Shares of BMP, a leading Vietnamese plastic company, have recently surged to new highs, reaching a peak of 121,600 VND per share. In just over a month, the share price has increased by nearly 34%, pushing the market capitalization to nearly 10,000 billion VND, a record high since its listing in 2006.

BMP Shares Surge to New Highs

The surge in BMP’s share price comes amid a sharp decline in PVC resin prices, the main raw material for the company’s products. According to tradingeconomics, PVC future contract prices have dropped to approximately 5,100 CNY per ton, the lowest level since 2016. This presents an opportunity for the company to maintain high gross profit margins in the coming periods.

PVC Prices at an 8-Year Low

The sharp rise in BMP’s share price has been a boon for Thailand’s SCG Group, which holds a controlling stake of 55% in the company through its subsidiary, Nawaplastic. SCG has been steadily increasing its holdings in the leading Vietnamese plastic company since becoming a major shareholder in March 2012.

In March 2018, SCG successfully acquired Nhua Binh Minh by purchasing a block of BMP shares from the State Capital Investment Corporation (SCIC) in an auction. The Thai conglomerate is estimated to have spent approximately 2,800 billion VND on this transaction. As of today, the market value of SCG’s investment in Nhua Binh Minh has nearly doubled to 5,500 billion VND, resulting in a substantial paper profit of nearly 2,700 billion VND.

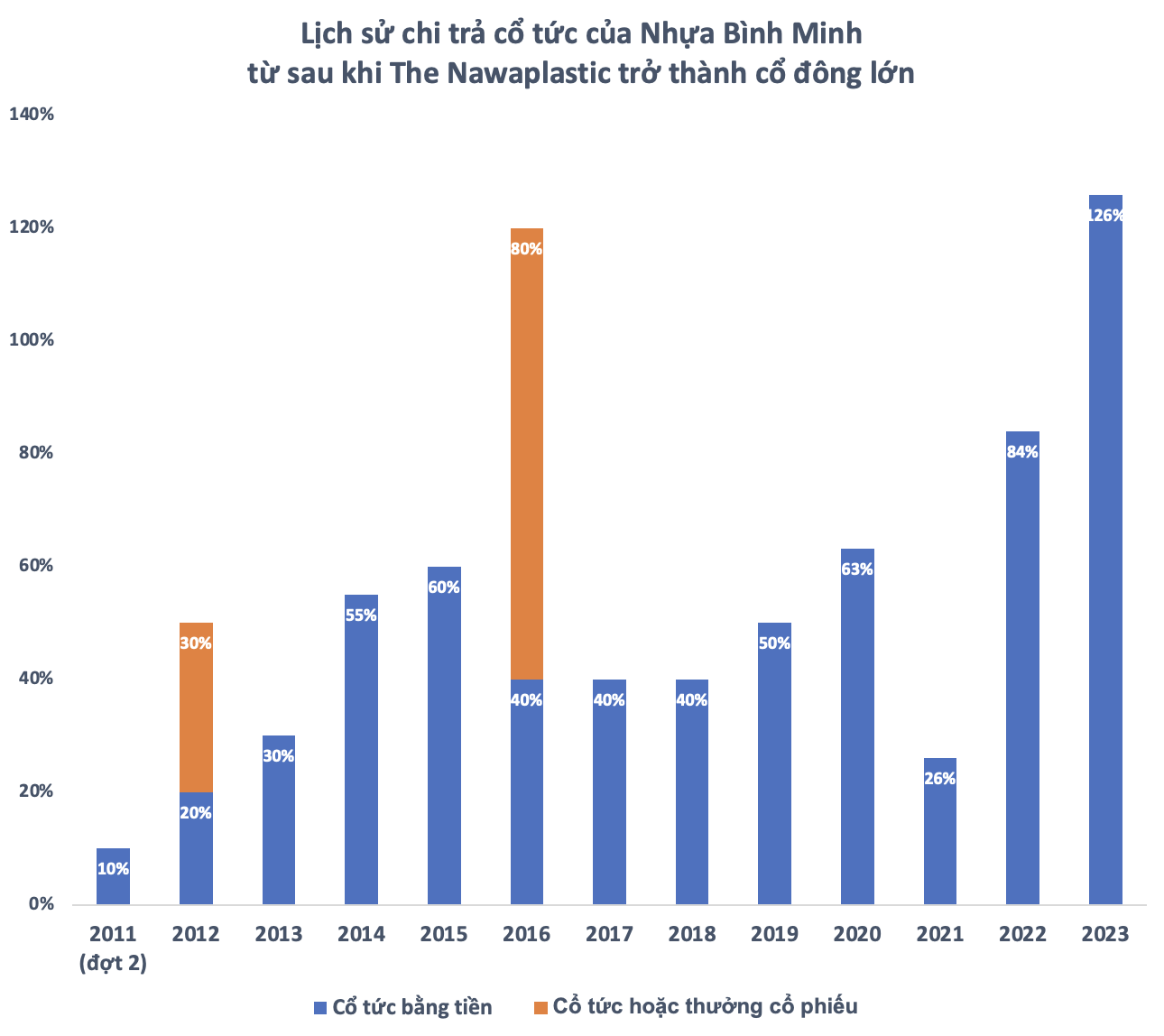

In addition to the capital gains, SCG has also benefited from generous dividend payouts from Nhua Binh Minh. The company has consistently paid dividends in cash every year since 2012. In 2023, Nhua Binh Minh distributed a record dividend of 126% in cash, with the Thai shareholder pocketing nearly 570 billion VND. Overall, SCG has received almost 2,100 billion VND in dividends since becoming a major shareholder.

