An illustrative image.

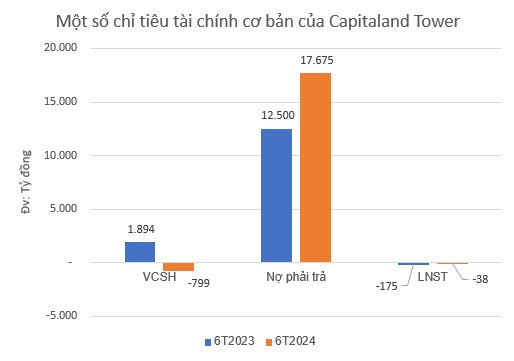

Capitaland Tower JSC has announced its financial results for the first six months of 2024, reporting a post-tax loss of 38 billion VND, a significant improvement from the 175 billion VND loss incurred in the same period last year.

As of June 30, 2024, the company’s equity capital decreased from 1,894 billion VND to negative 799.8 billion VND. The debt-to-equity ratio stood at a negative 22 times, indicating a substantial debt burden. The company’s total liabilities were estimated at 17,675 billion VND, including approximately 12,236 billion VND in bond debt. Based on this information, Capitaland Tower’s total assets are estimated to be 16,876 billion VND.

A visual representation of Capitaland Tower’s financial performance.

According to the Hanoi Stock Exchange (HNX), there were no principal or interest payments due for Capitaland Tower’s bonds in the first half of 2024.

The company currently has four bond issues outstanding, totaling over 12,200 billion VND. These bonds were issued on July 25, 2023, with a five-year maturity and an exceptionally low interest rate of just 1% per annum. With this issuance, Capitaland Tower became the largest real estate company in terms of bond issuance in 2023.

In addition to the attractive interest rate, bondholders have the option to use the principal and interest payments to subscribe to Capitaland Tower’s charter capital, effectively becoming shareholders in the company.

Capitaland Tower JSC, established on April 4, 2016, currently has a charter capital of 2,070 billion VND. The company’s legal representatives are Mr. Luong Phan Son, Chairman of the Members’ Council, and Mr. Ngo Nhu Vuong, General Director.

On March 27, 2024, CLV Investment 6 Limited, a shareholder, transferred its entire capital contribution of 103.5 billion VND (equivalent to 5% of the charter capital) to two domestic investors, Mr. Nguyen Manh Kien (2.5%) and Mr. Nguyen Tan Hung (2.5%).

As per the enterprise registration content update in April 2024, Mr. Luong Phan Son holds 95% of the capital contribution, while Mr. Nguyen Manh Kien and Mr. Nguyen Tan Hung each hold 2.5%.

Capitaland Tower is the developer behind the prestigious The Sun Tower, a Grade-A office building located in the Ba Son Complex in District 1, Ho Chi Minh City. The project boasts a total floor area of over 107,000 square meters, comprising 55 floors above ground and five basement levels. It offers 87,000 square meters of premium office space and 20,000 square meters of high-end commercial area.

“BB Sunrise Power Plagued by Losses, Negative Equity Exceeds VND 200 Billion”

BB Sunrise Power, owned by Chairman Vu Quang Bao, reported a loss of over 134 billion VND in the first half of 2024, with a negative equity of 222 billion VND. The company is facing financial challenges, and its future remains uncertain. With losses continuing to mount, the company’s survival hangs in the balance.