Vietnam’s Shrimp Export Prices Unlikely to Surge

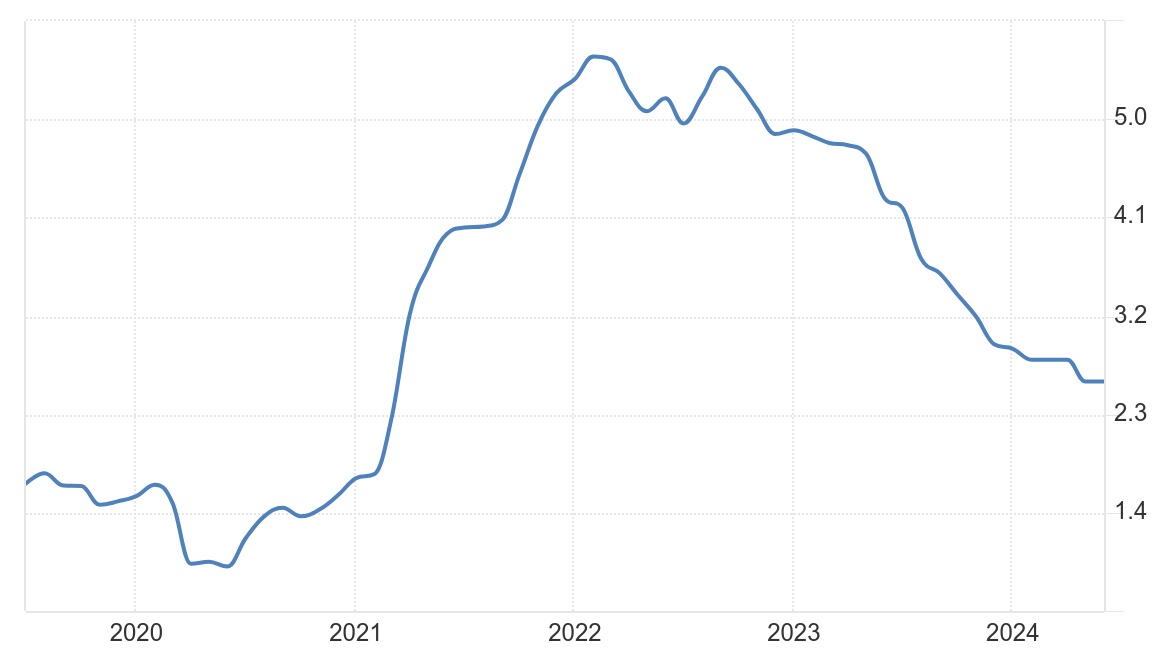

According to the Vietnam Association of Seafood Exporters and Producers (VASEP), shrimp exports in July 2024 recorded the highest value since the beginning of the year, reaching $375 million. This brings the total shrimp export turnover for the first seven months of this year to over $2 billion, an 8% increase compared to the same period last year.

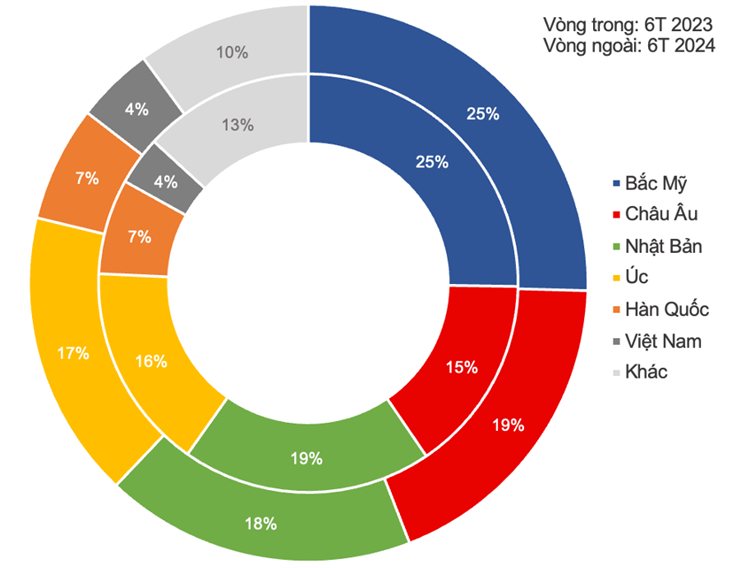

Vietnam’s Shrimp Export Turnover for 2019-7M/2024

(Unit: Million USD)

Source: VASEP

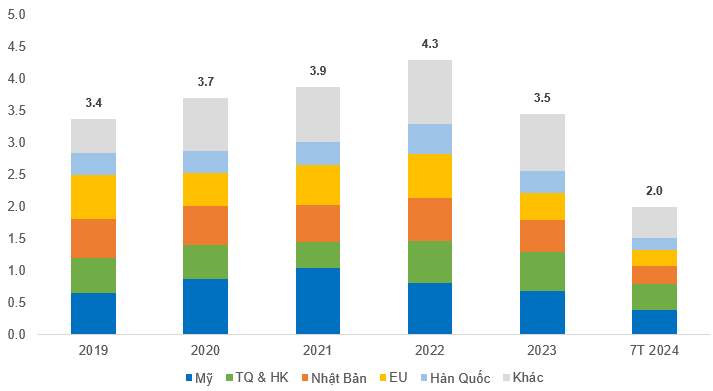

The top five export markets for Vietnamese shrimp include the US, China & Hong Kong, Japan, the EU, and South Korea. From the third quarter onwards, as inflationary pressures ease and inventory levels decrease, importers are expected to increase their purchases to prepare for the upcoming holiday season. Additionally, shrimp prices globally, including in Vietnam, have shown signs of recovery in recent months, presenting an opportunity for improved export prices. However, Vietnam’s shrimp export prices are unlikely to surge significantly due to intense competition from low-cost shrimp producers like Ecuador and India.

