The Ministry of Finance has officially issued Circular 68/2024 amending four circulars related to foreign institutional investors being able to trade stocks without pre-funding requirements (Non Pre-funding solution – NPS) and the roadmap for information disclosure in English. The circular will take effect from November 2, 2024.

According to the latest report by SSI Research, the Vietnam Securities Depository (VSDC), Securities Companies (Securities Companies), Central Depository Banks (CSDs), and investors are currently working to complete the paperwork. This is a step forward in bringing the Vietnamese stock market closer to the requirements for an upgrade to emerging market status by FTSE Russell.

SSI Research forecasts that Vietnam will be upgraded in the September 2025 review. With the upgrade to emerging market status, preliminary estimates suggest that inflows from ETFs could reach up to $1.7 billion, excluding inflows from active funds (FTSE Russell estimates that total assets from active funds are five times higher than those of ETFs).

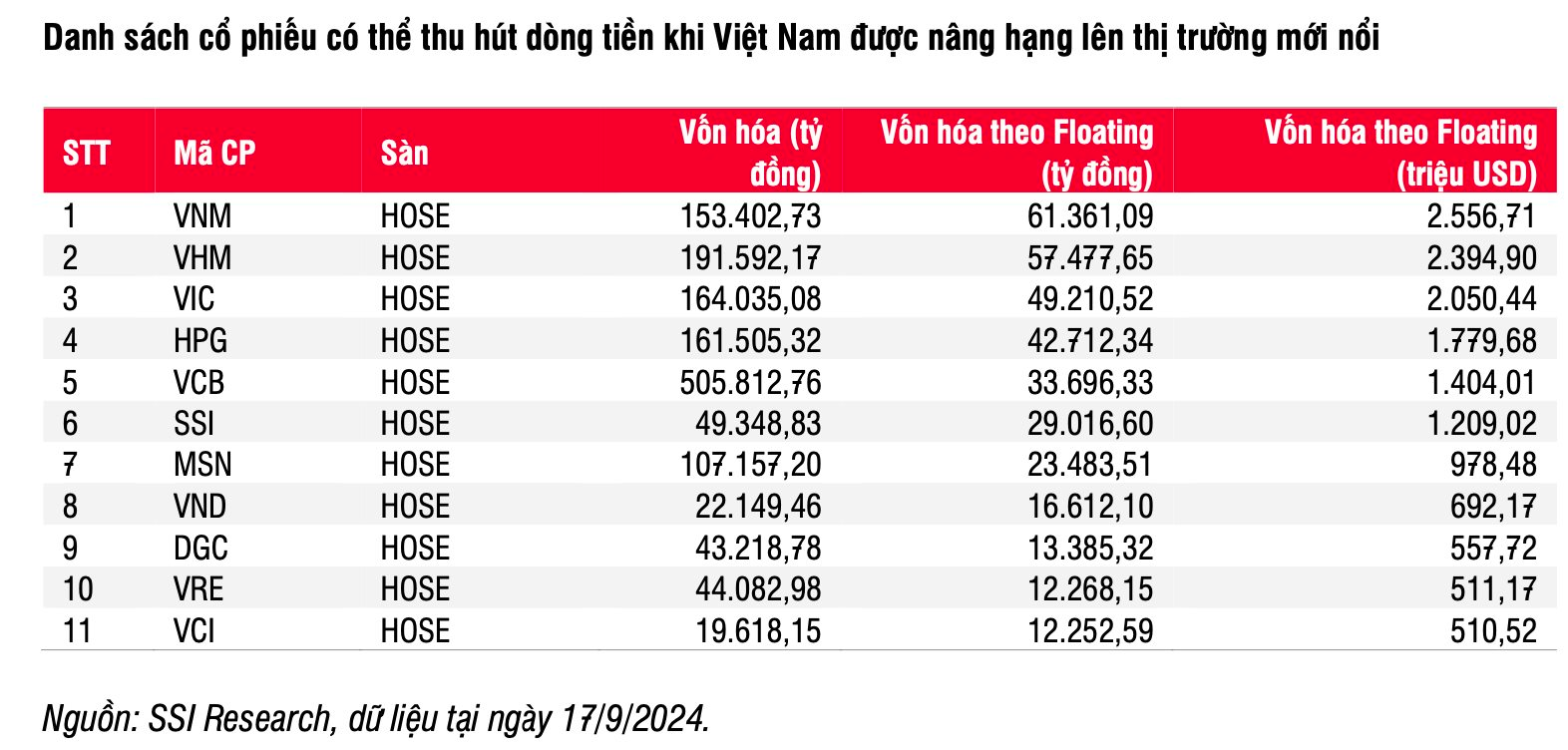

According to SSI Research, stocks such as VNM, VHM, VIC, HPG, VCB, SSI, MSN, VND, DGC, VRE, and VCI could attract large inflows of foreign capital once Vietnam is upgraded to emerging market status. These are all leading blue-chip stocks that have not yet reached their foreign ownership limit. However, the analysis department did not provide specific figures.

