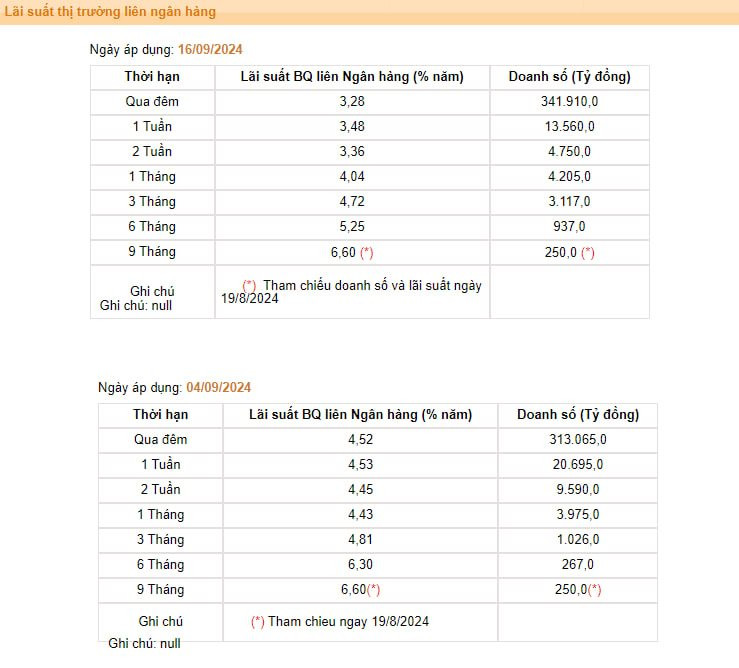

According to the latest data released by the State Bank of Vietnam (SBV), the average overnight VND interbank interest rate (which accounts for approximately 90% of transaction value) fell to 3.28% per annum during the September 16 session, down from 3.47% in the previous week’s final trading session. Compared to the beginning of September, the overnight interbank rate has decreased by approximately 1.2 percentage points, reaching its lowest level since early July.

In addition to the overnight rate, most other key tenors also witnessed significant declines compared to the start of September: the 1-week rate fell to 3.48%, the 2-week rate dropped to 3.36%, and the 1-month rate decreased to 4.04%.

Interbank interest rates have declined sharply compared to the beginning of September. (Source: SBV)

Apart from the plunge in interbank rates, the banking system has also signaled improved liquidity as banks have shown less interest in the SBV’s lending channel in recent trading sessions.

Despite the SBV’s reduction of the OMO rate to 4%, the auction results for the last two trading sessions only reached VND 524 billion and VND 546 billion, respectively, out of the offered VND 3,000 billion per session.

Previously, a total of VND 8,800 billion in OMO was won during the trading week of September 9-13, out of the VND 18,000 billion offered by the SBV.

The sharp decline in interbank interest rates and improved system liquidity follow a series of accommodative moves by the SBV.

In the latest development, the central bank lowered the collateralized lending rate (OMO) to 4% per annum from 4.25% per annum, which had been maintained since early August. This was the second time the SBV cut the OMO rate in just over a month. Previously, the SBV had also lowered this rate from 4.5% per annum to 4.25% per annum during the August 5 trading session.

Additionally, the SBV halted the issuance of new bills from the August 26 session and subsequently injected back all the liquidity it had withdrawn earlier as the old bill lots matured.

Analysts believe that the SBV’s actions indicate a supportive stance towards the banking system’s liquidity and suggest that interbank interest rates could remain at lower levels in the coming period. Moreover, the SBV’s adjustments are deemed appropriate given the sharp decline in exchange rates in recent weeks and the high likelihood of a Fed rate cut in the September meeting.

VNDirect Securities argued that the SBV’s latest moves have reversed the trend of rate hikes witnessed in the first half of 2024, when both the OMO rate and the bill rate were increased to 4.5% from 4.0% and 3.9%, respectively, at the beginning of the year.

VNDirect attributed these developments to the easing pressure on the exchange rate, which has provided the SBV with more flexibility in monetary policy management. Consequently, the central bank now has more policy space to support market liquidity through open market operations and favorable conditions to boost foreign reserves in the latter part of the year.

Following the SBV’s adjustments, Vietcombank Securities also forecasts improved VND liquidity in the commercial banking system compared to the previous period. Given the positive macroeconomic indicators and the central bank’s orientation, VCBS anticipates stable and ample liquidity, with interbank interest rates potentially falling further.

Sure, I can assist with that.

## Empowering Borrowers and Unraveling the Complexities of Collateral: A Lender’s Perspective

“In a proposal to the government, the Chairman of TPBank emphasized the need for enhanced public awareness and borrower accountability regarding loan debts. The bank seeks to address the challenging situation where lenders find themselves ‘standing when granting loans but kneeling when collecting debts.’ This metaphor highlights the urgent requirement for a cultural shift in borrowing behavior and a more responsible attitude toward financial obligations.”

The Art of Liquidity: Why Low Trading Volume Isn’t Always a Bearish Sign

The recent decline in liquidity can be attributed to investors awaiting pivotal monetary policy decisions by major central banks globally, according to KIS Vietnam Securities (KIS Securities). A series of socioeconomic events have also diverted investors’ attention, leading to reduced trading activity.