On September 26, 2024, the Vietnam Card Day Organizing Committee officially announced Vietnam Card Day 2024. This annual event is content-directed by the State Bank of Vietnam, organized by Tien Phong Newspaper and the National Payment Corporation of Vietnam (NAPAS). Vietnam Card Day 2024 is held with the theme “Live Chill – Quality Payments.”

Through three implementations, the Vietnam Card Day event series has contributed to promoting the habit of cashless payments among young people. Following the successes achieved in 2020, 2021, and 2023, Vietnam Card Day 2024 continues to contribute to realizing the goals of the Project for Development of Cashless Payments in Vietnam for the period of 2021-2025 and the National Comprehensive Financial Strategy until 2025, with orientation until 2030 of the Government; Creating a positive shift in cashless payments in the economy with high growth, making the use of cashless payment instruments in society a habit of urban residents and gradually developing in rural, remote, and mountainous areas; Enhancing access to banking services for the economy; Promoting bank payments for public services)…

At this Vietnam Card Day 2024 event, the concept of Open Banking is mentioned in the context of the banking industry facing a comprehensive digital revolution, with banks sharing data with third parties to bring new and superior experiences to customers. The trend of open banking is one of the main trends and drivers of change, promising to create breakthrough development in the supply of banking products and services.

Vietnam Card Day 2024 targets students, young families aged 15-40 who need to use digital payment methods and online payments through internet banking and mobile banking services of banks, as well as banking services integrated on the platforms of third parties such as online public services, e-commerce, online booking, travel services…

The future trend of banking is digital technology with applications in payment methods such as Tap to Pay, Tap to Phone, QR code payments, e-wallets, mobile payments… along with digital technologies such as electronic customer identification (eKYC),…

Identified as “digital natives”, young consumers are the factor ready to approach digital payment experiences, digital banking, and choose the methods that suit them best.

Mr. Phung Cong Suong, Editor-in-Chief of Tien Phong Newspaper, delivered the opening remarks at the event

Speaking at the press conference announcing Vietnam Card Day 2024, Mr. Pham Anh Tuan, Director of the Payment Department (SBV), said, “Credit institutions are tending to shift from the traditional banking model to the open banking model, enhancing connectivity and technology integration in many fields, becoming a bridge for information exchange between banks and enterprises, supporting well consumption payment activities or production and business with a customer-centric, multi-choice, and well-personalized service while ensuring safety and security, thereby contributing to the popularization of cashless payments to the people and businesses.”

Mr. Pham Anh Tuan also believes that with the series of events of Vietnam Card Day 2024, it will orient Vietnamese youth and banks to have a direct and diverse playground to approach and provide practical experiences about modern payment forms, approaching the world’s technology level being introduced by banks and gradually popularized in Vietnam such as contactless chip card payment (contactless), short-range wireless payment – NFC (Near-Field Communications), online and offline payment at points of sale via QR code, online payment for digital services, e-commerce through Mobile banking applications, … combined with supporting solutions and services such as secure biometric authentication, tokenization of card information, and safe and convenient electronic identification (eKYC)

Mr. Pham Anh Tuan – Director of the Payment Department (SBV) speaks at the event

Journalist Phung Cong Suong, Editor-in-Chief of Tien Phong Newspaper, Deputy Head of the Organizing Committee of Vietnam Card Day 2024, said, “The strong changes in all aspects of life, with the birth and influence of chat GPT, the 4.0 revolution, the banking industry always takes the lead in promoting the digital transformation flag, making it the fastest to enter life and serve the people most effectively. The theme of Vietnam Card Day 2024 “Live Chill – Quality Payments” keeps up with this development trend. We believe that the diverse and vibrant activities of Vietnam Card Day 2024 will attract the attention of Gen Z – those who grasp technology, master technology, and towards becoming the core force, mastering the country. One of the outstanding activities of Vietnam Card Day is charitable activities. This year, the Organizing Committee decided to call for and collect donations to present a computer room to a school in an area severely affected by Storm YAGI.”

