According to recent data published by the State Bank of Vietnam, 87% of adults in the country now have a bank account, totaling 180 million accounts and 138 million bank cards.

Financial services in Vietnam have never been more accessible to its citizens. With just a phone in hand, customers can open an account anywhere via online identification without having to visit a bank branch. They can also pay bills, save, borrow, invest, or shop via digital banking applications, all online and swiftly.

However, financial literacy among Vietnamese individuals remains limited, including the usage of banking products and services and, more broadly, access to financial investment channels. Therefore, in recent years, alongside developing more modern and convenient services, many banks have actively promoted financial literacy among their customers.

At BIDV, the bank not only finances key national projects but also pioneers in implementing the National Financial Strategy. As Vietnam’s oldest and largest bank in total assets, BIDV is committed to social responsibility, focusing on four priority groups: Healthcare, Education, Poverty Alleviation, and Disaster-affected Areas.

For BIDV, financial education and literacy for its citizens have been a key focus throughout its 67-year journey, especially in recent years with the strong development of the 4.0 technology revolution.

Recognizing the increasing accessibility of technology and smartphones among Vietnamese, BIDV has intensified its efforts to promote financial education for the youth, including those from primary to university levels. According to BIDV, this is the fastest way to disseminate personal financial knowledge to the entire population, enhancing the community’s understanding of this seemingly dry subject.

For instance, in early 2024, BIDV joined hands with the State Bank of Vietnam to organize the “Financial Knowledge” competition at elementary schools in Tuyen Quang, Hanoi, and Ha Nam. Previously, the bank also participated in similar meaningful programs such as “Money Savvy, Money Wise,” “Money Wisdom,” and “Key Holder,” initiated by the State Bank since 2019.

In addition, BIDV has launched various products and services targeting the youth. Among them is the introduction of BIDV Smart Kids, the first digital bank for children, which allows kids to learn how to manage their financial plans and spend independently within the limits set by their parents, featuring a unique interface.

BIDV is also one of the leading banks in offering preferential loan packages for students, creating favorable conditions for the country’s talents to pursue their studies and research. In recent years, digital banking, payment cards, and credit products have been designed with a more youthful and dynamic orientation to cater to diverse customer segments, including young people.

Embracing this spirit, BIDV is a strategic partner of The Moneyverse program, produced by VTV, the national television station of Vietnam.

Today, on September 24, The Moneyverse program was officially launched, comprising two main activities. The first is a series of Unitours, including activities and practical experiences for young people revolving around the five states of money flow, based on the imagery of five universes: Earn – Spend – Save – Invest – Preserve. The second is a reality TV show combining personal finance and investment challenges for the youth, expected to air on VTV3 this September.

So far, the program has reached 27 universities nationwide, and the participating teams are ready to “board” and enter The Moneyverse. This platform not only provides in-depth content on financial management but also helps viewers understand better how the market and state management work, enabling them to make wiser and more reasonable financial decisions.

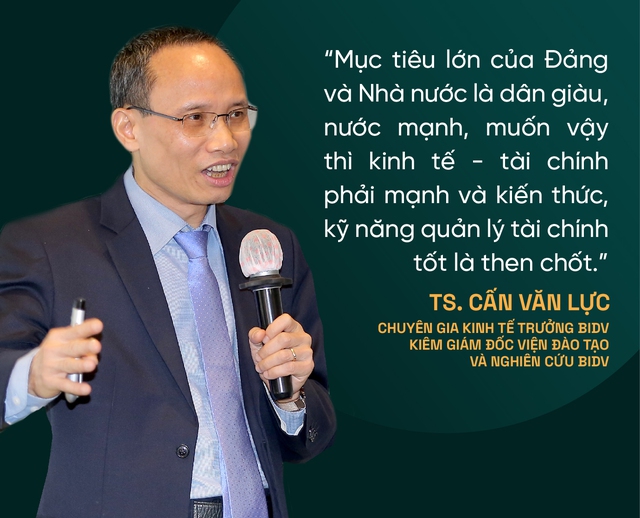

As one of the program’s expert advisors, Dr. Can Van Luc, Chief Economist of BIDV and Director of BIDV Training and Research Institute, shared his insights: “In today’s information explosion, online financial scams are skyrocketing, and many people have fallen victim. Therefore, programs like The Moneyverse are essential to enhancing investment knowledge and financial management skills for our citizens, helping them understand money, and earn and spend it wisely and legally.”

