Illustration

Oil Falls

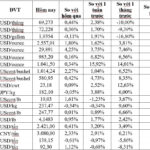

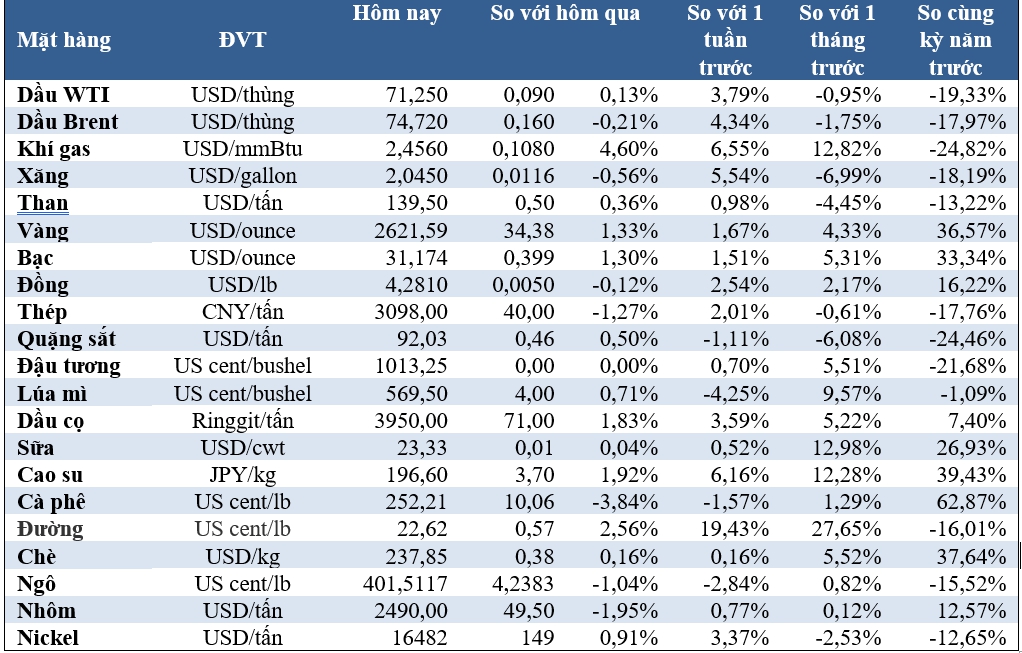

Oil prices fell on Friday but posted a second straight weekly gain, supported by U.S. rate cuts and falling U.S. crude inventories. Brent crude oil futures settled down 39 cents, or 0.52%, at $74.49 a barrel. U.S. West Texas Intermediate (WTI) crude futures fell 3 cents, or 0.4%, to settle at $71.92.

Signs of an economic slowdown in top commodity consumer China put pressure on prices. However, for the week, oil prices rose more than 4%.

Gold Surges Past $2,600

Gold prices surged past $2,600 for the first time on Friday, extending a rally driven by expectations that the U.S. Federal Reserve will cut interest rates further and escalating tensions in the Middle East. Spot gold ended the session up 1.3% to $2,620.63 an ounce, while gold futures for December delivery settled 1.2% higher at $2,646.20 an ounce.

The latest surge in bullion prices was driven by the Fed’s decision to initiate a monetary easing cycle on Wednesday with a larger-than-expected half-percentage-point rate cut, boosting the metal’s appeal as a safe-haven asset.

Gold prices have risen nearly 27% so far this year, marking the biggest annual gain since 2010, as investors also sought protection from uncertainties stemming from the prolonged conflict in the Middle East and elsewhere.

Iron Ore Edges Higher

Iron ore prices edged higher on Friday but posted weekly losses as traders weighed the impact of potential new monetary stimulus from China against the country’s sluggish economic recovery. At the same time, rising global supply put pressure on prices. The January 2025 iron ore contract on the Dalian Commodity Exchange (DCE) in China ended the session up 0.15% at 680 yuan ($96.43) per ton.

In contrast, iron ore futures for October delivery on the Singapore Exchange fell 0.99% to $91.75 per ton.

China unexpectedly kept its benchmark lending rate unchanged on Friday, confounding market expectations that had been primed for a cut after the U.S. Federal Reserve’s rate reduction earlier in the week.

Prices for most steel products on the Shanghai exchange fell during the session: rebar dropped nearly 0.3%, stainless steel fell about 0.1%, and hot-rolled coil decreased by 1.97%, while hot-rolled coil rose nearly 0.3%.

Copper Retreats from Two-Month Peak

Copper prices eased on Friday after touching a two-month high as a stronger U.S. dollar and producer selling weighed on the market. Three-month copper on the London Metal Exchange ended the session down 0.2% at $9,499 a ton, having earlier touched $9,599.50, its highest since July 18.

Copper trimmed gains after mining companies sold off to lock in profits ahead of the weekend, and as a stronger U.S. dollar made the metal more expensive for buyers using other currencies.

While China unexpectedly kept its benchmark lending rate unchanged on Friday, analysts said a rate cut could be part of a larger policy package.

Rubber Declines

Rubber prices on the Tokyo Commodity Exchange fell during Friday’s session but posted weekly gains amid concerns over supply across major producing regions, even as a gloomy economic outlook in top consumer China dampened demand prospects.

The rubber contract for February delivery on the Osaka Stock Exchange closed down 6.7 yen, or 1.79%, at 366.7 yen ($2.56) per kg.

However, the January rubber contract on the Shanghai Futures Exchange continued to rise, adding 20 yuan, or 0.11%, to 17,875 yuan ($2,534.89) per ton.

Coffee Drops

Coffee futures for December delivery fell 10.9 cents, or 4.2%, to $2,507.5 per lb, extending losses from Monday’s 13-year peak. There were some showers in Brazil’s coffee belt, and more are expected in the coming days. This was the main reason for the price decline.

Robusta coffee futures for November delivery fell 3.6% to $5,059 per ton.

Corn, Soybean Ease

Corn and soybean prices in Chicago eased slightly due to increasing harvest progress. Meanwhile, wheat prices rose due to drought conditions in some wheat-producing regions globally.

Corn futures on the Chicago Board of Trade (CBOT) ended the session down 4 cents at $4.01-3/4 per bushel, posting a weekly loss of 1.81%. Soybean futures fell 1-1/4 cents to $10.12 per bushel, while wheat futures rose 3 cents to $5.68-1/2 per bushel, with weekly losses of 0.57% and 4.91%, respectively.

Sugar Rallies

Sugar futures surged more than 3% on Friday and posted a weekly gain of 19.2%, the biggest since 2008, on supply concerns from Brazil. Raw sugar futures for October delivery rose 0.73 cent, or 3.3%, to 22.66 cents per lb, after hitting a near seven-month high of 23.13 cents.

On Thursday, Wilmar cut its Brazil sugar production estimate to 38.8-40.8 million tons from an earlier forecast of 42 million tons.

“The Market on 9/13: US Crude Oil Prices Surge Over 2%, Gold Hits Record High”

As of the market close on September 12th, U.S. crude oil prices surged over 2%, while gold reached a record high and palladium peaked at a 2-month high.