White Shrimp Prices (size: 100 pcs/kg) in some countries during 2023-7M/2024

(Unit: USD/kg)

Source: VASEP

Leading Enterprise with a Large Market Share in Key Markets

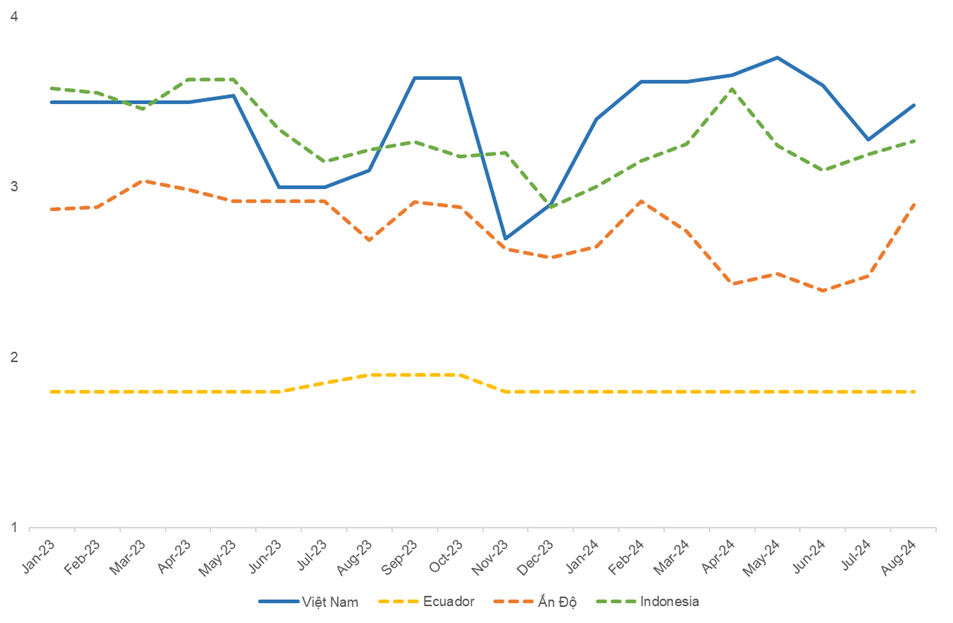

As a leading shrimp processor and exporter in Vietnam, Minh Phu has a diverse customer base in both domestic and international markets. According to MPC’s financial report, the European market showed significant growth in the first half of 2024, increasing from 15% to 19% of the revenue structure.

MPC’s Revenue Structure by Market

(Unit: Percentage)

Source: MPC Financial Report

The US, Japan, and the EU are MPC’s three largest export markets. In 2023, the export turnover to these markets accounted for 15%, 19%, and 11%, respectively, of Vietnam’s total shrimp export turnover.

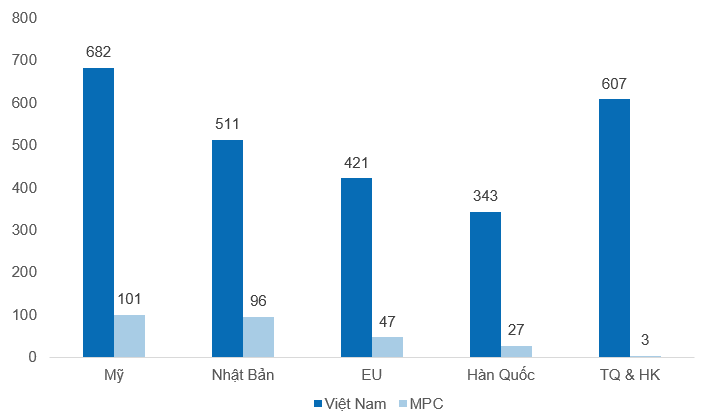

Shrimp Export Turnover in Major Markets in 2023

(Unit: Million USD)

Source: VASEP and MPC

Adapting Strategically in a “Low-Price Environment”

According to MPC’s 2023 annual report, the pandemic has led to increased shrimp farming costs in Vietnam. Additionally, subdued consumer demand due to the global economic downturn has negatively impacted shrimp exports.

