On September 23, the first-instance trial of the Van Thinh Phat ‘mega-case’ continued with the cross-examination of the accused, focusing on those charged with “fraudulent appropriation of property.” The accused were implicated in a VND 2,000 billion bond package issued by Ho Chi Minh City Service and Trading JSC (Setra Corp).

During the trial, Trinh Quang Cong, the General Director of Acumen Company, admitted to his crimes and revealed that he received instructions to issue the VND 2,000 billion bond package from Truong Khanh Hoang, the former General Director of SCB.

Notably, Setra’s 2019 financial statement showed that the company was making a loss (not meeting the conditions for bond issuance). To circumvent this, Cong instructed others to manipulate the 2019 financial statement to receive a fully accepted audit opinion and meet the financial requirements for bond issuance.

Specifically, Cong colluded with Tran Van Tuan, the General Director of Setra, and Tran Thi Lan Chi, the Chief Accountant, to fabricate capital withdrawal procedures from Khang Thanh Phu Company. They achieved this through

fictitious capital transfer contracts with backdated signatures

, ultimately

turning Setra’s financial statement from a loss to a profit.

Subsequently, the accused provided the altered contracts and financial statements to the auditors of A&C Company, who issued an independent audit report with a fully accepted opinion. This enabled Setra to meet the financial requirements for bond issuance in 2020.

When questioned about the manipulation of Setra’s financial statements, both Tran Van Tuan and Tran Thi Lan Chi disagreed with parts of the indictment. They denied creating the capital withdrawal dossier for Setra at Khang Thanh Phu, claiming that the Van Thinh Phat Group’s office prepared the dossier and only asked them to sign it.

“I was informed by Trinh Quang Cong that Setra would be the bond issuer, and I was asked to provide legal documents. I was unaware of the specific bond issuance plan or the identity of the bond purchasers…”

, said Tuan.

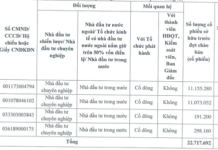

According to the indictment, after ensuring Setra met the conditions for bond issuance, Tran Van Tuan and Nguyen Van Phong Van, a hired representative of Dien Gia Cat, signed 20 bond purchase agreements. This enabled Dien Gia Cat to purchase all 20 million Setra bonds in the primary market, totaling VND 2,000 billion.

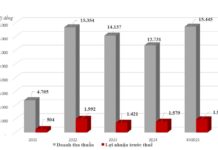

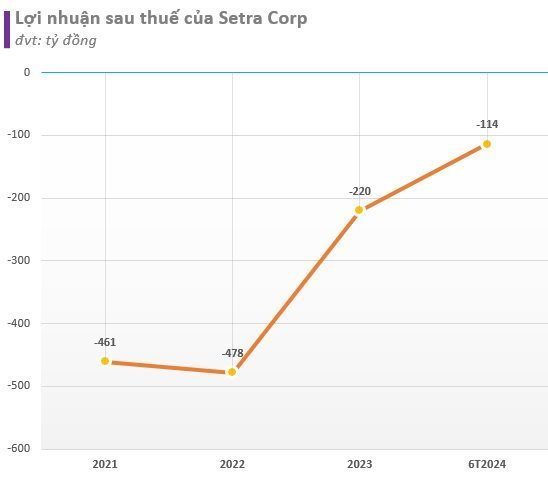

Setra Corp has incurred losses of nearly VND 1,300 billion in the last four years

Setra Corp was established in October 1999, with its headquarters located at 5 Cong Truong Me Linh, Ben Nghe Ward, District 1, Ho Chi Minh City. The company primarily operates in the real estate and land use rights trading sector. Its legal representative is Mr. Tran Van Tuan, and after privatization, the company’s charter capital is VND 2,000 billion.

According to the conclusion of the Investigation Agency of the Ministry of Public Security, Setra Corp is one of four legal entities that have committed acts of fraud and violated legal regulations by creating 25 bond packages with a total value of VND 30,081 billion to sell to bondholders, raising capital, and appropriating it.