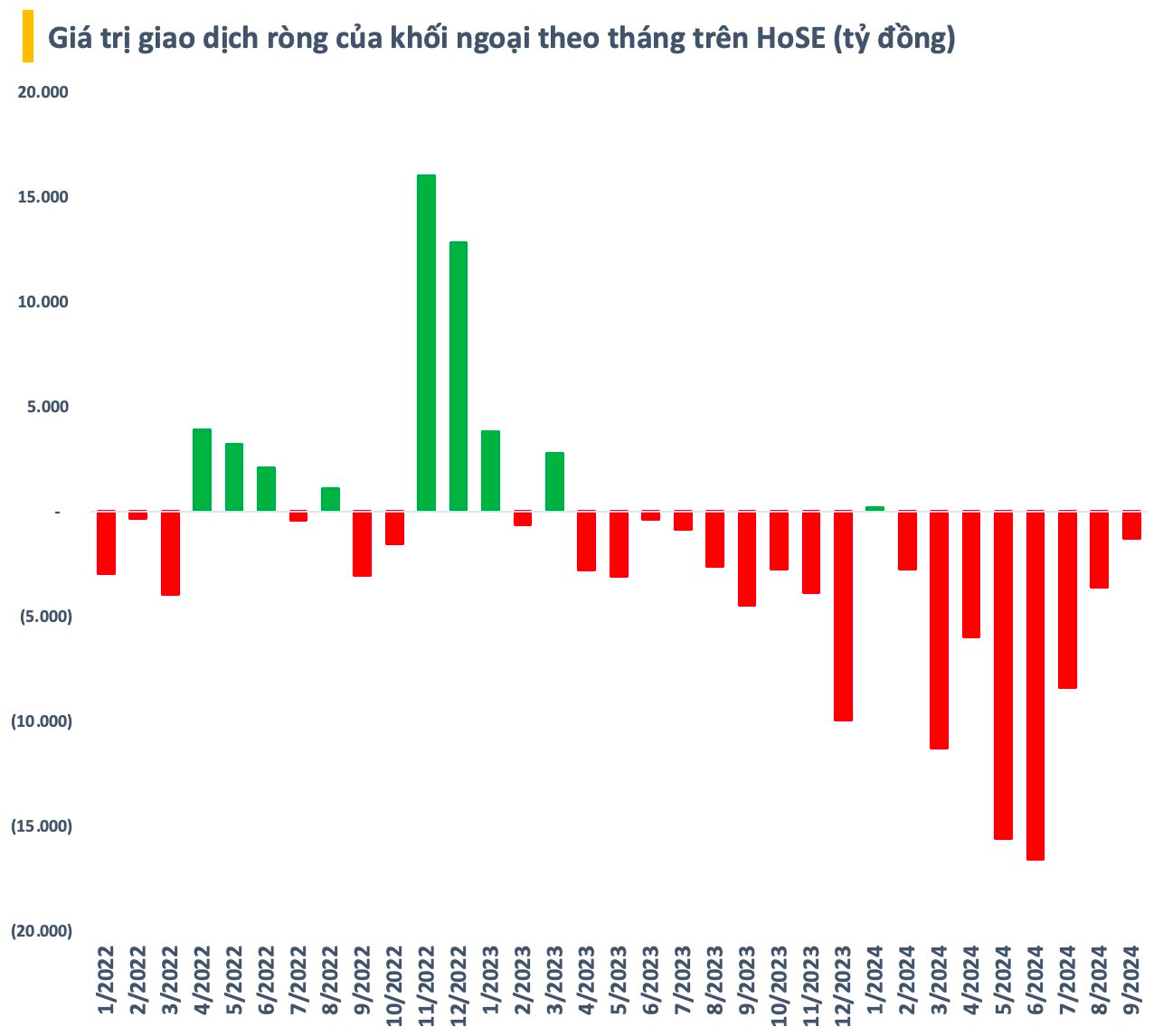

The removal of this important bottleneck in the upgrade process is expected to act as a catalyst to reverse the outflow of foreign capital in the Vietnamese stock market. In the past, foreign investors have been consistently selling, with a total net sell value of over VND 65,000 billion (USD 2.6 billion) on HoSE alone since the beginning of 2024.

Some opinions attribute the recent net selling by foreign investors to (1) profit-taking actions; (2) interest rate differentials causing capital outflows from emerging and frontier markets, including Vietnam; and (3) exchange rate pressure affecting the investment performance of foreign funds in the Vietnamese stock market.

From a longer-term perspective, Mr. Dominic Scriven, Chairman of Dragon Capital, attributed the cause to both internal and external factors. The world is facing no shortage of challenges, and even fears and threats, such as geopolitical issues in the Middle East and the Russia-Ukraine conflict. Typically, when foreign investors are afraid and perceive risks, their action is to sell and repatriate their funds to safer home markets.

Another issue of concern, according to the head of Dragon Capital, is the financial bubble. Many countries, especially developed countries, have been relentlessly printing money in the past decade, leading to public and private debt, inflation, asset values, and, in particular, the rising cost of living. From an analyst’s perspective, this is incomprehensible, and it gives rise to surprises. A typical example is the rapid change in the yen and the Japanese stock market over a short period. These factors have caused large global funds to adjust their investment strategies.

Mr. Dominic Scriven also pointed out that domestic factors have influenced foreign capital inflows. In the past two years, Dragon Capital analyzed 80 large companies, accounting for over 80% of the market capitalization, and found no profit growth. A market with no profit growth for two years (2022-2023) will cause investors to leave. This has been a significant factor in the recent outlook of foreign investors.

The Master of Ceremonies: Dragon Capital’s Chairman Hosts The Investors Talkshow

Host Pham Minh Huong and guest Dominic Scriven, two stalwarts of Vietnam’s financial and securities industry with a combined experience of over three decades, will be in conversation for the inaugural episode of the insightful talk show, The Investors.