The VN-Index witnessed a vibrant trading session with active participation from various industry groups. However, increased profit-taking pressure in the afternoon session led to a slight pullback, narrowing the index’s gains. At the close on September 18th, the VN-Index rose nearly 6 points to reach the 1,264.9-point mark.

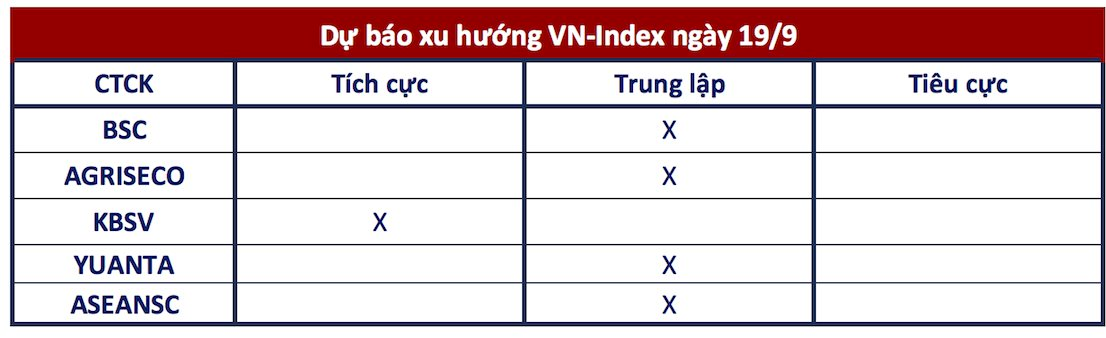

Looking ahead, several securities companies have offered contrasting predictions for the upcoming sessions. Investors should pay attention to potential market-moving events during the last two trading days of the week.

Accumulation

BSC Securities: In the upcoming sessions, if the positive momentum continues, the VN-Index is likely to consolidate at the 1,265 level to gather momentum for a further upward push.

Interspersed Fluctuations

Agriseco Securities: For the foreseeable future, the VN-Index is expected to exhibit sessions of wide-ranging fluctuations, retesting the support/resistance levels at the MA50/MA20-day moving averages. Agriseco recommends that investors increase their stock allocation at current price levels, favoring dips in securities and banking sectors when the VN-Index corrects with low intraday liquidity.

Note that the following session marks the expiration of September and Q3 2024 derivatives, so investors should consider the potential for heightened volatility and market reversals.

Uptrend Remains Intact

KBSV Securities: The significant increase in trading volume and the more aggressive price matching at the MA20-day resistance level indicate that the market’s recovery is facing challenges.

Nonetheless, most large-cap stocks and the VN-Index managed to hold on to their gains by the session’s end. KBSV remains optimistic about the index’s prospects of conquering nearby resistance levels as the uptrend remains intact.

Market-Moving Events

Yuanta Securities: The market may continue to test the 1,270 – 1,275 resistance zone of the VN-Index in the next session. At the same time, the market remains in a short-term accumulation phase, and several events could influence its trajectory over the next two trading sessions. These include the Fed’s interest rate cut, derivative expirations, the Bank of Japan’s new interest rate decision, and ETF portfolio restructurings. As a result, the market may continue to trade sideways unless the VN-Index successfully breaches the 1,270 – 1,275 resistance zone in the upcoming session.

Additionally, the short-term sentiment indicator has surged, suggesting that investors have become less pessimistic.

Potential Risks

Aseansc Securities: We maintain our view that the market will witness recovery rallies in the short term. However, investors should be cautious about potential risks stemming from negative news in the US stock market. Therefore, it’s crucial to closely monitor global markets to assess the longevity of the uptrend. For short-term trades, investors should exercise caution and strive for a balance between profits and risks.