The Editor-in-Chief of Tien Phong Newspaper also shared that, based on the reality of the rapid and breakthrough development of cashless payments through the four seasons of organizing Vietnam Card Day, the Organizing Committee is seeking the direction of the State Bank of Vietnam to change the name of the Vietnam Card Day program. The new name will ensure that it is more suitable for the development trend of digital payment methods in the future.

Mr. Nguyen Quang Hung, Chairman of the Board of Directors of NAPAS – the unit coordinating the organization of Vietnam Card Day, said, “With the goal of establishing a unified and synchronous national payment infrastructure, capable of integrating and connecting with other sectors and fields, thereby expanding the digital ecosystem, in the series of events of Vietnam Card Day 2024, NAPAS continues to introduce new payment technologies as well as the application of these payment solutions in fields and activities in the daily life of all businesses and people. Along with banks and partners, we bring many interesting and attractive experiential activities. Through this, Vietnam Card Day 2024 will be an opportunity for the banking industry to introduce new trends in digital banking as well as modern banking products and services, and young people will have the opportunity to access and learn about modern banking products and services, as well as improve their skills in using safe and effective banking services.”

Mr. Nguyen Quang Hung – Chairman of the Board of Directors of NAPAS

On this occasion, to create a resonance with the mega-sale program during Vietnam Card Day 2024, NAPAS, together with large domestic and international banks and partners, will deploy a series of promotional and incentive programs for customers when spending and making card payments through NAPAS. The practical benefits from the above programs will create attraction and encourage customers to use the card payment method more, which has outstanding advantages, safety, and high security, thereby promoting the growth of cashless payment transactions in general and domestic card transactions in particular.”

Within the framework of Vietnam Card Day 2024, there will be six main activities: a press conference to announce the event series on September 26; Mega Sale Online Campaign (September 30 – October 26); Thematic seminar on October 2; Career orientation seminar at the National Economics University (October 4); Vietnam Card Day 2024 – Song Festival at Bach Khoa Stadium (October 5-6)

Vietnam Card Day 2024 – Song Festival is where all customer payment experiences on devices take place. Along with bringing the latest payment method experiences to young people, the participating units also bring many practical gifts to the program. Song Festival is an event that gathers many booths from 26 commercial banks and international card organizations, large Merchants, and loved by young people.

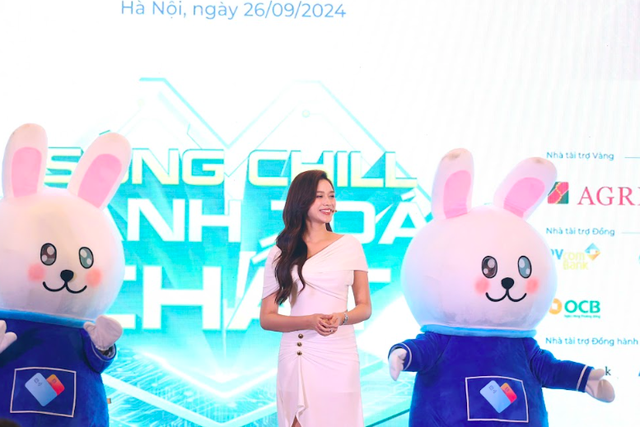

At the press conference, the Organizing Committee also announced that Miss Vietnam 2020 Do Thi Ha is the Brand Ambassador of Vietnam Card Day 2024.

Miss Do Thi Ha is the ambassador of Vietnam Card Day 2024

“Nam A Bank Gears Up for a Strong Finish in 2024 with Virtual Investor Meet-up”

On the afternoon of September 19, Nam A Bank (HOSE: NAB) successfully hosted its Q3 2024 virtual investor meeting, attracting a large number of investors, funds, and securities companies from both domestic and international markets.

How Many Bank Accounts and Cards Are There in Vietnam?

The Vietnamese payment card industry has made significant strides, thanks to several enabling factors. With over 87% of adults now holding a bank account, the industry is experiencing a notable boom.