A week full of significant information and events propelled the market to surge beyond many investors’ expectations. The rapid pace of growth even left some investors behind. However, experts believe that late investors still have opportunities as the market is expected to experience more fluctuations, allowing for the shedding of short-term speculative positions while welcoming new investors.

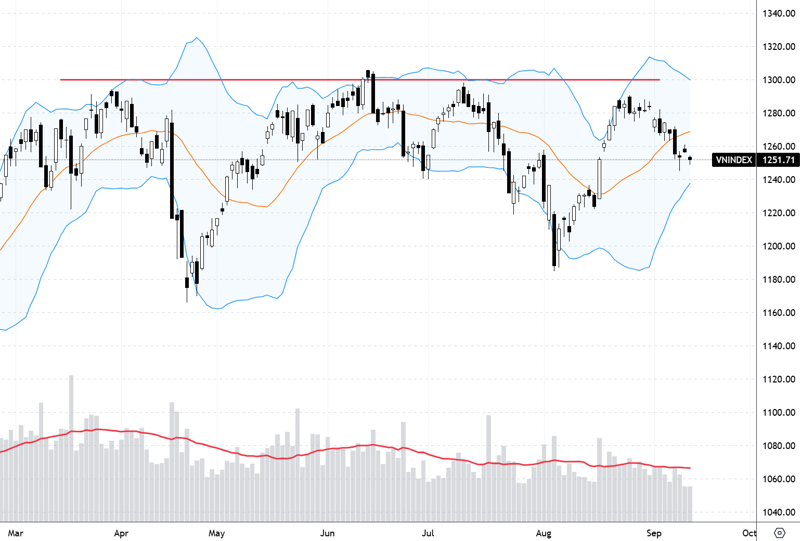

The VN-Index rose 20.33 points (+1.6%) last week, with unexpected developments in the first two sessions due to large margins. The issuance of Circular 68 and the Fed’s interest rate cut, combined with positive foreign capital inflows, fueled a recovery throughout the remaining four sessions. The rapid and robust increase in trading volume and liquidity was assessed by experts as effective, confirming that the market has reached the bottom of the correction phase.

The weak trading session at the end of the week was a consequence of ETF portfolio restructuring. Increased selling pressure allowed late investors to buy at better prices. Experts believe that the market will continue to experience short-term profit-taking pressure, creating opportunities for other investors to buy.

Regarding prospects, experts agree that the market is converging with supportive factors. The third-quarter financial reporting season is about to begin, and the Fed’s interest rate cut, combined with the opportunity to upgrade the market after Circular 68, has prompted foreign investors to net buy again. The buying trend has started and is expected to strengthen.

Nguyen Hoang – VnEconomy

The market closed a week full of important events with a decent increase, despite the impact of the last day’s restructuring. The only surprising factor was probably the issuance of Circular 68. VN-Index has strongly recovered to 1272 points, reclaiming all losses from the previous week. Were you surprised by the pace of this recovery?

I assess that the VN-Index has successfully formed a short-term bottom, and this fifth wave is expected to reach around 1300+/-10 points.

Mr. Nguyen Viet Quang

Nghiem Sy Tien – Investment Strategy Officer, KBSV Securities

As I mentioned in my previous assessment, the VN-Index is in a period lacking information, so trading liquidity is maintained at a low level, and investors lack a basis to open new positions or continue holding existing ones. Therefore, the issuance of Circular 68 right at this information-sparse time was enough to improve the market’s trading psychology, and I am not surprised that capital could support the index with such determination.

Nguyen Thi My Lien – Head of Analysis, Phu Hung Securities Company

Last week’s developments were unexpected, as the market dropped significantly at the beginning of the week, pushing investor sentiment to the extreme, and then quickly rebounded, recovering almost all losses from the previous three weeks. The market’s rapid increase suggests that short-term supply has been absorbed as discouraged investors sold, leaving little supply to hinder price movement.

Nguyen Viet Quang – Director of Business Center 3, Yuanta Hanoi

I had anticipated this recovery from the previous week: the market was approaching the end of the fourth wave and entering the fifth wave (1h frame), with the second adjustment session correcting around the 61.8% fibo and forming a bottom before bouncing back. Regarding the market’s recovery pace, I am not surprised, and I even predicted that the market could recover more strongly, but the restructuring pressure on Friday caused a strong upward session to fail, and the weekly candle has not yet formed a reversal cluster.

