Factory of Joint Stock Company for Investment and Trade Vu Dang. Photo: SVD

|

At the 2024 Annual General Meeting of Shareholders (on June 06), SVD announced that it had approved the business development orientation, focusing on developing its fiber production and agreed to research and seek opportunities to expand and diversify its business fields.

The General Meeting of Shareholders agreed to add real estate-related business lines to serve the Company’s development orientation.

The SVD management board assessed that after a period of stagnation due to the impact of the economy, the real estate market this year has been more positive than last year, influenced by the new laws (Housing, Land, and Real Estate Business). The company also believes that along with the improved demand, real estate prices are also on an upward trend.

With the positive developments in the real estate market, SVD wants to participate in investing, developing projects, and doing real estate business to establish and exploit potential land funds to serve its future development orientation.

The expected implementation time is October 2024, and the company will use its own capital and mobilize additional funds from individuals and organizations, such as issuing shares to increase capital, bonds, or bank loans. The total expected investment is unlimited.

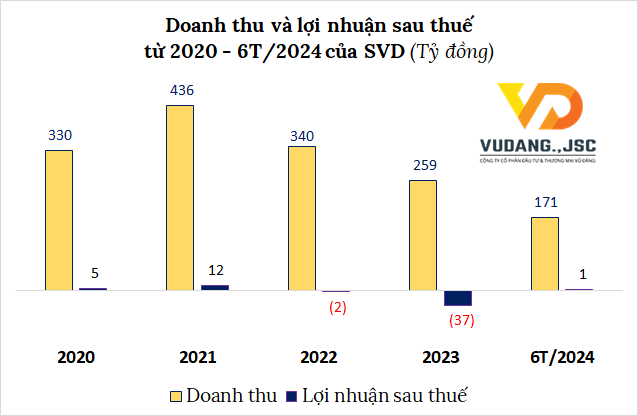

This fiber enterprise wants to enter the real estate sector as SVD has been making consecutive losses in 2022-2023, with losses of over VND 2 billion and nearly VND 37 billion, respectively.

In the first half of 2024, SVD’s business results gradually recovered, with a post-tax profit of nearly VND 1 billion (compared to a loss of over VND 15 billion in the same period). Revenue increased by 58% to nearly VND 171 billion.

With these favorable results, SVD said that the world economy in the first half of 2024 continued to face many risks but showed improvement compared to the same period in 2023. To adapt, the company has implemented appropriate policies for each product line, taking advantage of new opportunities to increase revenue and optimize costs, helping the company become profitable.

Source: VietstockFinance

|

Back to the Extraordinary General Meeting of Shareholders of SVD, based on the actual production and business situation, the Company approved the establishment of a subsidiary (a joint-stock company) in the Thai Binh area with a charter capital of VND 1-300 billion, with an expected ownership ratio of about 98%.

In addition, the SVD Board of Directors also approved the resignation of Mr. Mai Anh Tuan from the position of Chairman of the Board of Directors, as he had submitted a resignation letter in July 2024. Mr. Nguyen Van Don was elected to supplement the position of Member of the Board of Directors for the term 2020-2025.

In the stock market, SVD’s share price has risen to the ceiling for two consecutive sessions (September 20-23) with unusually high liquidity and temporarily stood at VND 3,270/share (as of September 23), up more than 36% compared to the beginning of 2024.

| SVD Share Price Trading since the beginning of 2024 |

The Billion-Dollar Real Estate Project: Unveiling TCM’s Latest Move

On the morning of September 20, TC Tower Co., Ltd., a wholly-owned subsidiary of Thanh Cong Textile Garment Investment and Trading Joint Stock Company (HOSE: TCM), entered into a strategic partnership with DBFS Joint Stock Company to develop the TC Tower real estate project. This project is expected to boast an investment of over VND 1,700 billion.

The Capital’s Affordable Housing Crisis: Hanoi’s Sky-High Prices for Aging Social Housing

After meeting the eligibility criteria for transfer, many social housing projects in Hanoi have seen a steady increase in prices, nearing those of commercial apartments. However, the development of social housing projects continues to face significant challenges.

“Tín Hưng Investment: Your Trusted Distributor of Masterise Homes Projects”

“Tín Hưng Investment is proud to announce its exclusive F1 distributorship for three prestigious real estate developments by Mastersie Homes: The Global City, Masteri Centre Point, and Lumière Boulevard. As the authorized distributor, we are thrilled to offer our clients unparalleled investment opportunities in these sought-after projects.”