Two of the most important factors for foreign investors are a company’s reputation and trustworthiness, as seen through the lenses of corporate governance and ESG (Environmental, Social, and Governance factors).

ESG is gaining traction among foreign investors due to its economic and geographical potential, especially with the support of the Vietnamese government.

Vietnam is also emerging as a leader in green growth in Southeast Asia, thanks to its robust National Green Growth Strategy. This strategy aims to promote a green economy and is projected to increase from $6.7 billion in 2020 to $300 billion by 2050. Vietnam has also committed to achieving net-zero emissions by 2050, as pledged at COP26.

According to a recent report by the Ministry of Planning and Investment, in the first eight months of 2024, the total registered capital of new, adjusted, and contributed capital purchases of foreign investors reached over $20.52 billion, an increase of 7% compared to the same period in 2023. During this period, the realized capital of foreign investment projects was about $14.15 billion, an increase of 8% over the previous year.

In the past eight months, 94 countries and territories worldwide have invested in Vietnam. Singapore led the way with a total investment of over $6.79 billion, accounting for nearly 33.1% of total investment, an increase of 75.5% over the same period in 2023. Hong Kong, Japan, and China followed in second, third, and fourth places, respectively.

During this period, foreign investors invested in 18 out of 21 sectors of the national economy. The manufacturing industry and real estate business were the top two sectors, with total investments of nearly $14.17 billion (accounting for 69% of total registered investment) and over $3.36 billion (nearly 16.4%), respectively.

A company’s reputation and trustworthiness, viewed through corporate governance and ESG, attract the attention and investment of international investors and funds. Illustrative image

With the current trend of investment market shifting to Vietnam, experts from the Vietnam Institute of Directors (VIOD) believe that information and data on corporate governance and ESG are being assessed alongside financial information to make new investment decisions or expansion plans by international investors and private equity funds. Therefore, corporate governance linked to ESG is considered a competitive advantage for businesses.

At the workshop, ” Corporate Reputation and Trust: A Perspective on Corporate Governance and ESG ” on September 20, Ms. Ha Thu Thanh, Chairman of VIOD, stated that, in the context of the Ministry of Finance and other government ministries striving to upgrade Vietnam’s stock market from a frontier market to an emerging market, the focus on ESG and corporate governance criteria aims to open the door for foreign capital inflows. This foreign capital will flow into enterprises rather than the stock exchange.

Ms. Ha Thu Thanh, Chairman of VIOD, speaks at the workshop.

” Focusing on ESG and corporate governance will not only help businesses overcome current challenges but also play a crucial role in attracting foreign investment. Therefore, companies that effectively implement ESG will enhance their image and build trust with investors, business partners, and the community,” shared Ms. Ha Thu Thanh.

The Chairman of VIOD emphasized that enterprises need to demonstrate transparent and efficient governance and a sustainable development strategy linked to minimizing environmental impacts and creating social value. These factors are highly regarded and valued by foreign investors.

Sharing the same view as Ms. Ha Thu Thanh, Mr. Phan Le Thanh Long, General Director of VIOD, stated that enterprises’ proactive disclosure of information, adoption of good practices, and their maintenance would contribute to enhancing their value and attracting foreign investment.

Instead of merely complying with legal requirements, enterprises should focus on disclosing information related to ESG development. This issue is of great interest to international investors. Currently, some large enterprises in Vietnam are pursuing and disclosing information about ESG development, thereby building their value.

Mr. Phan Le Thanh Long, General Director of VIOD, shares his paper, “Investors’ Trust and the Market: A Practical Perspective on Corporate Governance in ASEAN.”

” To contribute to the process of upgrading Vietnam’s stock market, each enterprise needs to have a specific plan to meet the requirements of corporate governance, especially information disclosure, on the market. This will enable investors, including foreign investors and large global funds, to perceive the Vietnamese market as a “nest” for capital allocation,” said Mr. Phan Le Thanh Long.

At this point, enterprises that can best meet the requirements for transparent information disclosure in English, ESG, sustainable development, corporate culture, and board behavior will build trust and attract the best investments,” he affirmed.