Le Duc Khanh – Director of Analysis, VPS Securities

I believe that the market’s rebound from the support zone of 1235 – 1240 points was not difficult to predict due to the dense support area from 1260 – 1240 points, which is a very strong support zone. Of course, we couldn’t know how the market would recover, but we could imagine that the recovery phases would consist of a series of sessions (some with slight increases and others with more substantial gains) and one robust session with improved trading volume, as seen in the middle of last week. Investors can be optimistic about the market’s current trend.

Money Flow Trend: Is the Peak of Floods the Bottom of the Stock Market?

Officially Allowing Foreign Institutional Investors to Not Margin 100% When Buying Stocks

Believing Inflation is Down, the Fed Aggressively Cuts Interest Rates by Half a Percentage Point

Le Minh Nguyen – Senior Director of Individual Customers, Rong Viet Securities

The market has just gone through a period of low liquidity with a lack of supportive information. However, in the past trading week, with supportive information about the Fed’s interest rate cut and the issuance of Circular 68, capital flowed back into the market, and the VN-Index recovered quite well. The quick return of capital shows that investors closely monitor the market and are ready to participate when there is supportive news.

Nguyen Hoang – VnEconomy

Last week also witnessed a rapid increase in trading volume. In our previous discussion, you were awaiting confirmation signals regarding the index and improved capital flow. Did the changes last week meet these expectations? Can we confirm that the market has reached the bottom?

Nguyen Thi My Lien – Head of Analysis, Phu Hung Securities Company

From my perspective, the signals last week were sufficient to confirm that the market has reached the bottom. The VN-Index dropped to the 1220-1240 demand zone, with investor sentiment at its lowest, selling in discouragement due to the market’s continuous decline over nearly three weeks, and then quickly rebounded with a small Double Bottom pattern, while trading volume gradually improved. The rapid increase in the index likely left most investors unable to open positions.

Le Duc Khanh – Director of Analysis, VPS Securities

In my opinion, there have been sufficient signals to confirm the market’s bottom around 1240 +/-, and the market has rebounded strongly to the 1270 – 1272 +/- zone. The market’s upcoming trend will fluctuate around the 1280 – 1300-point zone and surpass the 1300-point threshold.

Nghiem Sy Tien – Investment Strategy Officer, KBSV Securities

From a technical perspective, the first criterion I expected was for the market to show a recovery reaction around the 1250 (+/-10) mark, after filling the gap created during the August uptrend. Regarding the second criterion, I believed that the VN30 group and securities group would bottom out first, attracting capital back and spreading positive signals to other sectors. With last week’s developments, these signals have confirmed my expectations about the index’s bottom formation, and the VN-Index is likely to maintain its short-term upward trend.

Nguyen Viet Quang – Director of Business Center 3, Yuanta Hanoi

Looking at the wave pattern, the VN-Index, according to the 1h frame, has been in the fifth wave. The index closed last week above the MA20, MA50, MA100, and MA200, while trading volume has improved. Based on various factors, I assess that the VN-Index has successfully formed a short-term bottom, and this fifth wave is expected to reach around 1300+/-10 points.

The market’s upcoming trend will fluctuate around the 1280 – 1300-point zone and surpass the 1300-point threshold.

Le Duc Khanh

Le Minh Nguyen – Senior Director of Individual Customers, Rong Viet Securities

In the short term, the market has passed a challenging period, and investors have not sold desperately at the 1250-point zone but instead waited for the market to determine its trend. However, I think the market will experience some “shakes” for capital to continue flowing in.

Nguyen Hoang – VnEconomy

Except for the last session, which involved portfolio restructuring and net selling, foreign investors net bought notably in the remaining sessions last week. The strong net selling phase of foreign capital recently had a significant impact from the appreciation of the US dollar. Now that the Fed has reversed this trend and started a cycle of interest rate cuts, can we expect capital to flow back into the Vietnamese market? What are your predictions for foreign capital flow in the last months of 2024 and 2025, especially with Vietnam’s prospects for an upcoming upgrade?