In the second phase of the Van Thinh Phat case, the investigating authorities continued to sequester a series of real estate properties related to Ms. Truong My Lan. Among them, Setra, entrusted by Truong My Lan, holds an 18% capital contribution (over VND 142 billion) in the Limited Liability Company between Vietcombank – Bonday – Ben Thanh. This joint venture is the investor of the Vietcombank Tower Saigon, one of the tallest and most favorably located buildings in District 1’s center.

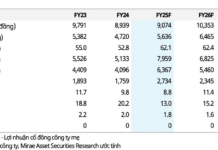

In the first half of 2024, Setra Corp reported a post-tax loss of VND 114.5 billion, a decrease compared to the previous year’s loss of VND 273 billion.

Thus, in nearly four years, the company has incurred losses of nearly VND 1,300 billion.

As of June 30, Setra’s equity reached VND 295 billion. The debt-to-equity ratio was 11.84 times, indicating total debt of nearly VND 4,700 billion, a reduction of over VND 3,000 billion from the beginning of the year. Of this, bond debt amounted to VND 2,700 billion. As a result, Setra Corp’s total assets reached nearly VND 5,000 billion.

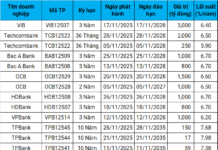

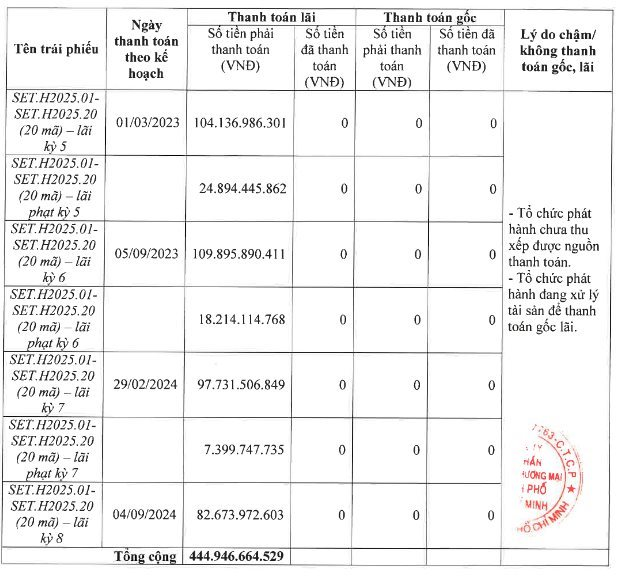

In a recent announcement by HNX, as of September 4, the company owed a total of nearly VND 445 billion in interest on 20 bond codes.

Of this amount, the company owed over VND 394 billion in bond interest and the remaining in late interest payment penalties. According to the explanation provided by Setra Corp’s leaders, the company has not been able to arrange for payment and asset disposal to settle the principal and interest.

These 20 bond codes of Setra Corp, from SET.H2025.01 to SET.H2025.20, have a total value of VND 2,000 billion. The bonds were issued on August 31, 2020, with a term of 5 years and a maturity date of August 31, 2025. The announced interest rate was 11%/year, and the issuance was guaranteed by Tan Viet Securities (TVSI), a securities company also related to Ms. Truong My Lan.

“A Billionaire’s Benevolent Gesture: Forgoing 30 Years of Salary to Right Wrongs”

“The defendant, Ngo Thanh Nha, the CEO of Van Thinh Phat Group, intends to use their salary earned over nearly 30 years of dedication to the corporation to rectify the situation and address any consequences that may arise.”

The Great Prosperity Scandal: Unveiling the ‘Magic’ Behind Turning Losses into Profits

Under the directive of Ms. Truong My Lan, her subordinates fabricated financial reports, turning losses into profits to meet the requirements for bond issuance. This deception enabled them to fraudulently obtain a substantial amount of money from unsuspecting victims.