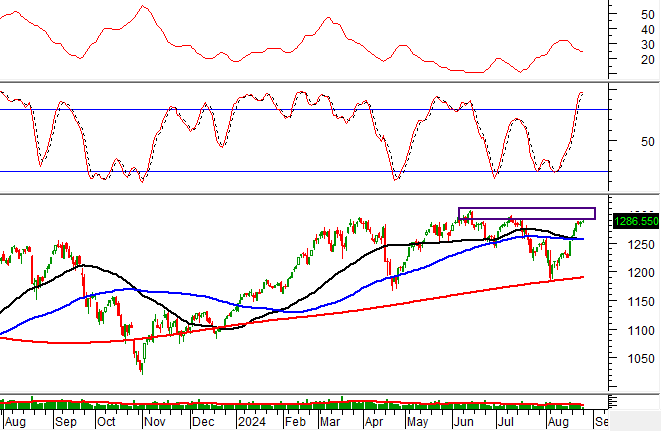

After a prolonged period of stagnation, the stock market regained its momentum during the trading week of September 16-20. The driving forces behind this resurgence were the Fed’s interest rate cut and significant strides made in the market upgrade trajectory. Specifically, on September 18, the Fed decided to loosen its monetary policy after four years, reducing the US benchmark interest rate by 50 basis points to 4.75-5%.

On the same day, the Ministry of Finance officially issued Circular 68/2024-BTC, amending four circulars related to foreign institutional investors being able to trade in stocks without the requirement of pre-funding and the roadmap for information disclosure in English.

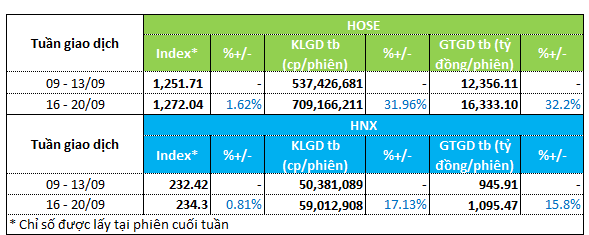

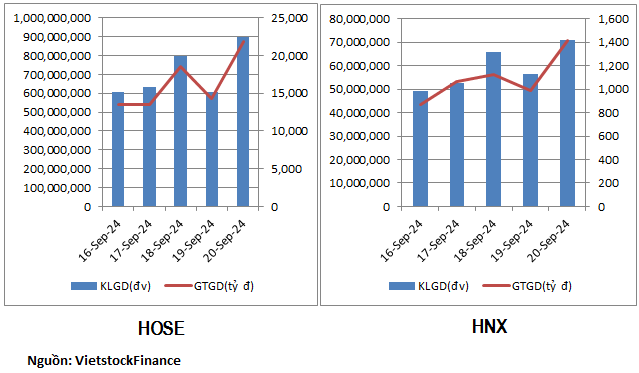

As a result, the stock market witnessed a robust increase in both index points and liquidity. The VN-Index rose by 1.6% to 1,272.04 points, while the HNX-Index climbed by 0.8% to 234.3 points. Liquidity also surged on the two listed exchanges. On the HOSE, trading volume and value increased by over 30%, reaching 709 million units and VND 16.3 trillion per session, respectively.

On the HNX, liquidity grew by approximately 16-17%. Consequently, the average trading volume reached 59 million units per session, while the trading value neared VND 1.1 trillion per session.

