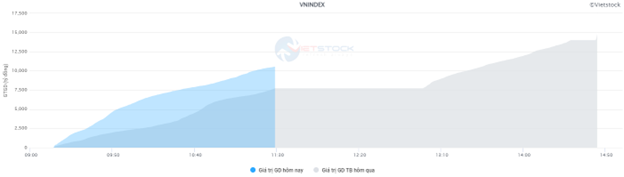

Market liquidity increased compared to the previous session, with the VN-Index matching volume reaching over 840 million shares, equivalent to a value of more than 20 trillion VND; HNX-Index reached over 57.1 million shares, equivalent to a value of more than 1,208 billion VND.

At the beginning of the afternoon session, sellers continuously put pressure on the VN-Index, and strong selling force suddenly appeared at the beginning of the ATC session as this was the session when the ETF funds restructured their portfolios for the third quarter of 2024. However, buying force quickly absorbed the supply and pulled the index back to the reference level at the end of the session.

FTSE ETF, VNM ETF, Fubon ETF: Which stocks will these ETFs buy this week?

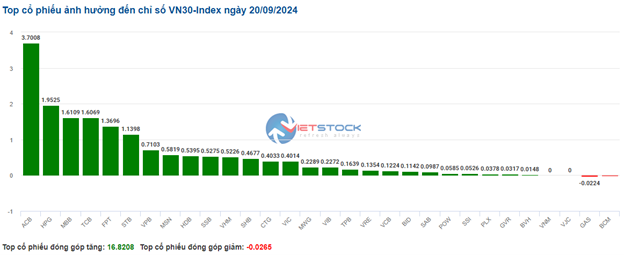

In terms of impact, ACB, HPG, TCB, and MBB were the stocks that had the most positive impact on the VN-Index, with an increase of more than 2.6 points. On the contrary, VCB, VIC, VHM, and VNM were the stocks with the most negative impact, taking away 2.4 points from the index.

| Top 10 stocks with the strongest impact on the VN-Index on 20/09/2024 (in points) |

Similarly, the HNX-Index also had a positive performance, with positive impacts from stocks such as PVS (+2.97%), HUT (+1.2%), VCS (+1.71%), and BAB (+0.85%)…

|

Source: VietstockFinance

|

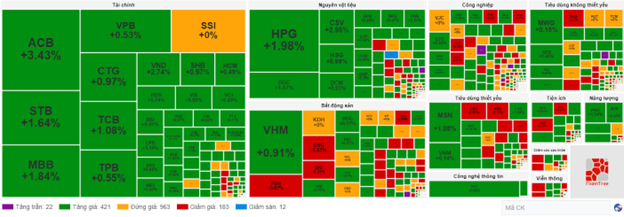

The energy sector was the group with the strongest increase, up 2.54%, mainly driven by the industry giants PVS (+2.97%), PVD (+5.05%), BSR (+2.14%), PVB (+5.65%), and PVC (+3.15%) after the news that the Super Project Lot B – O Mon of PVN was officially inaugurated with a total investment of about 12 billion USD, promising to bring many development opportunities for Vietnam’s energy industry in the future.

Following were the industry and essential consumer sectors, with increases of 0.65% and 0.53%, respectively. On the other hand, the telecommunications sector continued to fall and recorded the strongest decline in the market, down 2.09%, mainly due to VGI (-2.78%), CTR (-1.34%), FOX (-0.11%), and TTN (-2%).

In terms of foreign trading, they continued to net buy more than 128 billion VND on the HOSE exchange, focusing on SSI (139.79 billion), TCB (104.58 billion), VND (53.07 billion), and STB (52.43 billion). On the HNX exchange, foreigners net bought more than 27 billion VND, focusing on HUT (14.33 billion), SHS (9.57 billion), PVS (8.05 billion), and PVI (4.81 billion).

| Foreign Trading – Buying and Selling Dynamics |

Morning Session: Pillar Stocks Lead, Market Maintains Uptrend

The positive momentum continued until the end of the morning session, with vibrant liquidity. At the midday break, the VN-Index increased by 9.51 points, or 0.75%, to 1,280.78 points; the HNX-Index rose by 0.4% to 234.69 points. The VN30 basket outperformed, surging more than 16 points, with buyers dominating, recording 27 gainers, 2 stagnant stocks, and only 1 loser.

This morning’s liquidity improved significantly thanks to strong buying power, mainly in large-cap stocks. The matching volume of the VN-Index reached over 455 million units, equivalent to a value of more than 10.5 trillion VND, up more than 36% compared to yesterday morning. The HNX-Index recorded a matching volume of over 30 million units, with a value of over 647 billion VND.

