In its recently published report, J.P. Morgan emphasized that “Vietnam will outperform its ASEAN peers in the banking, information technology, and essential consumer goods sectors.”

According to the financial group, nearly $3 billion flowed out of the Vietnamese market in the past 12 months due to profit-taking and portfolio reallocation by investors toward tech/AI companies and the uncertainties surrounding the US elections. Nevertheless, J.P. Morgan believes that the Vietnamese stock market remains attractive with several positive catalysts.

Unblocking “pre-funding” to attract billions of dollars

On September 18, the Ministry of Finance issued Circular No. 68/2024/TT-BTC amending and supplementing a number of articles of the Circulars prescribing securities trading on the securities trading system; securities trading settlement; activities of securities companies and information disclosure on the stock market, which will take effect from November 2, 2024.

The new circular stipulates that investors must have sufficient funds when placing orders to buy securities, except in two cases: (1) Investors trading on margin as prescribed in Article 9 of this Circular; (2) foreign organizations established under foreign law participating in investment in the Vietnamese stock market are not required to have sufficient funds when placing orders as prescribed in Article 9a of this Circular. Circular 68/2024/TT-BTC has supplemented Article 9a on “Foreign institutional investors’ securities trading without requiring sufficient funds when placing orders.”

“We believe that these changes will enable FTSE to upgrade Vietnam to an emerging market within the next 12 months, leading to an inflow of over $500 million in passive funds into the market, and potential positive assessment from MSCI”, the J.P. Morgan report stated.

Sharing the same view as J.P. Morgan, SSI Research forecasts that Vietnam will be upgraded in the September 2025 review. With the upgrade to emerging market status, the preliminary estimate of inflows from ETFs could reach $1.7 billion, excluding inflows from active funds (FTSE Russell estimates that the total assets of active funds are five times higher than those of ETFs).

According to SSI Research, stocks such as VNM, VHM, VIC, HPG, VCB, SSI, MSN, VND, DGC, VRE, and VCI could attract large inflows when Vietnam is upgraded to emerging market status. These are all leading Bluechip stocks that have not yet reached their foreign ownership limit.

Concurring with SSI’s prediction of foreign capital inflows into MSN, the stock code of Masan Group, J.P. Morgan recommended increasing the allocation of MSN shares with a target price of nearly 95,000 VND per share.

“The essential consumer goods sector has risen 7% year-to-date, underperforming the broader market. We believe that the near-term tailwinds favor essential consumer goods stocks with: potential inflows from the stock market upgrade; lower USD reducing input costs; and stable revenue growth. We advise increasing allocation to this sector with MSN being one of our top picks”, J.P. Morgan analysts commented.

The Vietnamese economy is expected to accelerate in the fourth quarter

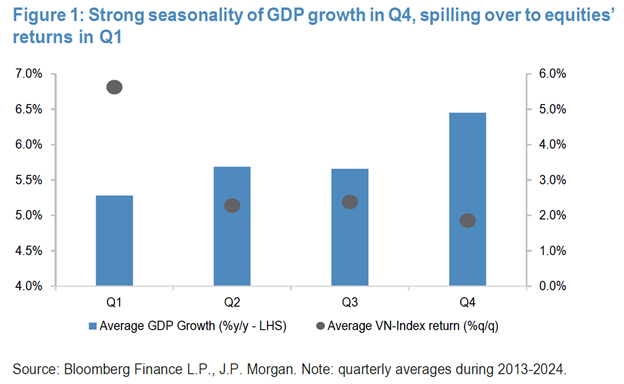

J.P. Morgan argued that the government’s economic stimulus measures and the business cycle would catalyze economic activities throughout the second half of 2024, which would extend into the stock market performance during the period from Q4/2024 to Q1/2025.

According to the report, the Vietnamese economy tends to accelerate in the fourth quarter due to the business cycle (exporters accelerating before the holiday season), public investment (the government promoting disbursement before the end of the year), and booming tourism. This positivity tends to spill over into the stock market with a one-quarter lag.

The financial group believes that this cycle will repeat this year as recent economic data indicates a continuous acceleration in the second half of 2024. Moreover, the government has been making efforts to boost public investment disbursement and expand credit quotas to support growth. The government is targeting a GDP growth rate of 6.5 – 7% (up from 6 – 6.5% at the beginning of the year). Notably, in the past four quarters, Vietnam’s growth has outpaced that of its ASEAN peers.

Using the SOTP (sum-of-the-parts) method, J.P. Morgan valued MSN at 94,640 VND per share, with a target P/E for 2025 of 39x and EV/EBITDA of 12x. This valuation is 27% higher than the closing price of 74,800 VND on September 24, 2024. SOTP is a method of valuing a company by assessing the value of its individual business segments or subsidiaries and then summing up these values to get the total value of the company.

“Global Leader Seeks to Develop Large, Modern Seaports in Vietnam”

On the afternoon of September 23, Prime Minister Pham Minh Chinh met with Mr. Robert Maersk Uggla, Chairman of A.P. Moller – Maersk, one of the leading transport and logistics companies in the world.

The $360 Million Scandal: Tan Hoang Minh’s Chairman Do Anh Dung Faces Trial.

The upcoming trial of Do Anh Dung, the chairman of Tan Hoang Minh Group, on fraud charges involving VND 8,600 billion and over 6,000 investors, will be heard by the appellate court on September 25.

The Signature Collection by Van Phu – Invest: Introducing Vlasta to Hai Phong’s Thuy Nguyen District

“For over two decades, Van Phu – Invest has been a leading force in Vietnam’s real estate market, renowned for its expertise in developing urban projects in major cities nationwide. Now, for the very first time, they are bringing their unparalleled expertise to Thuỷ Nguyên, the emerging economic center of Northern Vietnam. This new project promises to be an iconic landmark and a testament to their exceptional reputation.”