On September 18, the Ministry of Finance issued Circular No. 68/2024/TT-BTC, amending and supplementing a number of articles of the Circulars regulating securities trading on the securities trading system; securities settlement and payment; securities activities of securities companies and information disclosure in the securities market, which takes effect from November 2, 2024.

Circular 68/2024/TT-BTC has a number of notable points as follows:

Foreign institutional investors can trade stocks without pre-funding (Non Pre-funding solution – NPS)

Article 1 of Circular 68/2024/TT-BTC amends and supplements a number of articles of Circular No. 120/2020/TT-BTC dated December 31, 2020 of the Minister of Finance regulating the trading of listed stocks, registered for trading and fund certificates, corporate bonds, covered warrants listed on the securities trading system.

Specifically, the new Circular stipulates that investors must have sufficient funds when placing orders to buy securities, except in the following two cases: (1) investors trading on margin as prescribed in Article 9 of this Circular; (2) Foreign organizations established under foreign law participating in investment in the Vietnamese securities market (hereinafter referred to as FO) buying stocks without the requirement to have sufficient funds when placing orders as prescribed in Article 9a of this Circular.

Circular 68/2024/TT-BTC added Article 9a on “Stock trading without the requirement to have sufficient funds when placing orders by foreign institutional investors”.

Disclosure of information in English

Circular 68/2024/TT-BTC amends Article 5 of Circular No. 96/2020/TT-BTC on the language of information disclosure in the securities market as follows: The language of information disclosure in the securities market is Vietnamese. Listed companies, public companies, stock exchanges, VSDCs shall disclose information simultaneously in English in accordance with the provisions of Points 2 and 3 of this Article. Information disclosed in English must ensure consistency with the content of information disclosed in Vietnamese. In case of difference or different interpretation between information in Vietnamese and English, information in Vietnamese shall apply.

Circular 68/2024/TT-BTC stipulates the roadmap for information disclosure in English by public companies as follows:

i. Listed companies, large-scale public companies shall disclose periodic information simultaneously in English from January 1, 2025;

ii. Listed companies, large-scale public companies shall disclose abnormal information, information disclosure at the request and information disclosure on other activities of public companies simultaneously in English from January 1, 2026;

iii. Public companies that are not subjects specified at Points a and b of this Article shall disclose periodic information simultaneously in English from January 1, 2027;

iv. Public companies that are not subjects specified at Points a and b of this Article shall disclose abnormal information, information disclosure at the request and information disclosure on other activities of public companies simultaneously in English from January 1, 2028.

According to the latest report by SSI Research, this is a step forward for the Vietnamese stock market to meet the requirements for upgrading to an emerging market by FTSE Russell. With the upgrade to an emerging market, SSIResearch estimates that the capital inflow from ETFs could reach up to USD 1.7 billion, excluding the capital inflow from active funds (FTSE Russell estimates that the total assets of active funds are five times higher than that of ETFs).

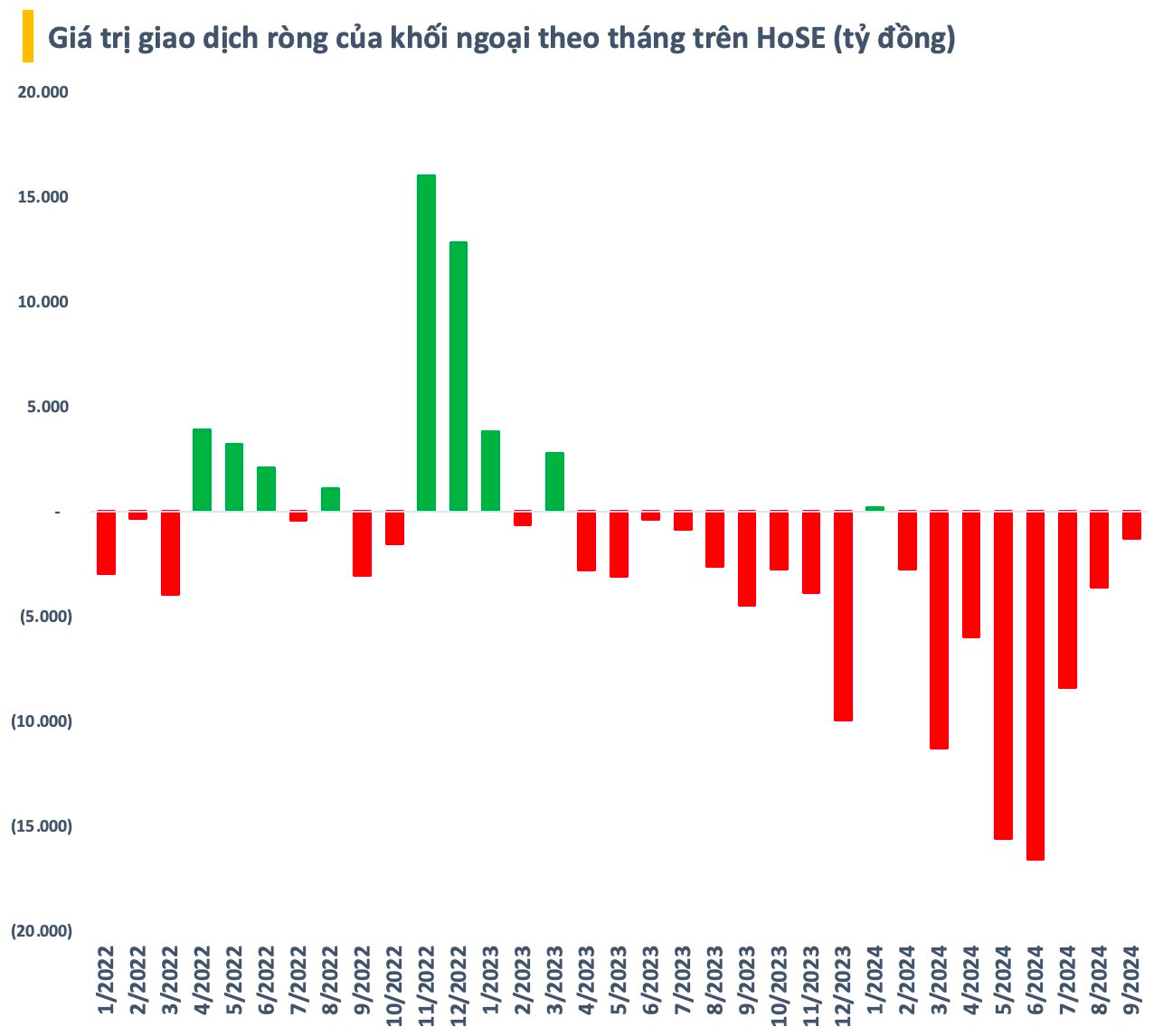

The removal of this important bottleneck in the process of upgrading is expected to become a catalyst to reverse the flow of foreign capital in the Vietnamese stock market. In the past time, foreign investors have been net selling continuously with a total value since the beginning of 2024 of up to more than VND 65,000 billion (USD 2.6 billion) on HoSE alone.

Unlocking the Prefunding Conundrum: A Step Closer to Market Upgrade

The Ministry of Finance has issued Circular No. 68/2024-BTC, amending four circulars related to foreign institutional investors’ ability to trade stocks without a pre-funding requirement (Non-Pre-funding Solution – NPS) and the roadmap for English-language disclosure.