On the morning of September 21, at the Government Headquarters, Prime Minister Pham Minh Chinh chaired a conference and worked with enterprises on solutions to contribute to the country’s socio-economic development. The conference included contributions from 12 large private groups nationwide, such as Vingroup, Hoa Phat, Thaco, TH, T&T, and Masan.

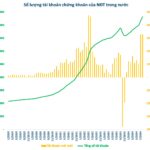

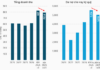

At the aforementioned conference, Vice Chairman of the Board of Directors – Deputy General Director Nguyen Thieu Nam of Masan Group (Masan Group) made several recommendations to the Government. He reiterated the goals of the strategy for developing the securities market by 2030: reaching a market capitalization of 120% of GDP and a bond market debt of 58% of GDP.

Mr. Nguyen Thieu Nam shared that the group agreed with this orientation as capital is the lifeblood that enables businesses to grow and thrive. The company also made several recommendations to help businesses access capital with better and more flexible costs while ensuring the risk management of the system. These include attracting long-term, low-cost capital from foreign investors and promoting the non-banking capital market.

-

First, Masan Group suggested that to reduce businesses’ capital costs, it is necessary to further open up the capital market to foreign investors with the ability to mobilize low-cost capital and make long-term investments.

“We highly appreciate the efforts of the Ministry of Finance in upgrading Vietnam’s market status from ‘frontier’ to ’emerging’, which will attract capital from foreign investors who can only invest in ’emerging’ markets. We look forward to the Ministry of Finance issuing new decrees and circulars guiding agencies, investors, and securities companies on removing the pre-transaction margin requirement, which is an important step in the roadmap to upgrade to an ’emerging’ market in 2025,”

said the leader of Masan.

-

Second, he suggested finding a way to make it easier for enterprises to access the non-banking capital market so that businesses can be more flexible in their capital plans.

He recommended that the Government review the conditions for listing on the stock exchange to better suit new business models (referring to the US Nasdaq exchange, where technology companies are listed). The current IPO listing process is lengthy and complex and does not follow international practices, leading to limitations in Vietnam’s IPO market.

The representative from Masan also mentioned two points in the latest draft amendment to the Securities Law that could slow down the development of the capital market. First is the addition of a condition that corporate bond offerings to the public must be secured by assets or guaranteed by a bank as prescribed by law.

“This addition has good intentions for risk management, but it is not suitable when an economy shifts from investing in physical assets to investing in knowledge. We need to have a suitable assessment method – for example, we can consider whether the generated cash flow is sufficient to repay the debt,”

Masan commented.

Regarding the conditions for offering shares and private placement of bonds by public companies, the draft amendment proposes extending the restricted transfer period from one year for professional investors to three years.

Previously, the restricted transfer requirement only applied to strategic shareholders. However, Masan believes that this amendment will also apply to professional investors, significantly impacting their investment decisions and the ability of issuing organizations to issue shares or private placement bonds.

“Businesses Remain Cautious About Taking on Loans Amidst Downsizing”

Despite implementing various promotional solutions and mechanisms, bank credit growth has not met expectations due to subdued capital demands. Many businesses have scaled back their production, and a cautious approach to risk means they are hesitant to utilize loans.

Enterprise Private Bonds: A Playing Field for Professionals Only, Inadvisable for Retail Investors

The proposed amendments to the current Securities Law aim to foster a stable development phase, paving the way for a more transparent market recovery and preventing past risks from reoccurring. This is according to experts in the field, who emphasize the importance of creating a robust foundation for the market’s rebound.

The Art of IR: A Market Tier Upgrade Tale

IR (Investor Relations) is a critical function for publicly listed companies or those seeking to trade on stock exchanges. Fostering strong relationships with shareholders brings numerous benefits, including enhanced capital-raising abilities and future growth opportunities. Of paramount importance is transparency – the cornerstone of effective IR practices – which also serves as a key criterion for attracting investors in the context of Vietnam’s evolving stock market landscape.

The Stock Market’s Elite: Unlocking the Power of High-Frequency Trading.

“The conditions, designed to mitigate investor risk, are perceived by some as stringent and potentially restrictive to market participation. While these regulations aim to protect, they may also inadvertently create a barrier for prospective investors, impacting the vibrancy of the stock market.”