Dr. Nguyen Viet Ha, Director of BIDV Brand Communication, shared: “The Moneyverse program offers a unique and novel approach to disseminating personal financial education to young people. The program’s purpose aligns with BIDV’s mission and social responsibility activities. This is why the bank has decided to accompany the program in various roles: as expert advisors on professional knowledge, as mentors sharing market experience, and, with our nationwide branch system, as facilitators of a practical business environment for contestants to explore and challenge themselves. Through this partnership, BIDV aims to impart valuable financial knowledge to young people, especially university students.”

BIDV participates in the program as an advisor, offering professional guidance. The bank’s team of experts, including Dr. Can Van Luc, serves not only as judges but also as mentors and content advisors for The Moneyverse. During the Casting phase, BIDV representatives acted as “Financial Doctors,” providing consultations and answering questions about banking products and services and financial knowledge for university students. The topics were designed to be youthful and relatable, such as “Gymoney for Your 20s,” “Assets and Liabilities – Flexing Done Right,” “How to Make the Most of Your Money,” “Can Money Buy Happiness,” and “Savings and Investments – Stocks vs. Blockchain.”

Additionally, during the Casting round at 24 university campuses, BIDV awarded 120 scholarships worth VND 360 million to talented students. Notably, BIDV also offered these students the opportunity to explore and intern at BIDV, Vietnam’s top employer. The winner of The Moneyverse will receive a formal job offer from the bank.

As Vietnam’s oldest and largest bank, BIDV has built a diverse ecosystem of products and services, leading the market in digital banking and branch networks. Through this program, BIDV is committed to enhancing the financial knowledge and practical experience of university students.

In September, October, and November, The Moneyverse will continue its journey to 10 major universities nationwide with a series of 10 UniTour events. Each event will feature interactive games and practical activities, challenging and educating young people about personal finance.

Young participants can engage with BIDV’s special experience zone, Money Legacy, to win attractive prizes and receive personal financial advice from BIDV’s experts.

On this occasion, BIDV has collaborated with The Moneyverse to launch an exclusive international debit card for Vietnamese students – BIDV Mastercard Moneyverse – offering superior benefits and a unique design tailored to young people. The bank waives issuance and annual fees for this card. Customers can earn unlimited points on all spending and enjoy exclusive privileges at leading brands.

Notably, BIDV Mastercard Moneyverse is the first international debit card in Vietnam exclusively for students. This means that, unlike regular cards used for domestic spending, this new BIDV card enables young people to spend abroad easily.

According to BIDV’s leadership, the collaboration with The Moneyverse and the introduction of the new student debit card reiterate the bank’s commitment to accompanying Vietnam’s young generation in implementing the National Financial Strategy. Through these initiatives, BIDV also showcases its ability to innovate and pioneer trends targeting dynamic and creative young customers while preserving its longstanding reputation.

“A Sparkling Investment: DIC Corp (DIG) Shines with a $63 Million Injection for their Vung Tau Project.”

The DIC Corp complex spans an impressive 11,014 square meters and boasts a total investment of 3,577 billion VND. This massive project is strategically divided into three phases, each meticulously planned to ensure a seamless and successful development. With a grand vision in mind, DIC Corp is set to make a significant impact with this ambitious undertaking.

The Power of Persuasive Copy: Crafting Compelling Titles

“The Alluring BIDV Lending Rates: A Dramatic Drop”

As of August 2024, BIDV has lowered its average lending rates by almost 1 percentage point compared to March 2024. This significant reduction showcases BIDV’s commitment to offering competitive rates and supporting its customers’ financial needs.