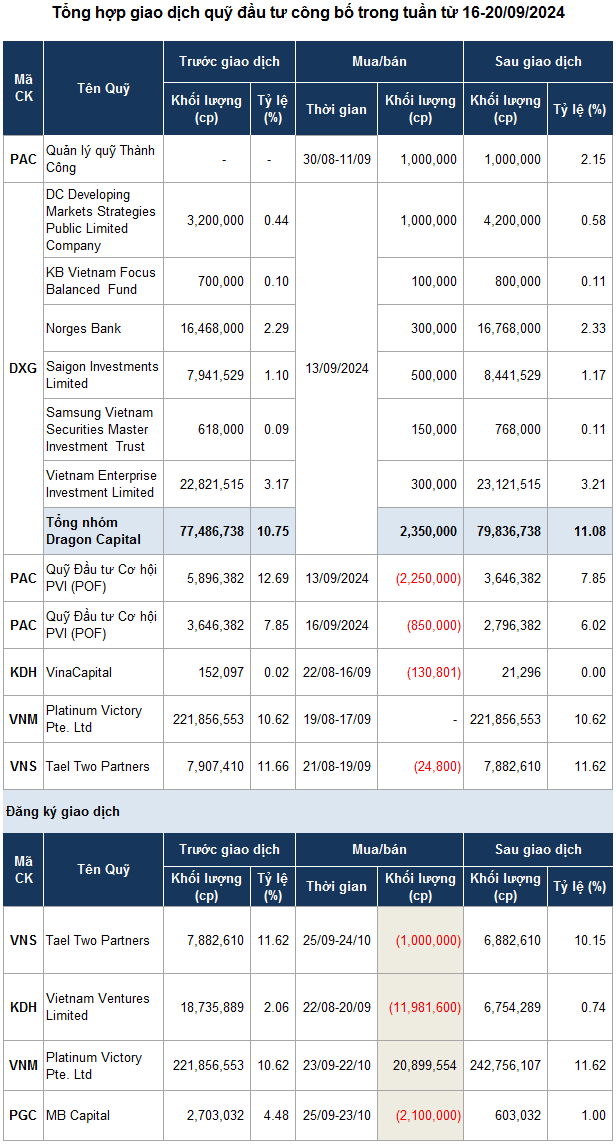

Specifically, through its six members, Dragon Capital purchased a total of 2.35 million DXG shares (of the Construction Corporation) during the September 13 session, bringing the group’s ownership ratio above the 11% threshold, equivalent to nearly 80 million shares.

| DXG share price movement from the beginning of 2024 to the September 20 session |

Temporarily calculated based on the DXG share price, which closed the September 13 session at VND 15,300/share, it is estimated that Dragon Capital spent nearly VND 36 billion to increase its ownership in DXG back to the 11% threshold.

Prior to this, Dragon Capital sold 1 million DXG shares during the July 8 session, earning more than VND 14 billion after reducing its ownership to 10.88%, equivalent to more than 78 million shares.

The foreign fund’s move to buy more shares took place against the backdrop of the DXG share price recovering from its low of VND 12,200/share (August 5 session). DXG share price hit its 2024 low after Mr. Luong Tri Thin stepped down as Chairman of the Board of DXG to assume the position of Chairman of the Company’s Strategic Council from July 3, 2024.

| PAC share price movement from the beginning of 2024 to the September 20 session |

On the selling side, the PVI Investment Opportunity Fund (POF) sold 2.25 million PAC shares (of the Southern Battery and Accumulator Joint Stock Company) during the September 13 session and then sold an additional 850,000 PAC shares during the September 16 session. After these two sales, the fund reduced its ownership from 12.69% (5.9 million shares) to 6.02% (2.8 million shares)

During the September 13 and 16 sessions, the PAC share price recorded trading volumes matching the volumes reported by the PVI fund, with a total transaction value of VND 124 billion.

The fund’s move to sell some of its shares came ahead of PAC’s announcement of a cash dividend payout with a performance ratio of 10% of the par value (1 share receives VND 1,000). The ex-dividend date is September 27, 2024.

Source: VietstockFinance

|