At the IR View Seminar held on September 24, 2024, Mr. Vuong Huy Dong, Vice Secretary of the Board of Directors and Investor Relations of Vietnam Joint Stock Commercial Bank (VietinBank, HOSE: CTG), presented on “VietinBank’s IR Practices.”

The presentation clarified how the bank has improved the quality of its IR department, its IR activities with institutional investors, attracting foreign capital, and adapting to the digital and green era.

Mr. Vuong Huy Dong, Vice Secretary of the Board of Directors and Investor Relations, Vietnam Joint Stock Commercial Bank (VietinBank, HOSE:CTG)

|

VietinBank’s Approach to IR

According to Mr. Dong, the bank established its IR department in 2009, and since 2014, the IR department has been organized under the Board of Directors’ Secretariat, directly advising the BOD. The IR department directly reflects feedback from shareholders and receives guidance from the BOD, ensuring continuous updates and quick dissemination of information to investors.

VietinBank’s IR activities comply with legal regulations, ensure shareholder interests, and integrate communications into financial activities. The bank provides information access in both Vietnamese and English to its shareholders.

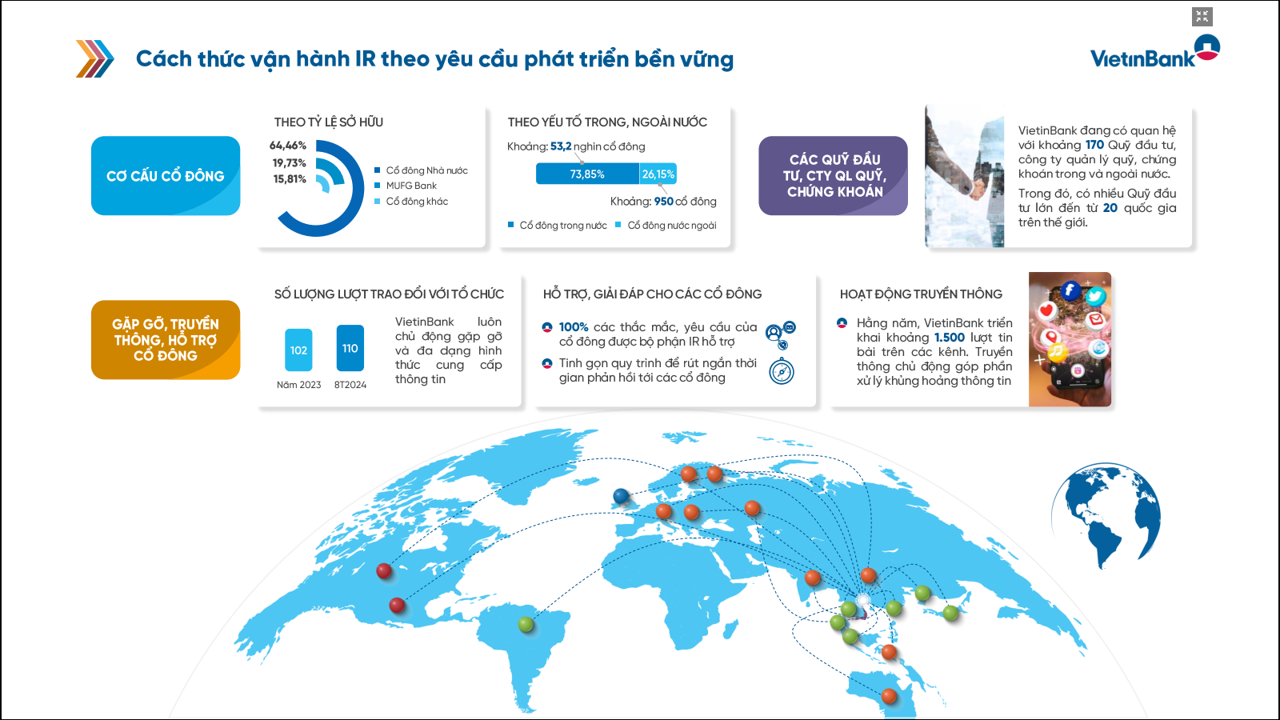

VietinBank also continuously analyzes its shareholder structure to develop a suitable IR strategy. Currently, VietinBank has two major shareholders: the State with a 64.46% stake and MUFG Bank with a 19.73% stake.

In terms of domestic and foreign ownership, domestic shareholders hold nearly 74% with approximately 53,000 shareholders. Foreign shareholders account for 26.15%, totaling almost 1,000 shareholders.

On average, each domestic shareholder owns approximately 9,500 CTG shares, while each foreign shareholder owns 400,000 CTG shares. This highlights the significantly higher investment value of foreign shareholders. Therefore, the bank needs to understand the information needs and expectations of institutional investors. VietinBank’s IR department maintains relationships with 170 securities companies and investment funds, both domestic and foreign, including prominent funds from 20 countries worldwide.

|

Recognizing investment funds as a bridge to shareholder groups, VietinBank places a high priority on engaging with these funds. Each year, the bank actively participates in nearly 100 conferences and investor meetings. In 2024, this number has already surpassed the 2023 figure. By the end of this year, the bank expects to have attended 120-130 such events.

However, VietinBank does not discriminate between investors. As a result, 100% of shareholder inquiries and concerns are addressed. The bank has also streamlined processes to reduce response times for shareholder inquiries.

Additionally, the bank prioritizes communication in its shareholder relations, publishing approximately 1,500 articles annually in mass media outlets. This ensures that investors receive timely updates, addresses potential communication bottlenecks, and mitigates communication risks related to CTG shares.

