There are several ways to classify investment funds. According to the source of capital, there are collective investment funds (public funds) and private investment funds (funds with 2-99 members). In terms of organizational structure and operations, there are company-type funds and contract-type funds. Finally, when assessed by capital structure, we have closed-end and open-end funds.

Among these classifications, the distinction between open-end and closed-end funds is the most common. So, what are the differences, and how do these two types of funds operate and perform?

A Plethora of Open-End Fund Options:

Open-end funds are a type of fund contributed by multiple investors with shared investment goals and managed by a fund management company. The fund’s investment experts invest in securities, including stocks, bonds, or other channels, based on specific philosophies, methods, and valuations, aiming to generate profits.

Open-end funds have an indefinite term, with no limits on issuance and repurchase. After the initial public offering, investors’ buy-and-sell transactions are conducted periodically, based on the net asset value per fund unit. These transactions are carried out directly with the fund management company.

Approaching and opening an investment account with open-end funds is also very straightforward. One can register directly at the fund management company’s distribution locations or online via their website or app. It is even possible through third-party platforms that distribute the fund certificates. In addition to regular account opening, investors have the option of periodic investment (SIP).

When purchasing fund certificates for the first time, investors will transfer funds directly to the fund’s account at the supervising bank. For subsequent purchases, investors can use the website, application, or order forms provided at the distribution points. These channels also serve as avenues for investors to sell their fund certificates.

Each fund stipulates different minimum investment amounts, trading days, transaction confirmations, payment schedules, etc. Therefore, investors need to conduct thorough research.

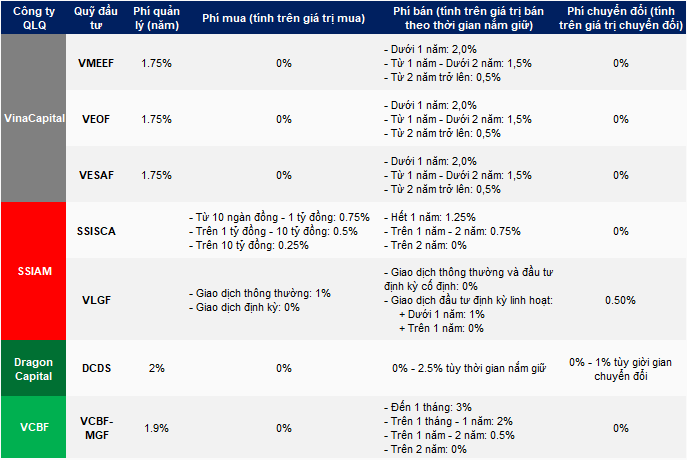

Investors buying and selling fund certificates should also pay attention to the fees involved, such as transaction fees, issuance fees based on the purchase value, repurchase fees based on holding periods, transfer fees between fund certificates, and money transfer fees based on transaction values.

Diversifying Investment Portfolios:

| | Mức phí của một số quỹ đầu tư |

| — | — |

|  | Investors can diversify their investment portfolios by investing in multiple fund certificates with different philosophies, orientations, and portfolios, thus reducing financial risks. |

| Investors can diversify their investment portfolios by investing in multiple fund certificates with different philosophies, orientations, and portfolios, thus reducing financial risks. |

| Nguồn: Người viết tổng hợp | |

Market Abundance of Open-End Funds:

On the market, investors can easily find numerous open-end funds to invest in, as their number is already substantial. The most prominent include funds managed by VinaCapital, SSIAM, Dragon Capital, Baoviet Fund, Mirae Asset, VCBF, and Manulife.

According to statistics on effectiveness (NAV/CCQ growth) in the first half of 2024, the top-performing open-end fund was the VinaCapital Modern Economy Stock Investment Fund (VMEEF), specializing in investing in stocks with good long-term revenue and profit growth prospects, with a rate of 30.25%. Additionally, in the top 10 best-performing funds, VinaCapital had two other funds: VinaCapital Thriving Stock Investment Fund (VEOF), with over 18.5%, and VinaCapital Market Access Stock Investment Fund (VESAF), with 17.9%.