Nguyen Viet Quang – Director of Business Center 3, Yuanta Hanoi

Typically, when a cycle of interest rate cuts begins, foreign capital flows into emerging markets and those near-emerging markets, boosting growth in Southeast Asian countries. We can clearly see this in the Vietnamese market, as the Fed maintained high-interest rates, and there were assessments that the Fed would cut interest rates in September. During this period, net selling decreased significantly, and when there were news of Fed rate cuts, foreign capital net bought quite strongly. We can entirely expect foreign capital to flow back strongly into the Vietnamese stock market in the last months of 2024 and 2025.

Nghiem Sy Tien – Investment Strategy Officer, KBSV Securities

Foreign capital net selling has probably been one of the most concerning topics in the Vietnamese stock market from the middle of 2023 until now. Although there are many opinions, including my own, that the trading state of this group of investors does not significantly impact the market, as liquidity is mainly dominated by small individual investors, up to 80%, the continuous net selling for an extended period has somewhat affected market sentiment and led to a significant outflow of capital.

The Fed has signaled its intention to continue cutting interest rates, possibly up to 1.5% by the end of 2025. This will reduce the interest rate differential between the US and developing countries, indirectly causing foreign capital to flow back into emerging and frontier markets like Vietnam.

Nghiem Sy Tien

However, the primary cause of foreign capital outflow from Vietnam was exchange rate tension, which has now cooled down and returned to balance after interventions by the State Bank. Additionally, the Fed has signaled its intention to continue cutting interest rates, possibly up to 1.5% by the end of 2025. This will reduce the interest rate differential between the US and developing countries, indirectly causing foreign capital to flow back into emerging and frontier markets like Vietnam. I believe that this trend will be increasingly supported from now until 2025 as the Ministry of Finance also accelerates its progress in meeting the FTSE Russell upgrade criteria.

Nguyen Thi My Lien – Head of Analysis, Phu Hung Securities Company

The inflow of foreign capital into emerging markets in the region has occurred over the past month in anticipation of the Fed’s interest rate cut. And in the past week, it was Vietnam’s turn to receive net buying again. I think this is just the beginning, and foreign capital inflows will become more vibrant in the coming time with the Non Pre-funding Solution – NPS regulation taking effect in early November.

Regarding the prospect of an upgrade, Vietnam is expected to be officially upgraded in September 2025. Active funds will flow in earlier, while passive funds that mimic market indexes will invest after the upgrade. Therefore, the timing of the upgrade announcement will significantly impact active funds’ investment decisions. The market expects FTSE to announce the upgrade in the September 2024 evaluation at the end of next week. However, if this scenario does not unfold, active funds’ investment may have to wait until the March evaluation next year.

Le Minh Nguyen – Senior Director of Individual Customers, Rong Viet Securities

The Fed’s interest rate cut demonstrates confidence in curbing inflation, and this decision positively affects Vietnam’s monetary policy. Additionally, the issuance of Circular 68 by the Ministry of Finance has begun to “untie the knot” for the Vietnamese stock market to be upgraded. These two factors are expected to attract substantial foreign capital inflows into the Vietnamese stock market soon. Moreover, domestic deposit and lending rates will stabilize, contributing to promoting public investment disbursement and enterprise credit growth, supporting the government’s growth targets.

The market expects FTSE to announce the upgrade in the September 2024 evaluation at the end of next week. If this scenario does not unfold, active funds’ investment decisions may have to wait until the March evaluation next year.

Nguyen Thi My Lien

Le Duc Khanh – Director of Analysis, VPS Securities

Looking back at the eight months of net selling by foreign investors, the net selling value has declined significantly in early September, and the situation has changed as foreign investors net bought in the past trading week. The accumulated net selling value on the HSX alone is now only about 980 billion VND. The increase in net buying by foreign investors may make September the first month this year to witness net buying by this group. This is the predicted trend for the end of the year. We can expect a reversal in the foreign capital flow trend in the coming period.

Nguyen Hoang – VnEconomy

The rapid increase last week caused many investors to miss the opportunity. In your opinion, will there be another adjustment phase to “welcome new investors”? What is your current stock holding ratio?

Nguyen Viet Quang – Director of Business Center 3, Yuanta Hanoi

As I predicted that the VN-Index would form a bottom for the fourth wave of correction around the 50% or 61.8% fibo, I