According to the document seeking opinions, SGR plans to offer 20 million private placement shares to professional securities investors at a price of 40,000 VND per share. Accordingly, if the issuance is successful, the Company can raise 800 billion VND.

According to the plan for capital usage, SGR will prioritize investing 500 billion VND in the Vietnam Xanh eco-urban area project and will use a maximum of 300 billion VND to pay off debts.

The list of investors participating in the private placement includes only Mr. Pham Thu – Chairman of the Board of Directors of SGR – who registered to buy the entire 20 million shares. After this offering, Mr. Thu’s ownership in SGR will increase from 29.94% (nearly 18 million shares) to 47.45%. Shares from this issuance will be restricted from transfer for one year.

The plan to issue 20 million private placement shares was approved at the 2024 Annual General Meeting of Shareholders held in April 2024. At the meeting, Mr. Pham Thu shared that the expected offering price would range from 30,000 to 35,000 VND per share. The Company’s decision to increase the offering price comes as the SGR share price has surged 122% since the 2024 Annual General Meeting of Shareholders, closing at 44,400 VND per share on September 19.

| SGR share price movement since the beginning of 2024 |

SGR stated that raising capital from shareholders will help the Company reduce loan interest, increase profits, and improve operational efficiency, especially considering the long-term nature of real estate investment and development projects.

Also, at the 2024 Annual General Meeting of Shareholders, Mr. Thu assessed that to implement the ongoing projects in the coming time, SGR‘s owner’s equity needs to reach 1,400-1,500 billion VND. Previously, the 2022 Annual General Meeting of Shareholders approved the plan to issue shares to increase charter capital, but due to the COVID-19 pandemic, it could not be executed.

It is known that recently, the consortium of SGR together with two enterprises, the Joint Stock Company for Investment Development and Construction (HOSE: DIG) and Hung Thinh Incons Joint Stock Company (HOSE: HTN), was the only investor registered to implement the Nam Tien 2 urban area project in Nam Tien ward, Pho Yen town, Thai Nguyen province, after the Department of Planning and Investment of Thai Nguyen province closed the file in July 2024.

The Nam Tien 2 urban area has an area of 352,862m2. The total investment amount is nearly VND 3,825 billion, of which the implementation cost is more than VND 3,403 billion, and the compensation and resettlement cost is nearly VND 422 billion. The investment progress is expected to last from Q2/2024 to the end of Q3/2029.

Previously, Saigon Real Estate Trading Company Limited (Saigonres Trading) – a subsidiary of SGR – was approved by the People’s Committee of Binh Duong province as the investor of Saigon An Phu residential area project. The project has an area of over 10,353m2 with a scale of 66 townhouses and shophouses with an area of 80m2, and an expected population of 264 people. The total investment capital is expected to be 68 billion VND.

SGR’s subsidiary officially becomes the investor of Saigon An Phu project

DIG, SGR, and HTN consortium to develop a nearly VND 4,000 billion urban area in Thai Nguyen

In addition to the private placement of shares, SGR also sought opinions on the dismissal of Mr. Kieu Minh Long from the position of Independent Member of the Board of Directors for the term 2021-2025 due to his passing and the appointment of a replacement.

Ms. Nguyen Thi Kim Quyen

|

In the document approved by the SGR Board of Directors on September 18, there was only one candidate for the position of Independent Member of the Board of Directors of SGR: Ms. Nguyen Thi Kim Quyen, who is currently a lawyer at 3A Law Firm Limited Company and a lecturer at Van Lang University’s Law Faculty. Previously, Ms. Quyen served as Head of the Legal Department of SGR from 2016 to 2017. Moreover, Ms. Quyen currently owns 56 shares of SGR.

The Sa Pa Airport Project: Seeking Investors for Takeoff

The Lao Cai province had set its sights on commencing construction of the Sa Pa Airport in 2023. However, due to a lack of investor interest, the project remains grounded. With a projected payback period of nearly 44 years, the local government is now seeking adjustments to the investment policy to make the airport a reality.

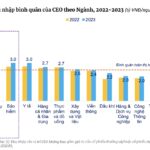

The Secrets to Executive Success: Unveiling the Compensation of 200 Listed Companies’ Leaders. A CEO’s Average Income Reaches 2.5 Billion VND per Year, Surpassing Chairpersons’ Remuneration.

“A recent report on executive compensation in public companies, titled “Income of General Directors, Chairpersons and Independent Members of the Board of Directors”, revealed that CEOs earn an average of VND 2.5 billion per year, surpassing the average remuneration of Chairpersons, who earn VND 1.7 billion annually. This insight highlights the value and importance placed on the role of the CEO in these organizations.”

The Maintenance Fund Handover Saga at Saigon Gateway: Thu Duc City to Take Action

The investors of Saigon Gateway must hand over the multi-billion-dollar maintenance fund to the People’s Committee of Thu Duc City. The authorities will take the necessary steps to enforce the handover of these critical maintenance funds, ensuring the protection of the residents and the fulfillment of the investors’ obligations.

“Insider Sells 5% Stake in PC1 Group for a Cool $20 Million Profit”

Prior to PC1, this entrepreneur had traded substantial volumes of LCG stocks, dealing in millions of units.