SSI Asset Management Co., Ltd. (SSIAM) also had two funds in the top 10: SSI Sustainable Competitive Advantage Investment Fund (SSI-SCA), with over 27%, and Vietnam Long-Term Growth Fund (VLGF), with over 23.5%, ranking second and third, respectively.

| | Top 10 Open-End Funds Leading in Investment Effectiveness in 1H2024 |

| — | — |

|  | Nguồn: Người viết tổng hợp |

| Nguồn: Người viết tổng hợp |

Closed-End Funds’ Presence on the Stock Exchange:

Closed-end funds are public funds where fund certificates, once offered to the public, cannot be repurchased at the investors’ request. Statistics from the Vietnamese stock market show that there are almost 20 closed-end funds in operation, most of which are ETF funds that mimic the fluctuations of a reference index. The remaining few are growth investment funds managed by Thien Viet Fund Management JSC (TVAM), with a projected five-year operation, and the Techcom Vietnam Real Estate Investment Fund managed by Techcom Capital.

Typical ETF funds include MAFM VNDIAMOND (FUEMAVND) by Mirae Asset and DCVFMVN DIAMOND (FUEVFVND) by Dragon Capital, both tracking the VN Diamond index. MAFM VN30 (FUEMAV30) by Mirae Asset, DCVFM VN30 (E1VFVN30), and SSIAM VN30 (FUESSV30) follow the VN30 index. Additionally, several other ETF funds track specific baskets of indices, such as VNX50, VN100, VN MidCap, VNFin Select, and VNFin Lead.

Investing in ETF funds is not complicated, as these closed-end funds can be listed on Vietnam’s stock exchange, and investors can buy and sell them like regular stocks.

In terms of transaction fee schedules, it is evident that most securities companies categorize ETFs similarly to stocks, with either fixed or tiered rates. Standard fees also apply.

ETF funds are considered suitable for small retail investors new to the stock market and lacking confidence in making single-stock investment decisions. Additionally, tracking specific baskets of indices helps reduce risk.

Vietnam’s stock exchange currently lists 19 fund certificates, with market capitalizations ranging from tens to tens of thousands of billions of VND. As of June 30, 2024, the largest fund by market capitalization was the DCVFM VN DIAMOND ETF Fund (FUEVFVND), with over 13,514 billion VND.

Investment Effectiveness of Leading Closed-End Funds:

Regarding investment effectiveness in the first half of the year for the top funds by market capitalization, the FUEMAVND certificate performed the best, with a rate of 24.35%. Closely following was FUEVFVND, another Mirae Asset-managed fund certificate, with a rate of 24.07%. In third place was FUEBFVND, managed by Baoviet Fund, with a rate of 22.77%.

Interestingly, the top three best-performing fund certificates since the beginning of the year have in common that they track the VN Diamond index, which includes many bank stocks that performed well in terms of price increases during the mentioned period.

| | Top 10 Closed-End Funds Leading in Investment Effectiveness in 1H2024 |

| — | — |

|  | Nguồn: Người viết tổng hợp |

| Nguồn: Người viết tổng hợp |

Performance of Other Closed-End Funds:

Among the remaining closed-end fund certificates, FUCTVGF5 led in investment effectiveness in the first half of 2024, with a rate of 0.64%. Following were the Techcom Capital Real Estate Investment Fund certificate (FUCVREIT) and two other growth investment fund certificates by TVAM, FUCTVGF3 and FUCTVGF4, which incurred losses with rates of -3.84%, -8.51%, and -9.41%, respectively.

| | Hiệu quả đầu tư của các quỹ đóng (trừ ETF) trong 6T2024 |

| — | — |

|  | Nguồn: Người viết tổng hợp |

| Nguồn: Người viết tổng hợp |

Huy Khải

Mrs. Bui Thi Thao Ly (SSV): ESG Disclosure Enhances Access to Foreign Capital

At the IR View workshop on ‘greening’, held as part of the IR Awards 2024 ceremony on the morning of September 24, Ms. Bui Thi Thao Ly, Director of the Analysis Center of Shinhan Securities Vietnam Co., Ltd. (SSV), represented the seller and shared her insights on attracting foreign capital through ESG disclosure.

Building Social Housing for Rent with Public Investment Funds

Vice Prime Minister Tran Hong Ha has signed Decision No. 927/QD-TTg, issuing a plan to implement the Secretariat’s Directive No. 34-CT/TW on strengthening the Party’s leadership in developing social housing in the new situation.