The CTP share price of Minh Khang Capital Trading Public ended at VND 37,000 per share on September 19, about 13% away from its all-time high. The stock surged nearly 6% intraday before closing at the reference price.

Nonetheless, year-to-date, CTP’s market price has climbed an impressive 722% in less than nine months, bringing its market capitalization to approximately VND 448 billion.

CTP Share Price Movement

Insiders Liquidated Their Holdings After a Sharp Rise in Share Prices

In a related development, the company’s General Director and Vice Chairman, Mr. Le Minh Tuan, reported selling all of his 200,300 CTP shares, holding none afterward. The transaction took place on September 9, right before the stock soared to its all-time high in the first half of September.

Similarly, Mr. Nguyen Tuan Thanh, Chairman of the Board of CTP, recently reported selling all of his 800,068 shares for personal reasons, reducing his ownership from 6.61% to 0%. The transaction occurred on September 13 when the CTP share price peaked at VND 42,700 per share.

Notably, these two executives had previously submitted their resignations in May, along with a series of resignation letters from other board members.

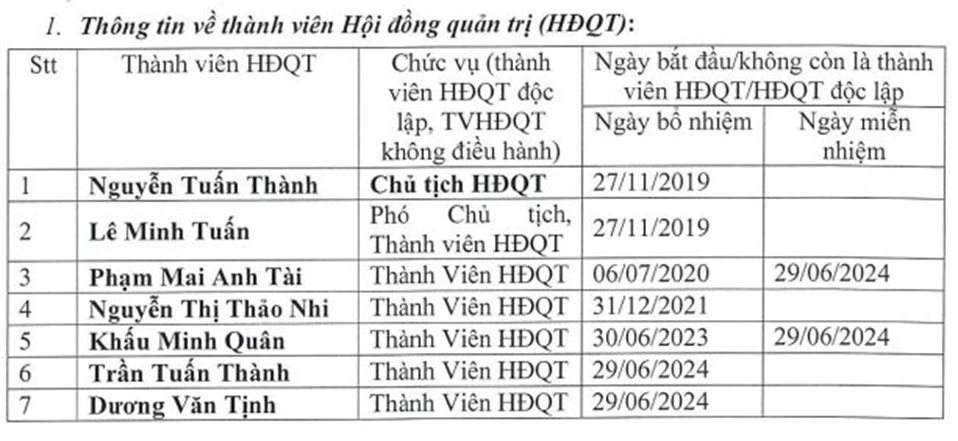

However, according to the latest corporate governance report, only two board members, Mr. Phan Mai Anh Tai and Mr. Khau Minh Quan, were dismissed.

The remaining three board members who had previously submitted their resignations retained their positions. Mr. Tran Cong Thanh and Mr. Duong Van Tinh were newly elected to the Board of Minh Khang Capital Trading Public.

It is important to note that CTP was once manipulated. Specifically, in December 2020, the State Securities Commission of Vietnam (SSC) issued a decision to fine Le Van Hoan (Hanoi-based) for using 29 accounts to continuously buy and sell, creating artificial supply and demand, and manipulating CTP shares.

Zero Revenue in the Second Quarter of 2024

Minh Khang CTP, formerly known as Thuong Phu Joint Stock Company, was established in 2010 with an initial charter capital of VND 3 billion. The company primarily focused on producing, processing, and trading coffee beans. It was recognized as one of the largest producers of green coffee beans in Vietnam and gradually expanded into the export of processed coffee beans.

According to Minh Khang CTP’s 2023 Annual Report, before 2020, the company concentrated on producing, processing, and trading coffee. Following the divestment of nearly 97% of its capital in Nansan Vietnam Joint Stock Company (specializing in producing and exporting Arabica coffee beans) in late 2019, the company diversified into multiple industries.

Currently, Minh Khang CTP operates mainly in the fields of coffee production, processing, and trading, as well as construction materials and real estate. According to its audited financial statements for the first half of 2024, Minh Khang CTP had only three employees.

