The Wall Street Journal (WSJ) reported that Ford’s CEO Jim Farley and CFO John Lawler were shocked after visiting a Chinese electric vehicle factory in 2023.

Specifically, when the two visited and test-drove vehicles at Changan Automobile, a long-time electric vehicle partner of Ford, early last year, they were surprised by the smooth performance and noise reduction capabilities of the products.

“Jim, this has never happened before. They are far ahead of us,” CFO Lawler complained to CEO Farley immediately after the test drive.

Then, after visiting the factory again in May 2024, Ford’s CEO Farley once again confirmed his fears with the Board of Directors.

“John, this is an existing threat,” CEO Farley said to former director John Thornton of Goldman Sachs, who sits on Ford’s Board of Directors.

CEO Jim Farley

A Repeat of History

“I’ve seen a similar situation before,” CEO Farley said, constantly reminding the directors about how Toyota and the Japanese auto industry took market share from American cars in the 1980s and 1990s.

That’s not to mention the success of South Korea’s Hyundai and Kia just a decade ago, and the same is happening with Chinese electric vehicles now.

According to Farley, Chinese electric vehicle makers are developing at the speed of light, employing a host of new technologies never before tested in the US. For example, artificial intelligence (AI) is being tested cautiously in the US, but in China, the fruits of this technology are being widely applied to electric vehicles.

Then there’s the affordable price, sleek design, and stable quality of Chinese electric vehicles that led CEO Farley to admit that Tesla is no longer the main driver of Western automakers’ transformation but rather a rival on the other side of the Pacific.

For many years, the name Tesla was a brand that made Western, Korean, and Japanese automakers cautious, but now, names like BYD are the real competitors that strike fear into their hearts.

Farley’s concern was evident as he shipped several Chinese electric vehicles to the Michigan headquarters so that the directors and employees could directly experience and sense this threat.

According to WSJ, whenever there was a break, the board members would test-drive these vehicles.

Business Insider (BI) said that Farley’s surprise was understandable, as Chinese electric vehicles are dominating the global market. Their affordable, quality products with good designs are taking over many developing markets such as Brazil, Mexico, and Southeast Asia.

Figures from ABI Research show that Chinese brands account for 88% of the electric vehicle market share in Brazil and 70% in Thailand in the first quarter of 2024. In Europe, one-fifth of all new electric vehicle sales are from China.

The expansion of Chinese electric vehicles is so strong that the US government had to impose tariff barriers to protect its domestic auto industry. Europe followed suit just a month later with an investigation into China’s electric vehicle industry.

In the end, Ford isn’t the only automaker in the world shocked by China’s electric vehicle industry. Even Tesla, the Western leader in this field, is under tremendous pressure.

In late 2023, BYD, China’s largest electric vehicle maker, dethroned Tesla to become the world’s largest electric vehicle manufacturer.

In its business results report in January 2024, CEO Elon Musk himself had to admit that Chinese automakers are Tesla’s main competitors and called them “the most competitive car companies in the world.”

“If it weren’t for tariff barriers, Chinese automakers would crush their rivals worldwide,” Elon Musk said.

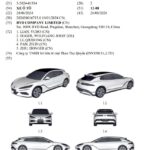

Back to the vehicles that CEO Farley brought back to Ford headquarters, one of them was the first electric vehicle from smartphone maker Xiaomi, designed to mimic a Porsche with a price tag of $30,000-$40,000.

This product features an in-car fragrance diffuser and an infotainment system that connects to home devices as the car approaches, for example, automatically turning on lights or air conditioning when the car nears the house.

Another product from Li Auto, priced at $77,000, offers hand and foot warming and a multimedia screen controlled by hand gestures.

Ford’s experts likened these designs to a business-class airline experience or a home theater inside an electric vehicle.

300 Million VND

For decades, Ford and other Western automakers didn’t consider China’s auto industry a threat, as this market only opened up in the 1980s, mainly through joint ventures with foreign brands.

Local car factories only did outsourcing and contract work to help international brands circumvent the law and sell to the Chinese. However, the Beijing government took a shortcut with electric vehicles.

After years of investing in hundreds of startups, the Chinese electric vehicle industry finally bore fruit.

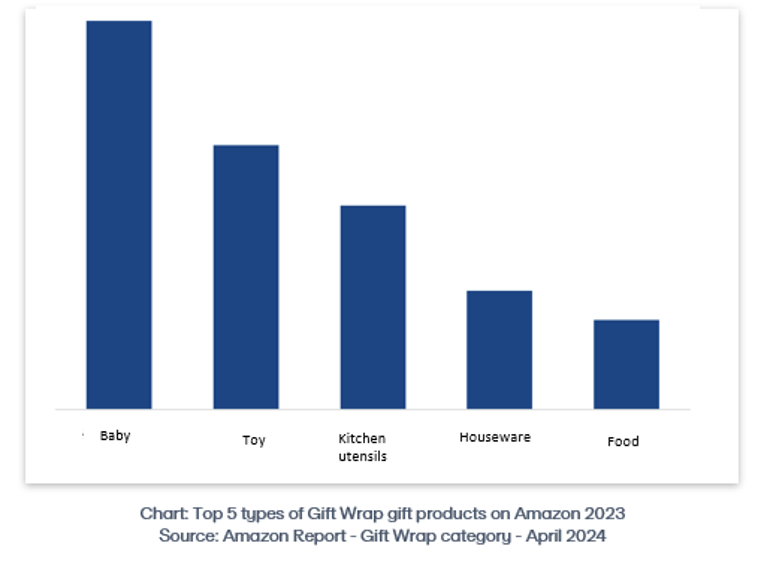

A prime example is BYD, which sold over 3 million electric and hybrid vehicles in 2023, nearly seven times more than in 2019.

Their cheapest model, the Seagull, costs just $10,000, or about 300 million VND, but it’s packed with modern features like a trendy interior design, a swiveling touchscreen like an iPad, and a range of up to 500 km.

This price is just one-third of equivalent electric vehicles from famous brands.

WSJ reported that after witnessing engineers dissect a BYD electric vehicle to understand its inner workings, CEO Farley was truly amazed by the quality and high-tech features that this product delivered.

This convinced Farley to focus on commercial electric vehicles instead of small cars for individuals in China. In simple terms, Ford chose to borrow from China’s success and learn their techniques to target a niche market rather than compete head-on.

In the international market, Ford now has the confidence to borrow Chinese technology to target the small electric vehicle market for individuals, thus competing in the electric vehicle space.

Currently, Ford estimates it will lose $5 billion in the electric vehicle sector, half of which is due to project operating costs. However, CEO Farley remains persistent because he understands that a new revolution is underway, and Ford can’t afford to sit idly by.

*Sources: BI, WSJ

Revolutionizing the Vietnamese Automotive Market: BYD’s Upcoming Luxury Sedan with an Astounding 1,000 Horsepower and Unparalleled Efficiency

The Chinese electric car manufacturer has produced a vehicle that is a formidable rival to the Porsche Taycan and the Mercedes-Benz EQS.