Illustrative image

A fruit nicknamed “heaven’s treasure” in Southeast Asia is none other than the king of fruits, durian. Due to its unique climate requirements, durian is predominantly cultivated in this region, including Indonesia, Thailand, Malaysia, Vietnam, the Philippines, and Cambodia.

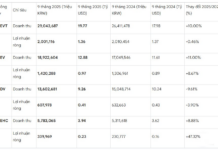

As of 2023, Vietnam ranks third in terms of durian cultivation area and yield, with almost 1.2 million tons, following Indonesia (1.8 million tons) and Thailand (over 1.32 million tons). According to the General Statistics Office of Vietnam, from 2017 to 2022, the average durian cultivation area in Vietnam increased by 24.5% annually.

Since July 11, 2022, durian has been officially exported to China through all border gates thanks to a three-year protocol agreement between the two countries. Furthermore, on August 19, the two nations signed a protocol for the export of frozen durian, presenting a significant opportunity for Vietnamese agricultural products.

A Fierce Competition with Thailand in the Chinese Market

In 2023, Vietnam exported over 603,000 tons of durian, 98.6% of which was destined for China.

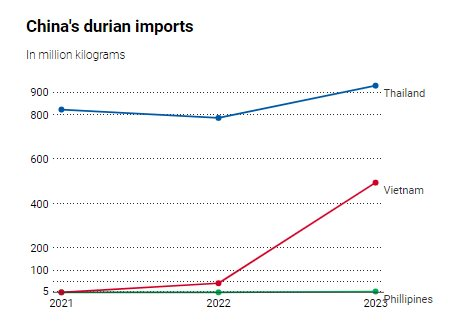

Vietnamese durian is becoming an increasingly strong competitor to Thai durian in China.

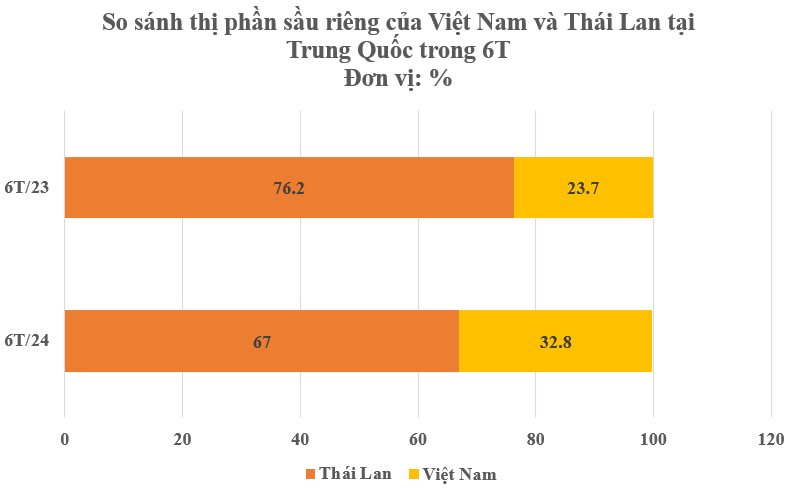

In the Chinese market, Thailand and Vietnam are taking turns as the largest suppliers. Thailand accounted for 68% of China’s durian import market share throughout 2023.

However, in the first two months of 2024, according to data from Chinese Customs, Vietnam exported more than 32,000 tons of durian to China, while Thailand exported just over 19,600 tons. Vietnam’s market share in terms of durian export value to China during this period unexpectedly surpassed that of Thailand, rising to 57%.

Nevertheless, as of August, Thailand officially regained its position as China’s primary durian supplier after experiencing a dip earlier in the year.

In the second quarter, durian imports from Thailand reached nearly $2.67 billion, accounting for 75% of China’s total durian imports. This figure marked a significant improvement from the 42.5% recorded in the first quarter.

The reason for this shift is that the second quarter coincides with Thailand’s main durian harvest season, resulting in a sudden increase in yield. Additionally, Thai durian has maintained its long-standing reputation for quality.

Advantages of Vietnamese Durian

Compared to Thailand and other countries, Vietnam boasts the advantage of year-round harvest seasons, ensuring a constant supply of durian for export to China. Specifically, from March to May is the main harvest season in the Mekong Delta region, while the Eastern provinces harvest durian from April to July. Tay Ninh and Binh Phuoc provinces have their main harvest season from May to July, and Dak Lak province’s main harvest time is from July to August, with other regions taking turns harvesting until March of the following year.

In Thailand, there are four main durian-growing regions: the North, Northeast, Central, and South. Thailand’s durian yield averages only 6.5 tons per hectare, and their durian season is fleeting, lasting merely from March to June.

According to the Import-Export Department, one advantage of Vietnamese durian in the Chinese market is its competitive pricing, being 20% lower than Thai durian.

As per the General Administration of Customs of China, in April, the import price of Thai durian was $5.80 per kg, slightly higher than the average of $5.38 per kg. In contrast, Vietnamese durian was imported at a lower price of $4.22 per kg.

Vietnam shares a border with China, which facilitates transportation and reduces logistics costs as durian only needs to be transported through the northern border gates, unlike Thai durian, which has to go through two or three border gates.

Who Will Dominate the Chinese Market?

Although Thailand currently reigns in the Chinese durian market, experts believe that Vietnam could emerge as a formidable competitor in the durian industry in the coming years.

A heat wave in Thailand during April and May reduced the country’s yield. Mr. Aat Pisanwanich, advisor to the Research Intelligence Company (Thailand), stated, “If there is no intervention from the Thai government, the country’s durian production will decrease by 53% in the next five years.”

Demand for durian in the Chinese market is projected to continue rising due to increasing consumer appreciation for this unique fruit.

Notably, several batches of Vietnamese durian have recently been flagged for banned substances. The authorities are investigating the cause and communicating with their Chinese counterparts.

Catering to the Chinese Palate, Farmers in This Southeast Asian Country Want to Change the Taste of the Famed ‘King of Fruits’ Durian

The Musang King durian is at risk of losing its distinctive flavor as it becomes a victim of its own success in the export market.

The Untold Story Behind Hang Du Muc’s ‘5 Minutes to 12 Tons of Durian’ Live Stream: A Journey to Find the Ultimate Source in Khanh Hoa, Despite Health Concerns and a Trek From Dak Lak.

“I’m tired of always being reactive and rescuing our country’s agricultural produce. Why can’t we take the initiative and sell our own produce nationwide?” expressed Hẳng Du Mục. Before settling on durian as the main product for her live sale on July 7th, she even contemplated selling Cà Mau crab on TikTok Shop.