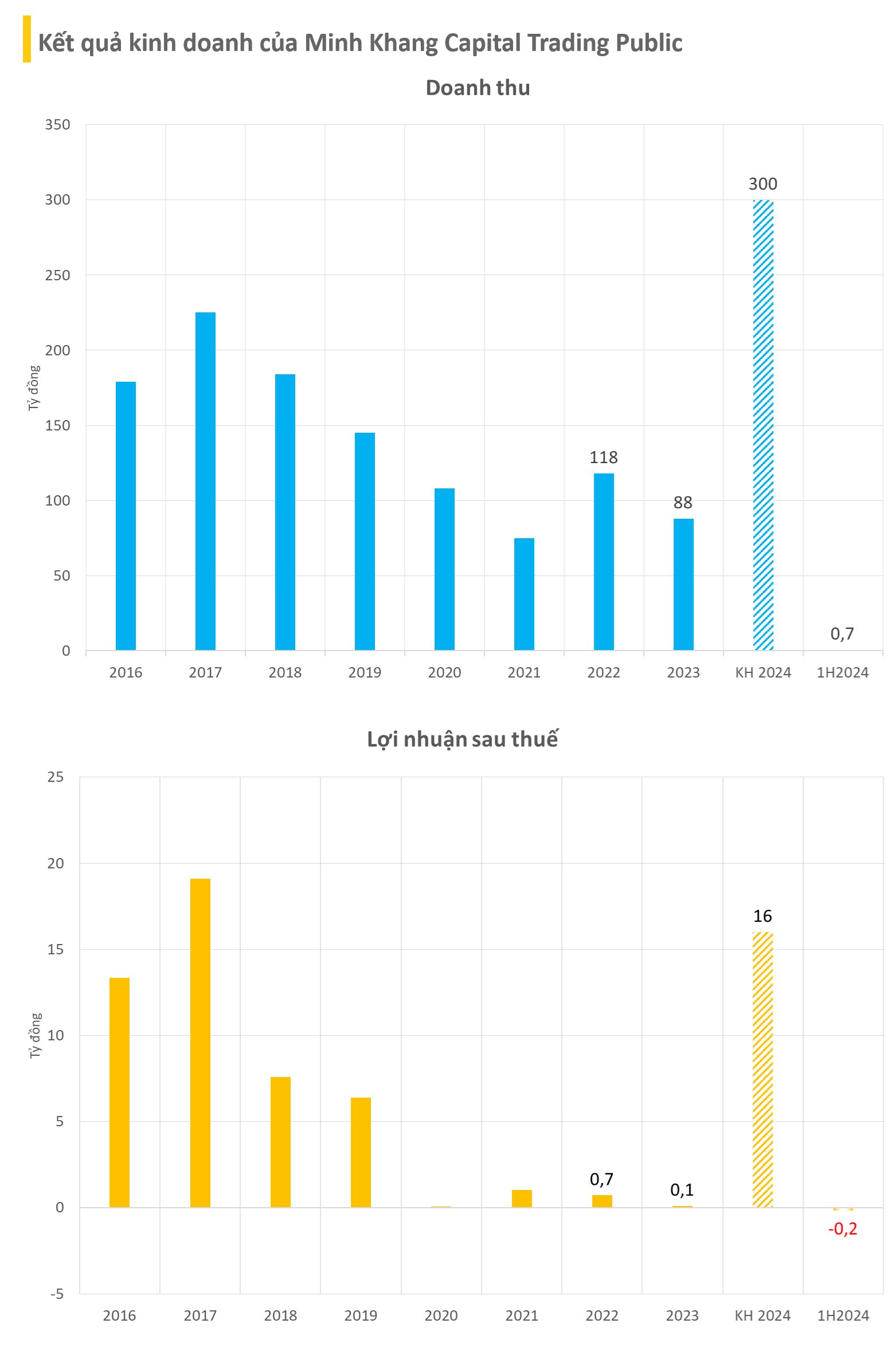

Regarding its business performance, in 2023, CTP recorded VND 88 billion in net revenue and VND 111 million in after-tax profit, a decrease of 25% and 84%, respectively, compared to the previous year. For 2024, the company planned to increase its revenue from business activities by 5-7% compared to the previous year.

However, the results for the first half of the year have not been as expected. CTP’s financial statements for the first six months of 2024 showed a meager revenue of just over VND 700 million. Notably, this revenue was generated in the first quarter, while the company had zero revenue in the second quarter of 2024. Consequently, CTP reported a loss of nearly VND 180 million in the first half, compared to a profit of nearly VND 400 million in the same period last year.