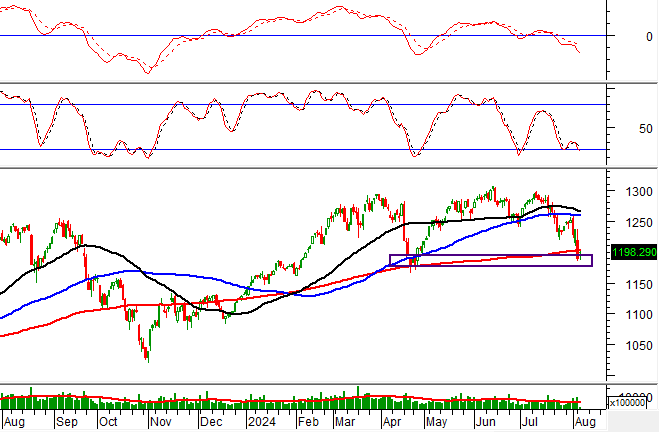

Technical Signals for the VN-Index

During the morning trading session of September 24, 2024, the VN-Index witnessed a decline and formed a Doji candlestick pattern, while turnover saw a sharp drop. These indicators suggest that investors are adopting a cautious stance.

At present, the VN-Index is testing the Fibonacci Projection 38.2% level (corresponding to the 1,265-1,275 range) as the MACD indicator flashes a buy signal. If the index successfully surpasses the resistance level, a short-term bullish scenario may unfold in the upcoming sessions.

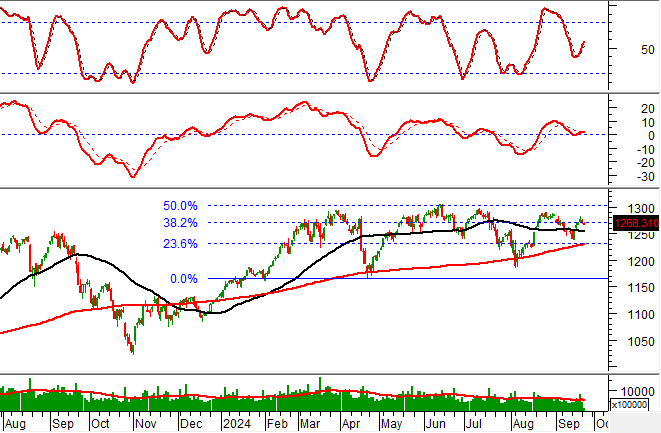

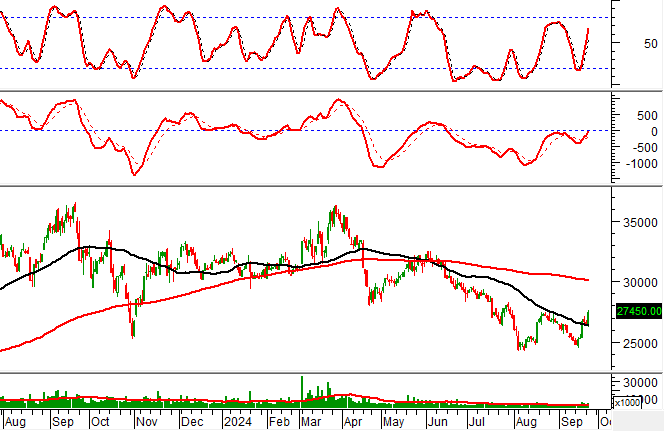

Technical Signals for the HNX-Index

On September 24, 2024, the HNX-Index declined, accompanied by a significant drop in trading volume during the morning session, indicating investors’ cautious sentiment.

Additionally, the index exhibited a ‘Death Cross’ between the 50-day SMA and the 200-day SMA, suggesting that the long-term optimistic outlook is gradually fading.

CTD – Coteccons Construction Joint Stock Company

On the morning of September 24, 2024, CTD witnessed a strong surge in price, accompanied by a trading volume surpassing the 20-session average, indicating a growing optimism among investors.

Furthermore, the stock’s price broke above the Middle line of the Bollinger Bands, while the MACD indicator continues to widen the gap with the Signal line after previously flashing a buy signal. These factors reinforce the strength of the stock’s short-term recovery trend.

KBC – Kinh Bac City Development Shareholding Corporation

On September 24, 2024, KBC witnessed a price increase and formed a White Marubozu candlestick pattern, accompanied by a turnover exceeding the 20-session average, indicating active trading among investors.

Moreover, the stock rebounded after successfully testing the 50-day SMA, while the Stochastic Oscillator continues its upward trajectory after providing a buy signal earlier. These factors underscore the presence of a positive mid-term outlook.

Technical Analysis Team, Vietstock Consulting Department

The Flow of Funds: Market Confirms Bottom, Shaking Hands to “Seal the Deal”

A week brimming with news and significant events propelled the market to surge beyond many investors’ expectations. The rapid ascent left some feeling like they missed the boat. However, experts believe that latecomers still have opportunities as the market is due for more volatility, shaking off short-term speculative positions while welcoming new investors.