Source: VietstockFinance

|

Pillar stocks are strongly supporting the market, with the VN30-Index ending the morning session up 16.56 points, at 1,334.97 points. ACB was the stock that broke out the most, up 3.6%, with this stock alone contributing more than 1 point to the VN-Index. Following were HPG, STB, and MBB, which also attracted positive buying force, increasing by more than 2%. BCM was the only stock in the basket that slightly decreased by 0.4%.

Most sectors were covered in green. The energy group broke out strongly at the end of the morning session, surpassing other sectors with a gain of 1.69%, mainly thanks to the large contributions of BSR (+1.28%), PVS (+2.72%), and PVD (+2.91%).

Positive buying force was also witnessed in the materials sector, typically in stocks such as HPG (+2.77%), HSG (+1.73%), DGC (+1.57%), CSV (+2.95%), DCM (+1.19%), BMP (+1.23%), and VCS (+2.02%). The financial sector, led by the “king” stocks, increased by 1%. The most prominent were ACB (+3.63%), STB (+2.3%), and MBB (+2.05%).

On the other hand, the telecommunications sector, after two strong gaining sessions, showed signs of correction, falling more than 1%. This was mainly due to pressure from the industry’s largest capitalization stock, VGI (-1.46%). The rest were mostly fluctuating slightly around the reference level. The other sector dominated by red was healthcare.

Foreigners continued to net buy this morning, but the value was quite low, at about 45 billion VND on the HOSE exchange. The two stocks that were the focus of their trading were STB and KDH. While STB was net bought the most in the market (nearly 55 billion VND), KDH was net sold the most with a value of more than 55 billion VND. On the HNX exchange, PVS was the typical stock that was net bought.

10:35 am: Buyers Dominate

As of 10:30 am, the VN-Index increased by more than 8 points, trading around 1,279 points. The HNX-Index rose by 0.41 points, trading around 234 points.

Green covered most of the stocks in the VN30 group. Among them, ACB gained 3.7 points, HPG added 1.95 points, MBB contributed 1.61 points, and TCB brought 1.6 points. Conversely, only 2 stocks were under selling pressure, GAS and BCM, but the impact was insignificant.

Source: VietstockFinance

|

Stocks in the financial sector soon turned green from the beginning of the session and continued to lead the overall market with a gain of 0.99%. Specifically, buying force concentrated on banking stocks such as ACB (+3.43%), STB (+1.8%), MBB (+1.84%), and CTG (+1.25%) … Only a few stocks recorded slight decreases, but the impact was negligible.

From a technical perspective, ACB stock in the morning session of September 20, 2024, surged strongly right from the opening bell and formed a Three White Candle pattern, with trading volume breaking out strongly above the 20-session average, indicating the participation of large capital flows. Currently, ACB stock maintains a strong uptrend in the long term, continuously creating new higher peaks and troughs (higher high, higher low) while the MACD has given a buy signal again, further reinforcing the current uptrend.

Source: https://stockchart.vietstock.vn/

|

In contrast, the telecommunications group recorded existing selling pressure, negatively affecting the overall market. Specifically, red dominated in VGI (-1.17%), CTR (-0.22%), YEG (-0.75%) … Only ELC (+0.61%), TTN (+0.67%), and FOX (+0.22%) were the stocks that maintained a relatively optimistic green.

Compared to the beginning of the session, buyers dominated. There were 421 gainers and 183 losers.

Source: VietstockFinance

|

Opening: Green Covers the Market

At the beginning of the September 20 session, as of 9:30 am, the VN-Index turned green right from the start, reaching 1,279.03 points. Meanwhile, the HNX-Index also slightly increased, reaching 234.99 points.

At the end of the September 19 session, the Dow Jones index rose 522.09 points (equivalent to 1.26%) to 42,025.19 points, marking the first time the index closed above the 42,000-point threshold. The S&P 500 index advanced 1.7% to 5,713.64 points, surpassing the 5,700-point level for the first time. The Nasdaq Composite added 2.51% to 18,013.98 points.

Investors had some confirmation that the Fed was engineering a “soft landing” for the economy on Thursday, as weekly US jobless claims fell by 12,000 to 219,000, much lower than expected.

Green temporarily dominated the VN30 basket, with 1 loser, 27 gainers, and 2 stagnant stocks. Among them, SSB, HPG, and ACB were the stocks with the strongest increases. Conversely, VJC was the only stock with a slight decrease.

The materials sector was one of the most prominent industries at the beginning of the morning session. Stocks that increased positively right from the start of the session included HPG (+1.39%), CSV (+3.21%), DCM (+1.19%), DGC (+0.87%), BMP (+1.23%), NKG (+0.7%),…