Australia has just signed a partnership with the Beacon Fund to pilot innovative capital solutions to bridge the capital access gap for women-owned or -led small businesses in Vietnam.

In fact, this is not the first time the Australian government has invested in promoting gender equality in Vietnamese businesses. For instance, ‘Aus4Equality’ is a well-known comprehensive support initiative by the Australian Government aimed at enhancing gender equality in Vietnam. This 10-year program (2017-2027) is backed by a budget of up to AU$96.4 million (approximately VND 1.615 trillion). Notably, ‘Aus4Equality’ has supported nearly 2,000 women in taking up leadership positions within community groups and has channeled millions of Australian dollars from the private sector into women-led businesses.

Similarly, in 2016, the Australian Government launched the ‘Investing in Women’ initiative, targeting barriers to women’s participation in the economy and promoting an environment for women to thrive in the workplace and business. This program collaborates with local organizations in Vietnam to reduce gender disparities in the workplace.

More recently, during an official visit to Vietnam in May 2024, Australia announced a new phase for this initiative. And today, the Australian Development Investments has signed and committed capital to impact investment funds like the Beacon Fund, to promote gender equality and women’s empowerment in the economy. However, the agreed-upon commitment amount has not been disclosed.

An Australian Government study found that inappropriate investment products and gender bias in capability assessments are significant barriers for women-owned small businesses in accessing capital. Therefore, since 2016, ‘Investing in Women’ has focused on capital access for small and medium-sized enterprises that benefit women in Indonesia, the Philippines, and Vietnam. ‘Investing in Women’ also continues to promote gender-lens investing through market-building collaborations and, together with the Australian Development Investments, provides capital to impact investment funds.

Photo: Australian Ambassador to Vietnam, Andrew Goledzinowski, speaking at the launch of the new phase of ‘Investing in Women’.

The Beacon Fund, established in 2020, is a private debt investment fund focused on promoting gender equality in Southeast Asia. It is also the first impact investment fund in the form of debt capital in Vietnam.

The fund targets the ‘missing middle’ segment, including women-owned or -led businesses that are: (i) too small to access private equity funds, (ii) too large for microfinance, (iii) not fitting the growth trajectory of venture capital funds, and (iv) not adequately served by banks.

By focusing on this ‘missing middle’ segment, the Beacon Fund aims to pioneer gender-lens investing (GLI) funds that employ novel investment approaches and structures. Specifically, the Beacon Fund offers two products: debt and mezzanine capital. Their investments range from $300,000 to $2,000,000 and are intended for medium-term purposes (2-4 years).

Notably, all the companies in the Beacon Fund’s investment portfolio are women-owned and -led. For instance, in May 2024, the Beacon Fund invested in CAS Energy, a company led by CEO Nguyen Pham Cam Tu. Prior to that, on April 15, 2024, Beacon finalized an investment deal with Lotus Group, a company chaired and directed by Le Van May, with an investment value of several million USD…

In this new deal, with capital from the Innovation Window of ‘Investing in Women’, the Beacon Fund will implement innovative capital solutions for women-owned small businesses, piloting newly adjusted investment structures that fit the capital needs and business profiles of each enterprise, such as performance- and impact-based loans. Post-investment, the Beacon Fund aims to support the companies in its investment portfolio to grow and attract more capital.

Taiwanese Firm Plans $100 Million Factory in Ha Tinh Province

The Dai Loi Pho Group, a leading developer and supplier of sports footwear materials, is eyeing the Lac Thien Industrial Cluster in Duc Tho District, Ha Tinh Province, as the potential site for their new factory. With an estimated area of 30 hectares, this new development promises to be a significant addition to the region’s industrial landscape.

The Billionaires’ Address to the Prime Minister: A Visionary Appeal for Progressive Change.

Let’s establish Vietnam as a regional and global aviation hub, suggests aviation billionaire Nguyen Thi Phuong Thao – Chairwoman of Sovico Group – in a proposal to the Prime Minister.

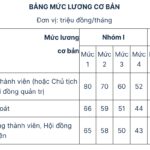

The Highest Salary in a State-Owned Enterprise is 80 Million VND/Month

The proposed highest base salary for the Chairman of the Members’ Council (or Chairman of the Company) and the Chairman of the Board of Directors of a state-owned enterprise is an impressive 80 million VND per month. This figure represents a significant sum and is indicative of the value and importance placed on these pivotal leadership roles within the organization.