|

Weekly Liquidity Overview for September 16-20

|

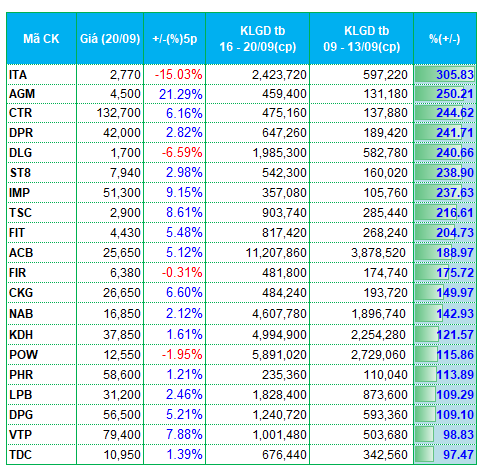

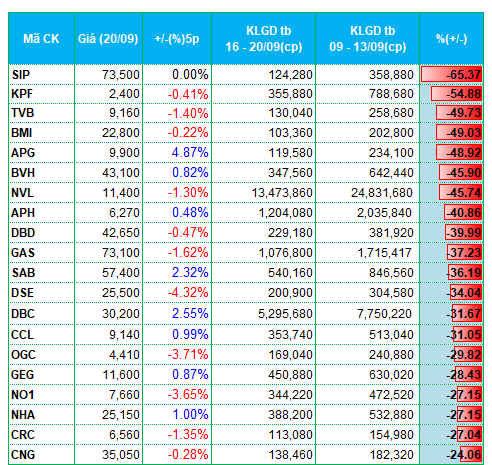

The surge in liquidity led to a broad-based increase in trading volumes across various sectors. ITA, for instance, witnessed a fourfold increase in trading volume compared to the previous week, reaching 2.4 million units per session. This spike in trading activity may have been prompted by the upcoming trading halt for this stock, effective from September 26.

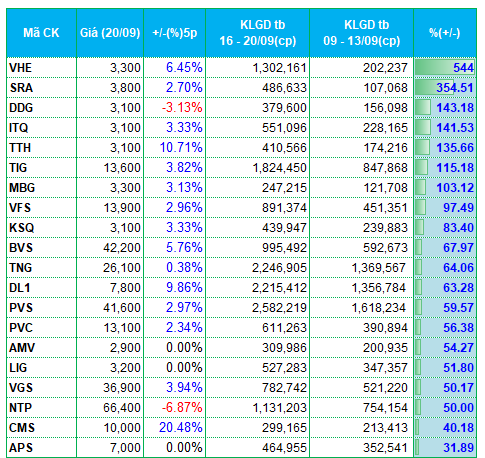

The agriculture and agricultural supplies sectors attracted significant investment, with notable performances from AGM, ST8, and TSC. Several bank stocks also witnessed strong liquidity, including ACB, NAB, and LPB. In the steel and metals sector, stocks such as ITQ, KSQ, and VGS stood out for their impressive trading volumes.

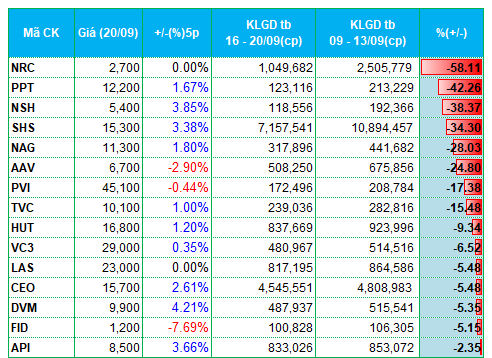

On the other hand, the securities and insurance sectors experienced substantial outflows, with APG, DSE, TVB, SHS, and TVC in the securities sector, and BMI, BVH, and PVI in the insurance sector, all witnessing notable declines in liquidity.

Within the real estate sector, FIR, CKG, TDC, and TIG were among the top performers in terms of liquidity on the HOSE and HNX exchanges. However, several stocks in this sector experienced outflows, including NVL, SIP, CCL, NHA, NRC, AAV, VC3, CEO, and API, indicating a net outflow of funds from this industry.

|

Top 20 Stocks with Highest Liquidity Increase/Decrease on the HOSE

|

|

Top 20 Stocks with Highest Liquidity Increase/Decrease on the HNX

|

The lists of stocks with the highest and lowest liquidity changes are based on a minimum average trading volume of 100,000 units per session.

“Japan Supports Enhancing the Efficiency of Vietnam’s Stock Market”

On September 23, the State Securities Commission of Vietnam (SSC) and the Japan International Cooperation Agency (JICA) hosted a workshop in Hanoi titled “Promoting the Efficiency of Vietnam’s Stock Market.” This event marked the launch of a project aimed at “Enhancing Capacities for Promoting the Efficiency of Vietnam’s Securities Market.”