ESG is a set of standards that measure a company’s orientation and activities in environmental, social, and governance aspects, ensuring long-term sustainable development and the company’s positive impact on the community.

Adopting ESG will help Vietnamese businesses enhance their competitiveness, increase resilience, and meet international requirements as countries increasingly focus on environmental, social, and governance sustainability.

ESG is Not New; It’s a Must-Do

Ms. Tran Thi Thuy Ngoc, Deputy General Director of Deloitte Vietnam, and Mr. Phan Le Thanh Long, General Director of VIOD, exchange and analyze during the seminar at the workshop.

From a business perspective, Ms. Tran Thi Thuy Ngoc, Deputy General Director of Deloitte Vietnam, shared that according to a Deloitte survey of 200,000 people in the past two years, companies with market trust compared to those without it showed a significant increase in their value.

In reality, international investors and funds tend to seek out companies in which they have trust and that have a high level of market trust. This trust is reflected in the confidence placed in the managers, board of directors, executive board, and how they work together to lead the company in its sustainable development strategy.

” According to Deloitte’s survey, 79% of employees want to work for a company because of its good culture, development opportunities, and talent for innovation and creativity,” said Ms. Tran Thi Thuy Ngoc.

According to Ms. Tran Thi Thuy Ngoc, implementing ESG is a must for businesses to survive and thrive in the long term.

The Deputy General Director of Deloitte Vietnam stated, ” Pursuing an ESG strategy is inevitable. In fact, every business wants to thrive for the long term, aiming for 10, 20, or even over 100 years. There are many such enterprises worldwide with a history of over a century. Therefore, ESG is not a new concept but a must-do for businesses to survive and thrive.”

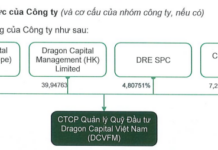

The seminar, ” Corporate Governance and ESG – Building and Strengthening Corporate Reputation and Investor Trust,” also featured practical insights from Mr. Pham Viet Anh, Chairman of PVTrans’ Board of Directors and Chairman of VIOD’s International Corporate Culture Council, and governance experts from investment funds such as Mr. Vu Quang Thinh, VIOD Board member and CEO of Dynam Capital Fund Management Company. They shared perspectives on the value of good corporate governance, the essence of building corporate trust, and transparent information disclosure, especially in the context of ASEAN.

The seminar included the online participation of Mr. Pham Viet Anh, Chairman of PVTrans’ Board of Directors and Chairman of VIOD’s International Corporate Culture Council, and Mr. Vu Quang Thinh, VIOD Board member and CEO of Dynam Capital Fund Management Company.

The goal of upgrading Vietnam’s stock market from a frontier to an emerging market is expected to be realized soon in the FTSE Russell’s evaluation and announcement in October 2025. This has attracted the special attention of domestic and foreign investors. In addition to the efforts of securities companies to ensure a “positive investor experience,” the cooperation of listed companies in promoting corporate governance is crucial to attracting investors’ interest.

In collaboration with the SSC, with the companionship and support of the Hanoi Stock Exchange (HNX) and the Ho Chi Minh City Stock Exchange (HOSE), VIOD organized the 18th Directors Talk in September: ” Corporate Reputation and Trust: A Perspective on Corporate Governance and ESG ” on September 20.

The program’s objective was to update and share the practical application of corporate governance linked to ESG by listed companies, analyze the “gap” between the current state of corporate governance in Vietnam and the requirements of ASEAN and OECD good practices.

What Message Does the Bank Want to Convey Through This Year’s Hanoi International Marathon – Techcombank?

Mr. Pham Xuan Tai, the Deputy Director of the Hanoi Department of Culture and Sports, emphasized that this year’s run is more than just a sporting event; it holds a special significance.

“Sophisticated Scam Alert: Uncovering the Deceptive Practice of Biometric Authentication Workarounds and Brand Name Bank Account Fraud”

The residents of Ha Tinh have fallen victim to a spate of scams, perpetrated by individuals who create fake companies and open bank accounts under the guise of well-known brands such as Mailisa cosmetics and ABX electric vehicles. These scammers exploit the reputation of popular names to deceive unsuspecting individuals online.