On September 18, Thu Duc Housing Development Joint Stock Company (coded TDH on HoSE) received a decision from the Ho Chi Minh City Tax Department on the enforcement of administrative decisions on tax management.

Accordingly, TDH was forced to comply with the administrative decision on tax management by having an amount of 91,164,420,218 VND deducted from its bank account.

It is known that the Ho Chi Minh City Tax Department has repeatedly issued notifications regarding the enforcement of administrative decisions on tax management towards Thu Duc Housing Development JSC. In response, the company has filed a lawsuit against the Ho Chi Minh City Tax Department, lodging a complaint with the Ho Chi Minh City People’s Court.

However, on September 9, Thu Duc Housing Development received a decision from the Ho Chi Minh City People’s Court to postpone the first-instance administrative trial, which was originally scheduled for August 21, 2024. The trial, which was supposed to take place on September 12 at 1:30 pm, has been postponed, and the company has not received any further updates about the new trial date.

Currently, HoSE continues to maintain a warning status for TDH stock based on decision No. 169 of the Ho Chi Minh City Stock Exchange, as the company’s undistributed post-tax profit as of June 30, 2024, was negative, amounting to VND 784.61 billion, according to its reviewed consolidated financial statements for the first half of 2024.

Recently, TDH’s Chief Accountant, Ms. Nguyen Thi Ha, resigned from her position effective September 5, and the company has appointed Ms. Le Ngoc Minh as the new Chief Accountant from September 6 until the end of the term (2020-2025) or until another replacement is decided.

In the stock market, TDH stock price slightly increased to VND 2,900 per share at the close of the trading session on September 19.

“When Words Transcend: Unlocking the Power of Persuasion”

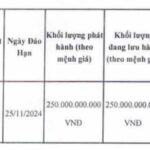

In a surprising turn of events, Hai Phat has announced that it is temporarily halting plans to offer over 152 million shares to raise 1.521 trillion VND to repay debts. Meanwhile, the company has just spent 67.5 billion VND to repurchase a part of the bond code HPXH2124009 ahead of schedule.

The Sun Jupiter Financial Stock Alert: A Cautionary Tale

“Shares of SJF, owned by Sao Thai Duong, have been placed on alert status due to the company’s delay in submitting its 2024 semi-annual financial report. The report was due over 15 days ago, and this delay has raised concerns among investors and regulators alike. With a history of providing transparent and timely financial disclosures, this recent development is an unusual occurrence for the company. The market is now eagerly awaiting the release of the audited financial statements to understand the company’s current financial health and future prospects.”