Mr. Nguyen Hoang Linh, CEO of the Vietnam Maritime Commercial Joint Stock Bank (MSB), shared that according to the State Bank of Vietnam’s statistics as of early September, the credit outstanding of the entire system had increased by approximately 7.15% (with a yearly target of 15%). Credit growth has been positive since April, with a more noticeable shift in August. In terms of the macro economy, the country’s GDP for the first six months reached about 6.42%, along with many positive signals in import and export, industrial production, total state budget revenue, and investment fields.

Diving into the details of MSB’s performance, the bank has maintained stable growth in the first eight months of the year. As of August 31, 2024, the credit growth rate reached 15.5%, focusing on sectors such as agriculture and rural areas, exports, auxiliary industries, small and medium-sized enterprises, and high-tech enterprises, with a cumulative disbursement of over VND 60,735 billion in these areas.

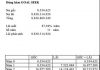

In addition, in compliance with the Government and SBV’s directives and to support customers in accessing loans, overcoming difficulties, and recovering production and business operations, MSB has implemented several preferential interest rate programs. These include a VND 15,000 billion and USD 150 million package with interest rates ranging from 6% to 7.5% for customers in the fields of commerce, production, construction, and import-export; and a VND 1,000 billion package for new corporate borrowers in 2024. For individual customers, MSB offers short-term business loans starting at 5.8%/year for new customers and medium to long-term loans for real estate, consumer, and construction purposes, ranging from 4.5% to 6.2%/year.

MSB not only plays an active role in the industry but also fulfills its social responsibilities. Even before Typhoon Yagi made landfall and caused damage, the bank instructed its units to review customers and quickly introduced a support program worth VND 2,000 billion. This program offered a 1% reduction in interest rates for VND and 0.5% for USD to corporate and household business customers affected by the typhoon or new borrowers in need of capital to rebuild their business operations.

Executives of Vietnamese joint-stock commercial banks take a photo with the Prime Minister and the Governor of the State Bank

In his speech, Mr. Nguyen Hoang Linh also put forward several recommendations and proposals from MSB to the Government and relevant ministries and branches.

First, MSB proposed that the Government and the Prime Minister implement solutions to remove obstacles for green energy and renewable energy projects, such as wind and solar power, to attract new investors and support completed projects to be put into use. This would help businesses operate stably and promote a shift in the structure of power sources, ensuring national energy security.

Second, MSB suggested that relevant ministries and branches continue to maintain an open fiscal policy to support businesses, including credit institutions, through measures such as exempting/reducing/postponing certain taxes during difficult periods and providing financial support for production and business recovery. They also proposed support for credit institutions in debt recovery, such as providing information, direct communication, and legal assistance in asset handling.

Sure, I can assist with that.

Title: HDBank: Foremost Credit Room in the Banking Sector, Projected Profit Growth of Over 28% Annually for the Next 5 Years

In their recently published analyst report, MB Securities (MBS) has assessed HDBank’s business outlook as positive for the second half of 2024 and 2025. This optimistic forecast is attributed to the bank’s exceptional financial performance in the first half of this year, which has set a strong foundation for continued success in the upcoming periods.

“Planning for Prosperity: How Strategic Urban Development Attracts Premier Projects and Investors”

On September 22, Prime Minister Pham Minh Chinh attended the Conference on Announcing the Planning and Investment Promotion of Bac Ninh Province. According to the Prime Minister, planning plays a leading role in guiding sustainable development. Good planning attracts quality projects and investors, ultimately resulting in successful outcomes.

The Province Next Door to Hanoi is Getting an Aeon Mall: A $190 Million Project in the Works

At the Conference on the Announcement of the 2021-2030 Planning Period, with a vision towards 2050, and the Promotion of Investment in Bac Ninh Province in 2024, AEON Mall Vietnam Co., Ltd. was presented with a Memorandum of Understanding (MoU) for the development of the AEON Mall commercial project in the 2024-2025 period in Bac Ninh Province, with a total expected investment capital of 190 million USD.

Mrs. Bui Thi Thao Ly (SSV): ESG Disclosure Enhances Access to Foreign Capital

At the IR View workshop on ‘greening’, held as part of the IR Awards 2024 ceremony on the morning of September 24, Ms. Bui Thi Thao Ly, Director of the Analysis Center of Shinhan Securities Vietnam Co., Ltd. (SSV), represented the seller and shared her insights on attracting foreign capital through ESG disclosure.