Vietnam-based fiber manufacturer and trader Vu Dang Investment and Trading Joint Stock Company (stock code: SVD) has approved a plan to invest in and develop a real estate project, according to the resolution of the 2024 Extraordinary General Meeting of Shareholders held on September 23. This marks a strategic expansion beyond their core business of fiber production.

After a period of stagnation due to economic challenges, the company’s leadership recognizes the positive shift in the real estate market this year compared to 2023, attributed to new laws on housing, land, and real estate business.

Third-party data cited by the company shows a significant increase in nationwide land and property searches in the third quarter of 2024: a 49% rise for land, 25% for private homes, 24% for apartments, and 22% for villas compared to the same period last year. Along with this surge in demand, real estate prices are also on an upward trend.

As early as October, Vu Dang Fiber plans to utilize its own capital and additional funds raised from individuals and organizations through equity offerings, bond issuances, or bank loans for this real estate venture. The total investment is unlimited, depending on the company’s fundraising success and investment efficiency assessment during the project’s implementation.

This decision to enter the real estate market comes after two consecutive years of losses in their traditional business. Founded in 2013, Vu Dang Fiber is known for producing and supplying OE (open-end) fibers domestically and internationally, with China as its primary market.

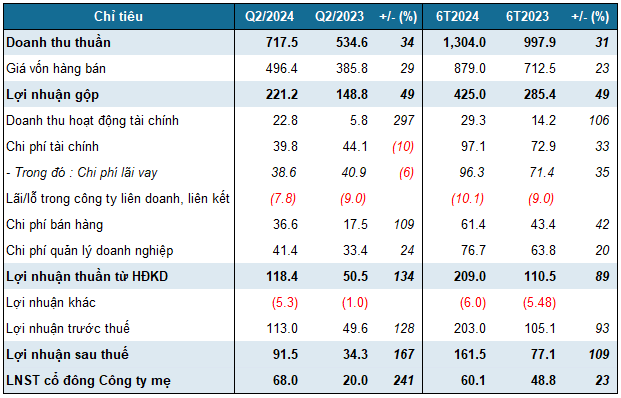

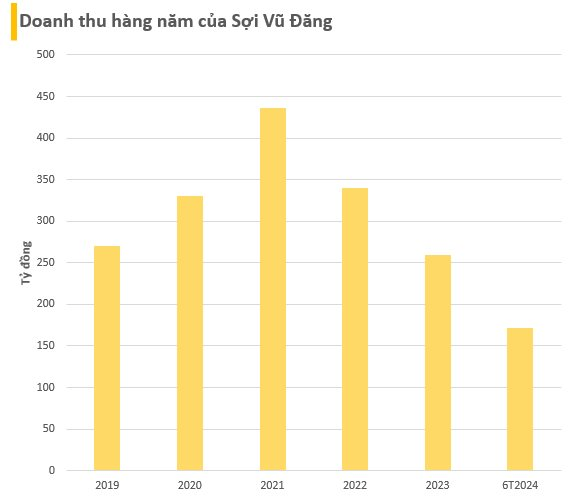

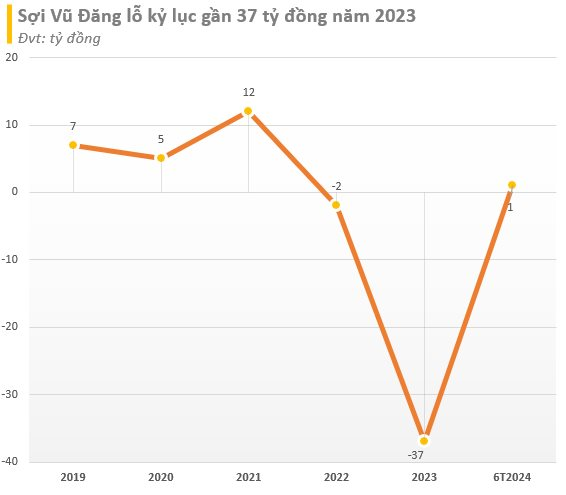

According to Vu Dang Fiber’s financial statements, their revenue was primarily generated from fiber manufacturing and exports in previous years, yielding hundreds of billions in revenue annually. However, the company incurred losses in 2022 and 2023, and if this trend continues into 2024, their stock (SVD) faces the risk of delisting from the HoSE.

In 2023, the company attributed their challenges to the stagnant recovery of the Chinese market, which froze their exports. Additionally, fluctuations in bond prices for cotton and fiber further impacted their export revenue, resulting in a meager total of over 8 billion VND for the year. Their domestic market share also shrunk due to increasing competition among fiber manufacturers.

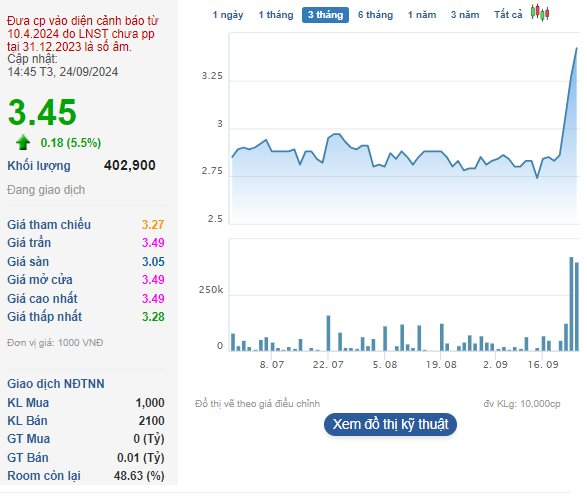

With a record loss of nearly 37 billion VND in 2023, the company accumulated a loss of close to 29 billion VND as of June 30, 2024, despite a modest profit of almost 1 billion VND in the first half of this year. As a result of these losses, SVD stock has been placed on a warning status on the HoSE since April 10, 2024.

The company’s financial struggles have led to a reduction in their workforce. As of the last reporting period, they had 83 employees, less than half of the 177 employees reported at the end of 2021.

Following the announcement of their foray into real estate, SVD stock witnessed four consecutive gains, including two ceiling-price hikes, resulting in a remarkable 22% increase.