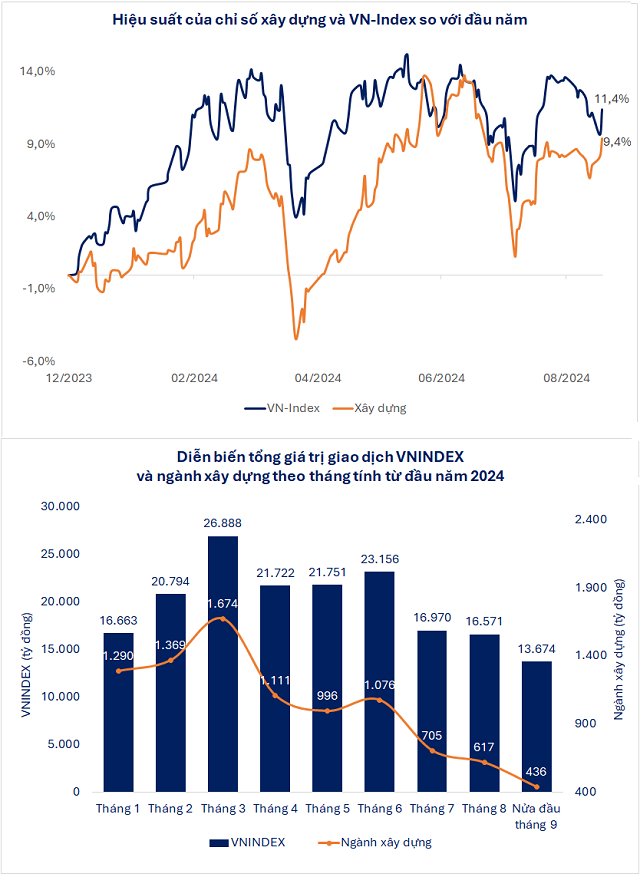

Since the beginning of the year, the construction sector index (9.4%) has been underperforming compared to the VN-Index (11.4%). Additionally, the total trading value of the construction sector has been on a continuous downward trend, falling from an average of around VND 1,290 billion per session in January to VND 490 billion per session in the first half of September (a decrease of over 62% in value).

According to Dr. Phung Thai Minh Trang, Head of Finance and Banking at Hoa Sen University, the performance of construction stocks is going against the fundamental factors. At the same time, there are still many prospects for this sector.

Dr. Phung Thai Minh Trang, Head of Finance and Banking, Hoa Sen University

|

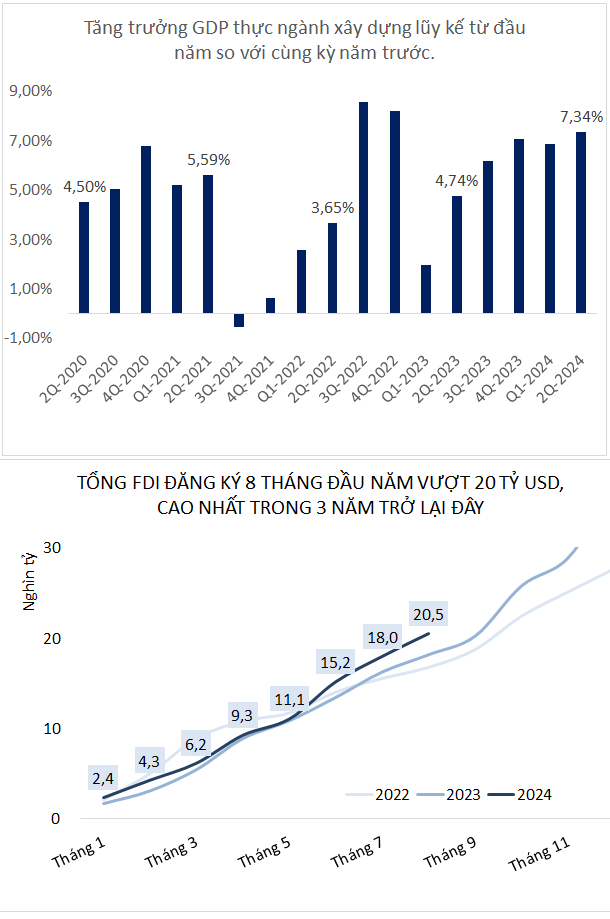

Specifically, in the first six months of the year, the real GDP of the construction group increased by 7.34% over the same period last year, the highest growth rate in the last five years. In reality, both large and small construction enterprises continuously recorded growth in the value of work to be constructed (backlog), even exceeding the annual plan or setting records.

For example, Coteccons (CTD) recently announced that the backlog for the following years is valued at approximately VND 30,000 billion, with the backlog for 2025 alone exceeding VND 22,000 billion. Vinaconex (VCG) and its joint ventures won a series of trillion-dollar packages at the Long Thanh Airport project. Searefico (SRF) won multiple projects in the first nine months, with new contract values totaling nearly VND 1,250 billion and a backlog of over VND 2,600 billion, surpassing the 2025 plan…

In terms of industry trends, Ms. Trang believes that the construction sector has two main drivers: infrastructure and industry. This is because the current trend is that the government is promoting public investment, and FDI is returning positively. Meanwhile, the civil group is slower because the real estate market is not too vibrant, and people’s income and savings are still low. However, with the current situation, the Fed has cut interest rates, and global economic activities can become more vibrant. As a result, people’s spending power may increase, stimulating shopping and real estate activities, thereby positively supporting the civil construction group.

“The beginning of 2025 will be the peak for quite a few construction companies’ profits, especially those that won new bids in 2024. Among them, the public investment group will benefit first, thanks to the government’s efforts to accelerate disbursement in the last months. The next group is industrial construction, thanks to the positive FDI flow, the life cycle of this group of projects is very fast, usually less than 12 months, so the profit peak can be in the first six months. The civil group may be in the second half of 2025 when people’s income and savings become more stable,” said Ms. Trang.

Mr. Do Thanh Son, Head of Investment Consulting at Mirae Asset Securities, agreed with the profit peak of construction companies and added that stock prices often react before the business results of enterprises actually appear.

Mr. Do Thanh Son, Head of Investment Consulting, Mirae Asset Securities

|

Accordingly, the stock prices of the public investment group, such as HHV, VCG, LCG, FCN, etc., after the recent upward momentum, have slowed down and entered an accumulation phase, waiting for new catalysts. Such as stronger public investment disbursement at the end of the year, in which enterprises with large backlogs will be supported more.

The main highlight of the industrial construction group lies in the stocks of enterprises that have shifted from civil to industrial construction. For example, Coteccons (CTD) with construction projects for foreign enterprises’ factories and Searefico (SRF) with high-tech logistics warehouse projects. However, the group’s stocks are still accumulating, waiting for opportunities.

Meanwhile, the civil construction group has not seen many bright spots and is relatively harder to find opportunities.

“Construction stocks still have prospects from now until the first half of 2025. However, there will be a differentiation. The positive may be the public investment group, followed by the industrial construction group. The civil construction group will need to be observed and waited for in the second half of 2025,” said Mr. Son.

In general, from the perspective of experts, the profit peak of the construction industry will mostly occur in the first half of next year. Stocks in the industry may differentiate and be led by the public investment group and the industrial construction group. The civil construction group still needs further observation.

Ha Kim Thanh