Investor sentiment improved after a strong market rebound earlier in the session, with the VN-Index briefly surpassing the 1,270-point mark. However, towards the end of the trading day, the benchmark index couldn’t hold on to its gains, as large-cap stocks (blue chips) trimmed their advances. Of the 30 stocks in the VN30, 17 advanced, while many heavyweights such as GVR, MSN, VNM, and VHM failed to sustain their upward momentum and closed below the reference level.

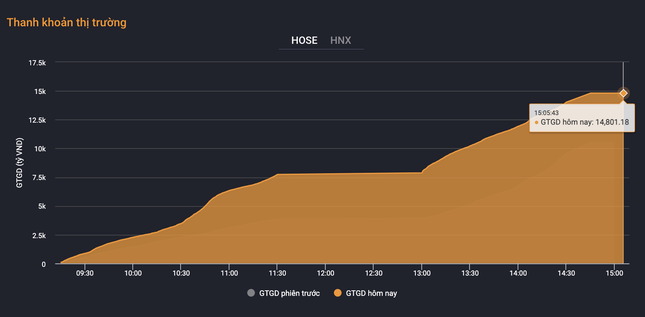

Liquidity surged, with the value of matched orders on HoSE exceeding VND 14,800 billion.

The banking sector provided the most significant support to the market’s recovery, with CTG and VCB taking the lead. Blue chips such as FPT, HVN, and MWG also witnessed positive trading activities. HVN soared by 4.7%.

In the context of the market rebound, securities stocks witnessed a synchronized surge. SSI and HCM maintained the highest liquidity on the exchange, with transaction values of around VND 900 billion each. Securities stocks such as SSI, HCM, VIX, VND, SHS, and VCI closed in the green.

Today’s notable development was observed in the Viettel group of stocks – CTR, following the company’s announcement of a cash dividend payout for 2023, with a ratio of 27.2%. The ex-dividend date is set for September 27.

In the real estate sector, DLG plummeted to the floor price after being placed on the warning list by the Ho Chi Minh Stock Exchange (HoSE) starting from September 23 due to a delay in submitting its reviewed semi-annual financial statement for 2024 beyond the 15-day deadline.

Additionally, DLG is under surveillance for control status due to negative after-tax profits in the audited financial statements for the last two consecutive years (2022-2023) and the external audit opinion on the financial statements. Recently, DLG has been embroiled in controversies regarding bankruptcy proceedings.

At the close, the VN-Index climbed 5.95 points (0.47%) to 1,264.90. The HNX-Index advanced 0.65 points (0.28%) to 232.95, while the UPCoM-Index rose 0.35 points (0.38%) to 93.47. Liquidity spiked, with the value of matched orders on HoSE surpassing VND 14,800 billion. Foreign investors net bought for the third consecutive session, with a net purchase value of over VND 300 billion, mainly in SSI, FUESSVFL fund certificates, FPT, TCB, and TPB…