IR Leads the Way in VietinBank’s Digital Transformation

Regarding digital transformation, VietinBank is a pioneer in the government’s and the industry’s digital transition. The bank has 108 innovation initiatives. IR activities showcase the bank’s progress in its digital journey to investors.

Specifically, VietinBank adopts online seminars, livestreams events, and continuously improves its website to enhance investors’ access to information. Investors can visit the bank’s IR website to consolidate reports and quickly obtain the necessary information. Alternatively, they can subscribe to receive timely updates on the banking industry and CTG shares.

Weekly analysis reports on CTG shares are published, presenting data, updates, and addressing shareholders’ concerns. VietinBank also leverages social media platforms like Facebook and YouTube, using concise titles to increase information accessibility for investors.

IR’s Role in Sustainable Development

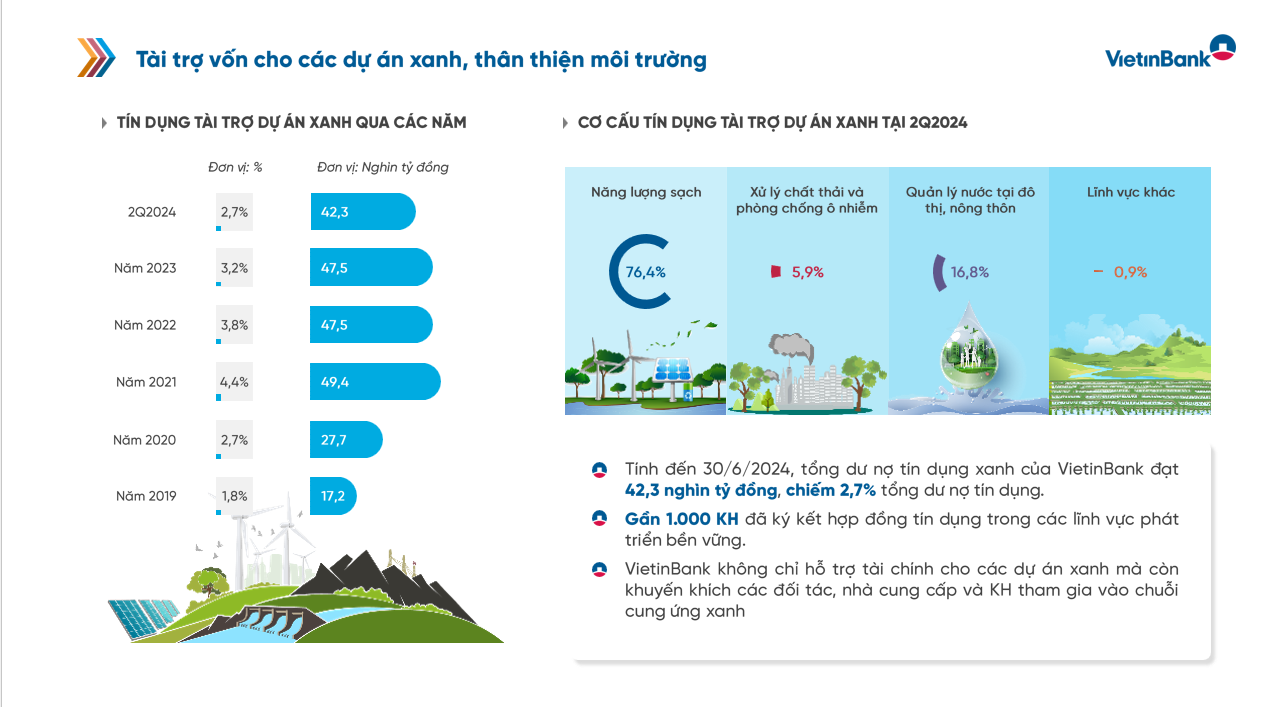

The IR department also engages in sustainable development activities to enhance shareholders’ understanding of VietinBank’s commitment to sustainability. The bank recognizes that demonstrating responsibility towards the community and the environment attracts investment funds, especially those with an ESG focus. VietinBank integrates its sustainability report into its annual report, providing investors with the best possible information.

|

VietinBank actively pursues sustainable development initiatives, such as signing a cooperation agreement with the Ministry of Natural Resources and Environment and participating in the World Economic Forum. The bank also signed an MoU with MUFG at COP28 to arrange $1 billion for sustainable development projects.

The Pen Is Mightier Than the Sword: Crafting Words to Conquer and Inspire.

On September 20, 2024, DBFS officially signed a contract to develop a luxury apartment project on nearly 1-hectare land in Tan Phu District, Ho Chi Minh City, with the investor, TC Tower Co., Ltd. This marks the beginning of an exciting journey towards creating a prestigious commercial residential project.

The Flow of Funds: Market Confirms Bottom, Shaking Hands to “Seal the Deal”

A week brimming with news and significant events propelled the market to surge beyond many investors’ expectations. The rapid ascent left some feeling like they missed the boat. However, experts believe that latecomers still have opportunities as the market is due for more volatility, shaking off short-term speculative positions while welcoming new investors.

VietinBank – The Domestic Bank for International Businesses

VietinBank is proud to announce that it has been awarded the prestigious “Best Local Bank for Foreign Direct Investment in Vietnam” and “Infrastructure Deal of the Year” for three consecutive years (2022-2024). These accolades recognize the bank’s exceptional services and commitment to supporting businesses with foreign direct investments in the country, as well as its expertise in facilitating infrastructure projects.