Impact:

UOB Bank has released its Q3 economic assessment report, and the findings are noteworthy. According to the report, Typhoon YAGI (the third storm of the season) caused an estimated $40 trillion VND in damage to northern provinces, which is expected to result in a 0.15% reduction in Vietnam’s GDP for 2024.

Prior to Typhoon YAGI, Vietnam’s data up to August exhibited robust growth. Exports recorded double-digit increases compared to the previous year, with a trade surplus of $18.5 billion.

From the beginning of the year until August, retail sales maintained an average monthly growth rate of 8.8% year-on-year, despite a high base in 2023. FDI disbursed during the first eight months rose 8% to $14.2 billion. However, regarding growth prospects for this year, UOB believes the impact of the third storm will be more pronounced in the latter part of Q3 and early Q4 in the northern regions of the country.

The report states, “The impact will be felt through production disruptions and damage to facilities across various sectors, including manufacturing, agriculture, and services. However, beyond these temporary disruptions, the long-term fundamentals remain solid.”

Vietnam’s data up to August showed robust growth before the third storm.

UOB’s experts opine that while Vietnam achieved impressive growth of 6.93% in Q2 this year, it is unlikely that this momentum can be sustained in the second half.

Taking into account the impact of the third storm, reconstruction efforts, and a higher base in the latter half of 2023, UOB has adjusted its growth forecast for Vietnam downward.

Specifically, for Q3, UOB Bank predicts Vietnam’s economic growth to slow to 5.7%, down from the previous forecast of 6.0%. For Q4, growth is expected to be 5.2%, a reduction from the earlier estimate of 5.4%. The bank has also lowered its full-year growth forecast for Vietnam to 5.9%, a 0.1% decrease from the previous prediction of 6%.

“This is still a positive recovery compared to the 5% growth in 2023. The GDP growth forecast for 2025 has been adjusted upward by 0.2% to 6.6%, reflecting the expected makeup for previous shortfalls,” said UOB experts.

Interest Rate Challenges:

According to UOB, despite the impact of the recent third storm and the VND’s significant recovery since July, the bank’s experts anticipate that the State Bank of Vietnam will maintain its key policy rate for the remainder of the year while remaining vigilant about inflation risks.

From the beginning of the year until August, headline CPI increased by 4% year-on-year, slightly lower than the 4.5% target. Price pressures may intensify following disruptions in agricultural production, as food accounts for 34% of the CPI weight.

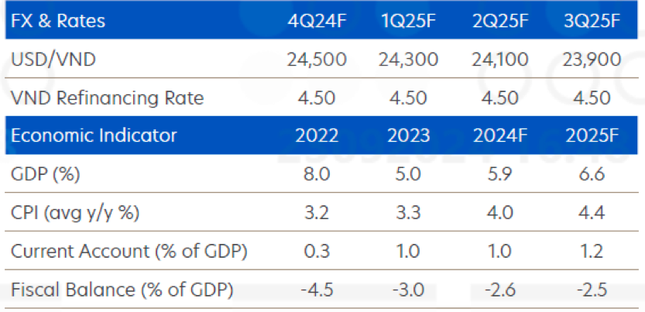

UOB’s forecast for exchange rates and Vietnam’s economic indicators up to Q3/2025.

The State Bank may opt for a more focused support approach to assist affected individuals and businesses in the impacted regions, rather than implementing a broad-based nationwide support tool such as an interest rate cut.

Consequently, UOB predicts that the State Bank will maintain the refinancing rate at its current level of 4.50% while focusing on promoting credit growth and other supportive measures.

However, the Federal Reserve’s announcement of a 50-basis-point rate cut in September could increase the likelihood and pressure on the State Bank to consider a similar easing policy.

UOB also notes that, in line with regional currencies, the VND has recorded its largest quarterly gain since 1993, appreciating by 3.2% to 24,630 VND/USD. External pressure from the strength of the USD is starting to ease as the Fed embarks on an easing cycle as expected, while domestic factors indicate further stability for the VND.

UOB forecasts the USD/VND rate to be 24,500 in Q4 this year, 24,300 in Q1/2025, 24,100 in Q2/2025, and 23,900 in Q3/2025.

The Capital’s Mooncakes: Slashed Prices, Still No Takers

This Mid-Autumn Festival, consumer demand was lackluster, leaving many mooncake vendors in Hanoi with an abundance of unsold goods. In an effort to boost sales and clear inventory, numerous shops implemented significant post-holiday discounts.

“Government-Backed 2000 Billion VND Loan Scheme to Aid Post-Disaster Reconstruction”

Military Commercial Joint Stock Bank (MB) is offering a special loan package of up to 2000 billion VND with a 1% reduced interest rate for individuals and households affected by the floods. This initiative aims to support those impacted by the natural disaster to rebuild their lives and get back on their feet with ease.

The Seafood Industry is Rocked by Storm Yagi

The recent Typhoon No. 3 (Yagi) has wreaked havoc on aquaculture, resulting in a severe shortage of raw materials for seafood processing businesses. The storm’s impact has been far-reaching, with many shipments delayed and left in prolonged storage, potentially affecting product quality and increasing the risk of financial losses for these businesses.