The cut-throat pricing war among Chinese electric vehicle (EV) manufacturers in Thailand has led to unforeseen consequences. According to a source from the “Prachachat Business” news site, the situation has escalated to the extent that senior officials from the Chinese Embassy in Thailand held a meeting with representatives of Chinese EV brands to discuss their business strategies in the country.

The automotive companies involved in this discussion with the Chinese Embassy included MG, Great Wall Motor, Neta, BYD, Changan, AION, OMODA & JAECOO, and Zeekr.

” We have to admit that the automotive market, particularly the Chinese EV segment, has become quite chaotic. Operators have been engaging in intense price competition, significantly impacting the overall image of the industry ,” the source revealed.

Geely electric vehicles lined up for shipment at Taicang Port, Jiangsu, China

The root of this issue lies in the incentives for EVs, which attracted multiple competitors to the market. Coincidentally, the current EV market is facing a severe downturn due to weak purchasing power and stringent lending policies from financial institutions, causing an unprecedented contraction in the Chinese market.

Meanwhile, the export market faces geopolitical challenges. The price war is expected to persist until the end of the year or longer, making it a pressing issue to address. These factors have resulted in a significant surplus for Chinese EV companies, forcing them to offload their inventory into any potential market—Thailand being a prime example.

This situation has compelled executives of EV brands to engage in fierce competition, and if they aim to clear their inventory quickly, the easiest solution is to offer deep price cuts. However, this strategy is backfiring and creating unintended consequences for these Chinese EV manufacturers in the Thai market.

A case in point is BYD. Despite planning to build a massive EV assembly plant in Thailand, their rapid price cuts—up to 30% within a year for some models—have angered customers. Such drastic reductions have led to buyer’s remorse and a wait-and-see attitude among potential purchasers, anticipating further discounts. Worse still, BYD’s deep discounting has attracted the scrutiny of Thailand’s consumer protection agency, which is investigating this behavior.

Additionally, the influx of Chinese EV brands and their aggressive pricing strategies have had ripple effects on Thailand’s economy. Since the entry of these Chinese EV brands, sales of traditional gasoline vehicles have plummeted, leading Suzuki and Subaru to announce the closure of their car manufacturing plants in the country. This has had a domino effect on the supply chain, with over 2,000 factories shutting down in 2023.

From a broader perspective, this price war is not just impacting Thailand but also has the potential to affect the entire EV industry. When the focus is solely on price competition, quality and safety standards may be compromised, especially for smaller EV manufacturers.

Consequently, even a small number of low-quality EVs flooding the market from China could tarnish the reputation of the entire industry. Similar to how incidents at nuclear power plants have created misconceptions about their safety, subpar EVs could turn consumers away from environmentally friendly vehicles in the short term.

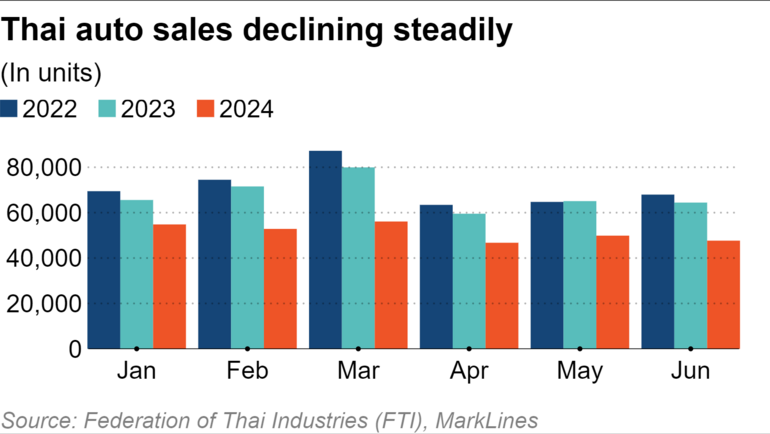

Thailand’s auto sales have been steadily declining since 2022

” More problems are bound to arise, especially with new Chinese brands entering the market later this year. Meanwhile, dealers’ profits from car sales have significantly diminished due to the price war. Now, it’s a matter of who has the longer financial runway because a business where everyone is losing money cannot sustain itself in the long run ,” the source added.

According to another source, during the discussion, the Chinese automotive executives and the Embassy debated various topics, with a particular focus on long-term marketing strategies in Thailand. The aim was to ensure fair competition without resorting to a pricing war, thereby building trust and sustainability in their marketing efforts.

Most executives proposed reflecting their concerns back to the Embassy and the Chinese government, urging the parent companies of each brand to reconsider their price war policies and the dumping of inventory into Thailand.

Ultimately, if all brands resort to price competition, it is not a sustainable business approach. The executives want to avoid a repetition of the situation in the Chinese EV market, where price collapses have led to market distortions due to supply exceeding demand.

The Brutal Reality of the Ride-Hailing Market Wars

“With a limited customer base and an oversaturated market, many ride-sharing and food delivery platforms have fallen by the wayside. The challenge of standing out in an increasingly competitive market is a formidable one.”