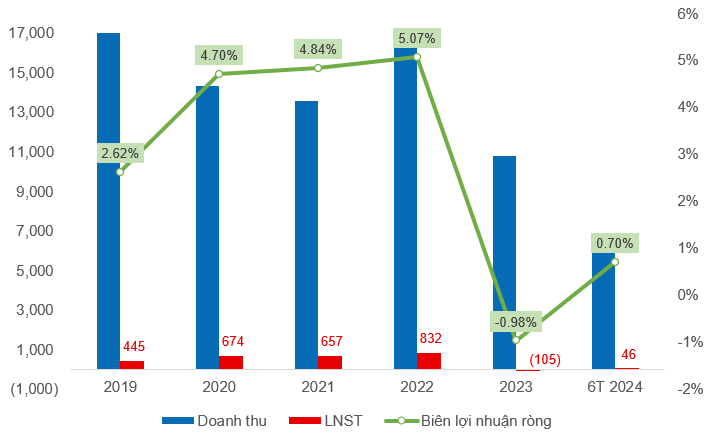

Meanwhile, international shrimp supply has been excessive due to increased production from competing countries like Ecuador and India, causing shrimp prices to continuously drop to levels equivalent to only 50% of farming costs. This was the primary reason for MPC’s significant loss of VND 105 billion in 2023.

MPC’s Business Results for 2019-6M/2024

(Unit: Billion VND)

Source: MPC Financial Report

To address these challenges, MPC has opted not to directly compete with the extremely low prices offered by India and Ecuador. Instead, the company focuses on enhancing product quality and diversification, with a particular emphasis on developing value-added processed products to increase profit margins and ensure the quality of raw materials.

Additionally, MPC is considering expanding its export markets to new countries while also aiming to increase its domestic market revenue to 5-10% by strengthening collaborations with Bach Hoa Xanh and other supermarket, restaurant, and hotel systems.

Not only MPC but also many seafood enterprises are adopting strategies to expand their market share in the domestic market alongside promoting exports. Typical examples are the leading enterprises in the pangasius industry, VHC and ANV, which derive more than 25% of their total revenue from the domestic market in the first half of 2024. In contrast, shrimp enterprises like MPC and FMC primarily focus their resources on exports, with less than 5% of their revenue coming from the domestic market. With a population of 100 million, the domestic market will become an attractive destination, especially given the ongoing challenges in seafood exports.

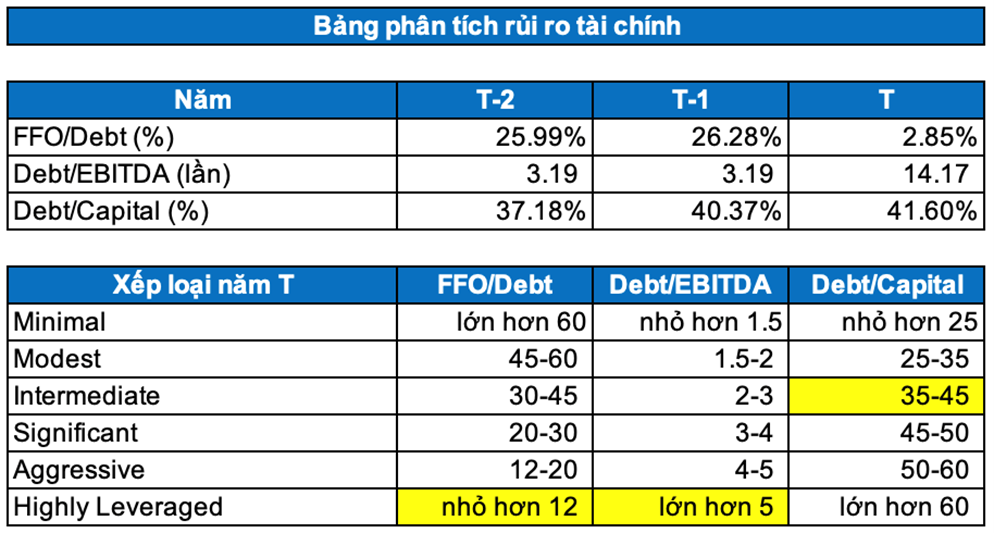

Alarming Financial Risks

According to Standard & Poor’s criteria, MPC’s financial risk is currently high due to its substantial loss in the previous year. Specifically, the FFO/Debt and Debt/EBITDA indicators have shifted from a “significant” risk level to a “highly leveraged” risk level. However, the Debt/Capital indicator remains at a “moderate” level, indicating some stability in the company’s financial structure.

Source: VietstockFinance

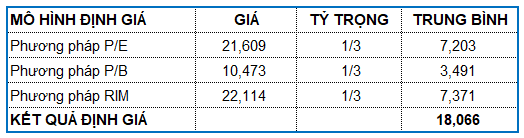

Valuation

Using the Market Multiple Models approach in conjunction with the RIM (Residual Income Model), we determined a reasonable valuation for MPC at VND 18,066. If MPC’s stock price continues to decline, purchasing for long-term investment purposes could be considered at a price below VND 15,000.

Vietstock Enterprise Analysis Department, Advisory Board

Fisherman Strikes Gold with Big Catch Overnight

With just one overnight fishing trip within 12-15 nautical miles from the shore, numerous fishermen from Quang Ngai are thrilled to pocket millions of VND each day thanks to their huge catch of anchovy fish.