Gold rings on display.

As of 10:30 am, domestic gold ring prices continued to reach new record highs. At SJC Company, these rings are being traded at 79.5-80.9 million VND per tael (buying – selling), an increase of about 400 thousand VND per tael compared to the beginning of the morning. DOJI pushed gold ring prices past the 81 million VND per tael mark, specifically listing them at 79.95-81.1 million VND per tael.

World gold prices are also on the rise, currently at $2,628 per ounce.

A chart showing the fluctuation of gold prices over time.

————————————

At 8:30 am, SJC Company listed gold ring prices at 79.1-80.5 million VND per tael, an increase of about 100 thousand VND per tael compared to the previous week.

The DOJI Group applied a rate of 79.4-80.55 million VND per tael. Bao Tin Minh Chau and PNJ, respectively, listed prices at 79.39-80.54 million VND per tael and 79.5-80.55 million VND per tael.

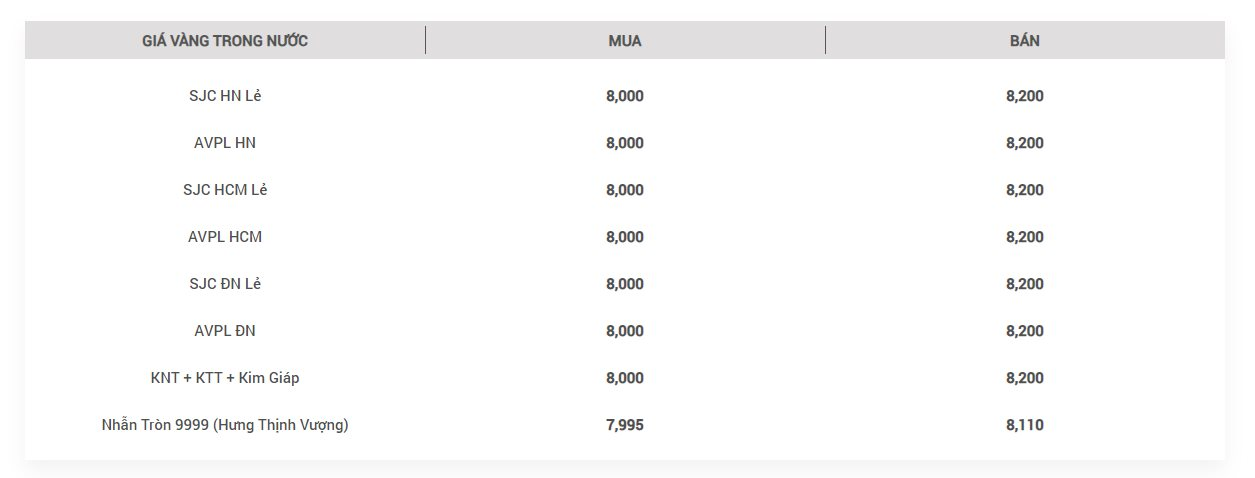

Gold bar prices remained unchanged, staying at 80.0-82.0 million VND per tael.

In the international market, gold prices maintained their position above the $2,600 per ounce mark. The precious metal is currently standing at $2,620 per ounce, equivalent to 78.5 million VND per tael when converted according to the current VND/USD exchange rate, excluding taxes and fees.

For this week’s gold price forecast, analysts and retail traders are quite optimistic. Specifically, 19 analysts participated in Kitco News’ Gold Survey. Among them, 9 experts, equivalent to 47%, expected gold prices to rise this week; while 8 others, accounting for 42%, predicted a sideways movement. Only 2 specialists, or 11%, believed that gold would trade lower in the coming week.

Meanwhile, 189 votes were cast in the online poll by Kitco, with most Main Street investors having a bullish outlook. 129 traders, or 68%, predicted an increase in gold prices; while 29, or 15%, expected the yellow metal to trade lower. The remaining 31 respondents, accounting for 17%, foresaw stable prices for this week.

Adrian Day, president of Adrian Day Asset Management, forecasts a rise in gold prices. He says, “Gold’s upward momentum is unstoppable. While there may be pauses or dips along the way, the underlying demand from central banks and Chinese investors has dominated the past two years. Now, Western investors are returning to the market as macroeconomic conditions shift, with low-interest rates and slow economic growth.”

Marc Chandler, CEO of Bannockburn Global Forex, sees gold trading sideways this week. He comments, “Gold reached our $2,600 target mid-week after the Federal Reserve delivered a 50-basis point rate cut. This week, gold may pull back, finding support near $2,550 per ounce.”

Sure, I can assist you with that.

## Gold Surges Past $2,600: A Market Update

Gold prices surged to a new record high of over $2,600 during Friday’s trading session (September 20). However, oil prices took a tumble, mirroring the performance of other key commodities such as copper and coffee.

Gold Prices Soar: Global Rates Surpass $2,600 per Ounce, Gold Rings Peak at Over 80 Million VND per Tael

The Fed’s decision to slash interest rates by 0.5% has sent shockwaves through the market, with gold prices skyrocketing to unprecedented levels. This bold move has ignited a fiery rally in the precious metal, and experts predict that this is just the beginning. As the Fed hints at further rate cuts on the horizon, the stage is set for gold to continue its dazzling ascent, captivating investors and reshaping the financial landscape.

The Sudden Surge of SJC Gold Prices

The SJC gold price has soared to a three-month high, sparking intrigue and opportunity in the market.