HoSE floor liquidity soared 87% this afternoon compared to the morning session, mainly due to buyers raising prices to sweep the selling volume at higher levels. The emergence of abundant upward momentum helped to dramatically reverse the breadth of the VN-Index. The index closed up 0.67% (+8.51 points), despite still being in the red at the morning close. Banking and real estate stocks were the focus of today’s session.

Today’s upward momentum was not entirely unexpected, as the morning’s decline lacked significant selling pressure at lower prices. Many buy orders were placed at deeper levels, and in the afternoon, there was a notable shift in risk appetite. Buyers gradually raised their prices, and since selling pressure was not intense, the upward range was quite broad.

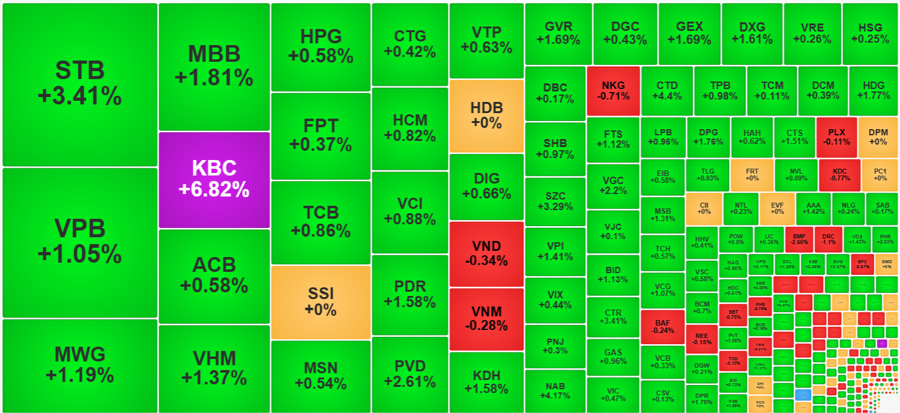

At the morning close, the VN-Index had 157 gainers and 176 losers, but by the end of the day, there were 256 gainers and only 119 losers. This indicates a significant number of stocks reversing their trends and turning green, not to mention those that advanced further. Among the 256 stocks that ended in positive territory, 84 rose more than 1% (compared to just 38 in the morning session). The top-performing stocks in terms of liquidity accounted for 48.2% of the total matched volume on the HoSE.

Several stocks witnessed large trading volumes, mainly in the banking and real estate sectors. STB led with a liquidity of 780.9 billion VND, a 3.41% increase. VPB followed with 717.3 billion VND and a 1.05% gain. These two banking blue chips experienced a highly dynamic afternoon session. STB’s liquidity was 8.3 times higher than in the morning, and its price surged by 2.91% compared to the morning close. MBB also underwent a significant transformation, climbing 1.41% in the afternoon and closing above the reference price by 1.81%, with its liquidity five times higher than in the morning. It’s a bit unfortunate that STB and MBB had a limited impact on the VN-Index, but they were the main drivers of the VN30-Index, which rose 0.74%, outperforming the main index.

In the real estate sector, KBC stood out with a dramatic shift. The stock was already strong at the morning close, up 3.98%, but by around 1:45 pm, it hit the daily upward limit. KBC’s afternoon liquidity was also double that of the morning. Among the large-cap stocks, VHM’s 1.37% jump was the main contributor to the VN-Index’s gains. Additionally, PDR, KDH, and DXG were notable performers in the real estate sector, posting strong gains with robust liquidity.

Although the afternoon rally was initiated and led by banking and real estate stocks, the shift in market breadth reflected a strong price improvement across the market. If only BID and VHM were pulling the VN-Index higher, such vibrant activity wouldn’t have been achievable. Moreover, foreign investors were also significant net buyers. Towards the end of the session, VIB saw a large-scale block trade worth 2,749.8 billion VND in net selling. Excluding this trade, foreign investors still net bought approximately 235.6 billion VND worth of stocks, of which they net sold 115 billion VND in the morning session. Therefore, excluding VIB, stocks were net bought by foreign investors in the afternoon session to the tune of 350 billion VND. Notable stocks in this regard included MWG (+93.9 billion VND), MSB (+77.9 billion VND), STB (+68.1 billion VND), and NAB (+51.8 billion VND)…

Today’s laggards didn’t witness much in terms of notable trading activity. Large-cap stocks like VND (152.9 billion VND) and VNM (146.3 billion VND) saw only minor losses. Stocks that declined more sharply, such as ITA hitting the floor price, PSH dropping 4.91%, TCD falling 3.12%, BMP down 2.66%, and DSE slipping 1.58%, only managed a few billion VND in liquidity.

Today’s solid gain of 8.51 points on the VN-Index easily recouped yesterday’s losses, and the index continued its upward trajectory after 2.5 volatile sessions. However, one missing piece is overall market liquidity: even with the increased trading in the afternoon, the combined matched volume on the HoSE and HNX for the day was only 12,384 billion VND.