GKM Holdings JSC (HNX: GKM) has just announced a resolution by its board of directors to seek consent from bondholders in writing. The consent solicitation pertains to a proposal to extend the maturity of the GKMH2124001 bonds by 24 months, resulting in a new maturity date of September 20, 2026.

The record date for bondholders is set as September 10, and the deadline for bondholders to submit their responses to the consent solicitation is 9:00 AM on September 18. Subsequently, the votes will be tallied, and the results will be announced on September 19.

According to data from HNX, GKMH2124001 is the only bond issue currently in circulation by GKM. It was initially issued on September 20, 2021, raising VND100 billion to supplement the company’s working capital for production and business activities, financial investments, and the Aluminum Khang Minh factory project in Ha Nam province.

The bonds were allocated to professional securities investors, with an original term of 36 months, maturing on September 20, 2024. They carry a fixed interest rate of 12.6% per annum, payable quarterly. These bonds are of the non-convertible type, do not include warrants, and are secured by 7 million GKM shares.

APG Securities JSC (HNX: APG) acted as the issuance advisor, issuance agent, registrar, custodian, and asset manager for this bond issue.

During the first half of 2024, GKM Holdings made interest payments totaling nearly VND 3 billion and principal repayments of VND 300 million. Currently, the outstanding value of this bond issue stands at VND 44.9 billion.

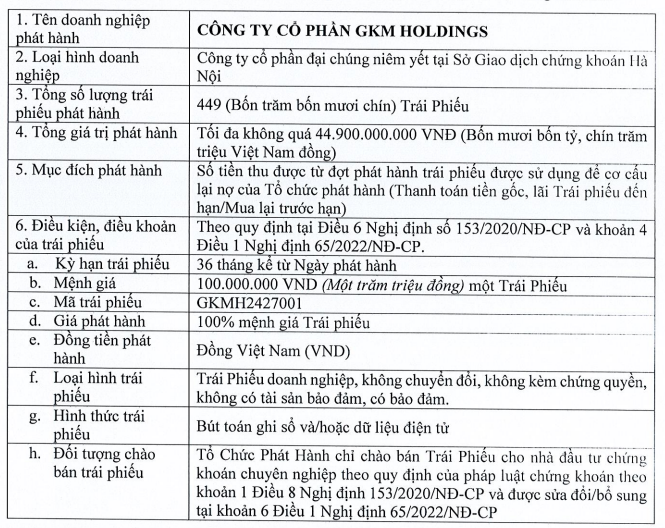

In June 2024, the board of directors of GKM approved the issuance of new bonds, GKMH2427001, with a maximum value of VND 44.9 billion, equivalent to the remaining value of the GKMH2124001 bonds.

This new bond issue aims to restructure the company’s debt, including the repayment of principal and interest on the maturing bonds or their early repurchase. Once again, APG, a familiar partner, assumes the roles of advisory organization, issuance agent, and bondholder representative.

Source: GKM

The new bonds have a fixed term of 36 months, with an annual interest rate of 11%, payable annually. They are also of the non-convertible type, do not include warrants, and are not backed by any collateral.

However, nearly three months have passed since the resolution was approved, and GKM Holdings has not yet disclosed the results of the bond offering.

In terms of business performance, GKM Holdings’ reviewed financial statements for the first six months of 2024 reported revenue of over VND 133 billion, more than 86 times higher than the same period last year. Net income reached nearly VND 6.3 billion, almost double that of the previous year, largely due to the capital divestment from Quartz Stone Khang Minh JSC.

Sure, I can assist with that.

### PVI Insurance: Navigating the Storm with Over VND 400 Billion in Claims Paid to Customers Affected by Storm No.3.

A devastating storm, known as Storm No. 3, swept through northern provinces and cities, leaving a trail of destruction in its wake. The powerful storm resulted in casualties and extensive property damage. In the aftermath, an insurance company stepped up to provide compensation, with payouts totaling an astonishing 400 billion VND to those affected by the storm’s wrath.