Nhua Binh Minh’s Production Facility

For the 2024 dividend policy, Nhua Binh Minh plans to allocate a minimum of 50% of its after-tax profit to dividends. In practice, the company has been distributing almost its entire annual profit as cash dividends in recent years.

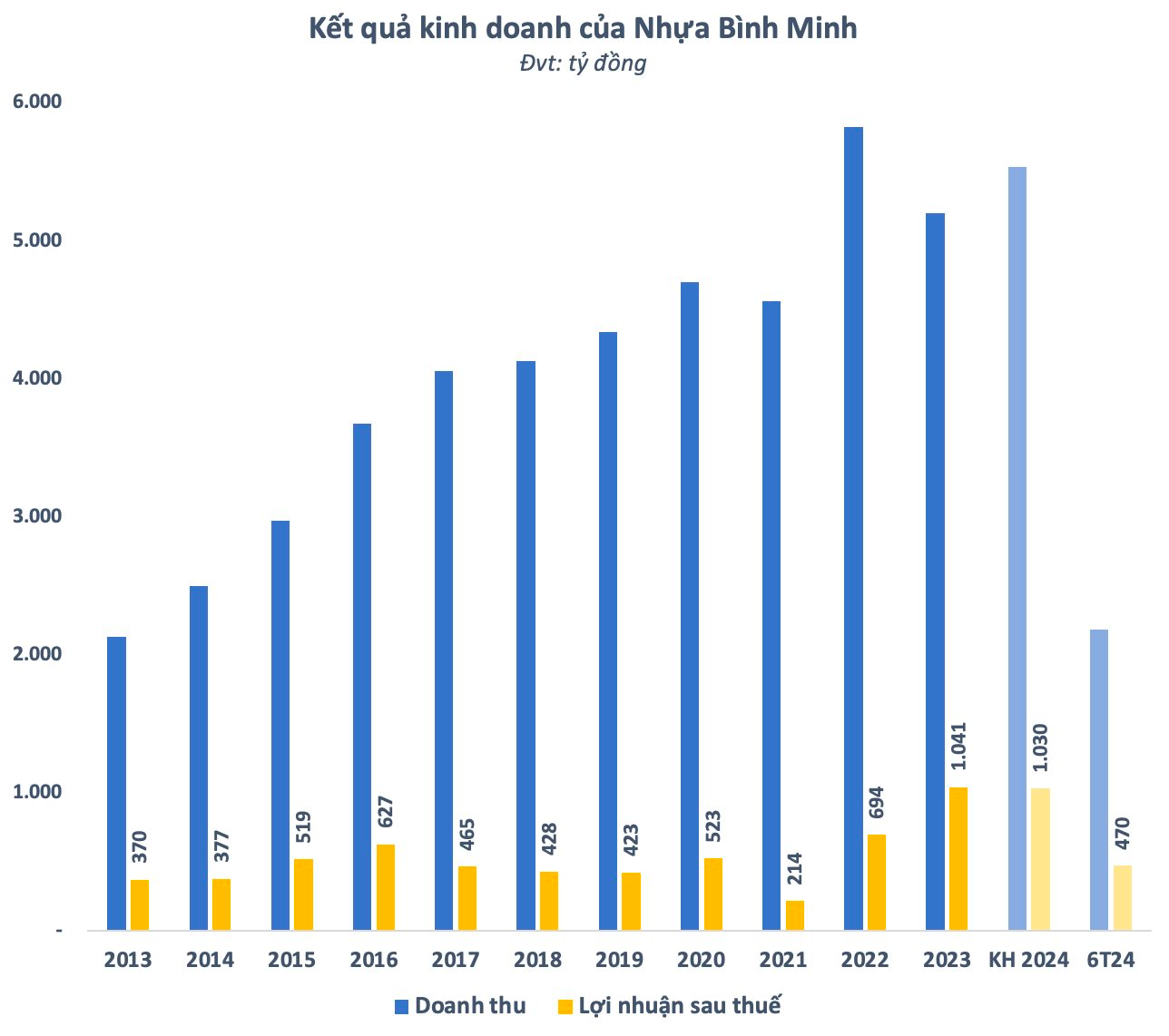

This year, Nhua Binh Minh has set a business plan with a revenue target of 5,540 billion VND, an increase of 6.5% compared to 2023. The after-tax profit is projected to be 1,030 billion VND, similar to the previous year’s performance. If the plan is realized, it will be the company’s second consecutive year of achieving profits in the thousands of billions.

Nhua Binh Minh’s Business Plan for 2024

In the first half of the year, Nhua Binh Minh reported a 22% decrease in net revenue compared to the same period last year, amounting to 2,156 billion VND. After-tax profit also declined by 18% to 470 billion VND. With these results, the company has achieved 39% of its revenue plan and 46% of its profit target for the year.

Nhua Binh Minh is a leading manufacturer of plastic pipes in Vietnam, with a dominant market share of 27% in the domestic market as of the end of 2023, primarily serving the southern region. The company operates four factories with a combined capacity of 150,000 tons per year, focusing solely on the production of plastic pipes.