Hai Phat Joint Stock Company (coded HPX on HoSE) has recently announced a resolution to temporarily halt the implementation of its plan to offer additional shares to existing shareholders. This plan was approved by the 2024 Annual General Meeting of Shareholders on April 26, 2024, and the Board of Directors had formulated an implementation plan in their resolutions on June 5, 2024.

The company cited ensuring shareholder interests due to unfavorable market conditions and maintaining the feasibility of the offering as reasons for the temporary halt.

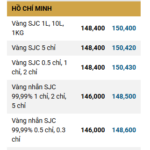

Source: HNX

Previously, Hai Phat intended to offer over 152 million shares to existing shareholders at VND 10,000 per share, aiming to raise nearly VND 1,521 billion. The proceeds were intended to repay bond debts totaling VND 1,410 billion and bank loans of VND 110 billion.

On the stock market, HPX shares are currently trading at around VND 5,000 per share, a nearly 40% decrease compared to when the shares resumed trading on HoSE in March 2024.

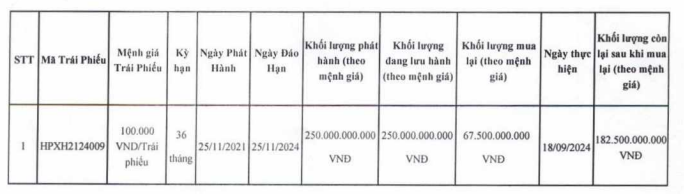

In another development, on September 18, Hai Phat repurchased part of the HPXH2124009 bond series ahead of its maturity date, spending VND 67.5 billion. This bond series, issued in January 2021 with a maturity date in November 2024, initially had a value of VND 250 billion, and the remaining value after the repurchase is VND 182.5 billion.

So far this year, Hai Phat has repurchased bonds ahead of their maturity dates on five occasions, spending a total of VND 277 billion.

In terms of business performance, for the first half of 2024, Hai Phat recorded revenue of VND 655 billion, a 27% decrease compared to the same period last year; and after-tax profit of VND 47 billion, an 18% decrease.

For the full year 2024, Hai Phat set a revenue target of VND 2,800 billion, a 67% increase compared to 2023, and an after-tax profit target of VND 105 billion, a 22% decrease. Thus, after six months, the company has achieved 45% of its profit target.

As of June 30, 2024, Hai Phat’s total assets stood at over VND 8,460 billion, with inventory accounting for VND 2,756 billion (33% of total assets) and long-term receivables at VND 834 billion (10% of total assets). Total liabilities were nearly VND 2,300 billion, equivalent to 63% of equity.

The Sun Jupiter Financial Stock Alert: A Cautionary Tale

“Shares of SJF, owned by Sao Thai Duong, have been placed on alert status due to the company’s delay in submitting its 2024 semi-annual financial report. The report was due over 15 days ago, and this delay has raised concerns among investors and regulators alike. With a history of providing transparent and timely financial disclosures, this recent development is an unusual occurrence for the company. The market is now eagerly awaiting the release of the audited financial statements to understand the company’s current financial health and future prospects.”

“The Novaland Chairman, Bui Thanh Nhon: Treasuring What Matters Most.”

Novaland has submitted a document to the State Securities Commission of Vietnam (SSC), the Ho Chi Minh City Stock Exchange (HoSE), and the Hanoi Stock Exchange (HNX) providing clarification on its efforts to address and rectify the issues that led to the warning.