The Ministry of Labour, Invalids and Social Affairs has received inquiries from Ho Chi Minh City voters regarding the 30% increase in the basic salary for officials and public employees, while retirees only received a 15% adjustment. Voters advocated for more attention to be given to pension policies for retired individuals.

STRIVING FOR FAIR PENSION ADJUSTMENTS

In response, the Ministry of Labour, Invalids and Social Affairs clarified that according to Article 57 of the 2014 Social Insurance Law, pension adjustments are based on consumer price index increases and economic growth, in alignment with the state budget and the Social Insurance Fund.

Over the years, the Party and the State have consistently prioritized the well-being of pensioners and social insurance allowance recipients by adjusting pensions and allowances. These adjustments have gradually improved their living standards.

Specifically, between 2013 and 2023, the government adjusted pensions seven times, with an average increase of over 8.43% per adjustment. This is significantly higher than the consumer price index increase for the same period.

“There were instances when the state did not increase the basic salary but still proceeded with pension adjustments, such as an 8% increase in 2015 and a 7.4% increase in 2022,” informed the Ministry of Labour, Invalids and Social Affairs.

In 2024, to implement the Conclusion No. 83-KL/TW dated June 21, 2024, of the Politburo on salary reform, the government issued Decree No. 75/2024/ND-CP dated June 30, 2024, regulating pension and social insurance allowance adjustments. As a result, from July 1, 2024, a 15% increase was applied to the June 2024 pension and allowance levels for current pensioners and allowance recipients.

This adjustment is nearly double the average increase during the 2013-2023 period and far surpasses the combined increase in the consumer price index and economic growth. In 2023, the consumer price index rose by 3.25%, and economic growth was 5.05%. Estimates for 2024 project a consumer price index of 4%-4.5% and economic growth of 6%-6.5%.

According to the Ministry of Labour, Invalids and Social Affairs, the adjustment ratio reflects the government’s efforts to balance resources and improve pension and social insurance allowance levels, taking into account the Social Insurance Fund’s capacity for balance.

EXPANDING PENSION BENEFITS FOR MORE INDIVIDUALS

Based on the 2024 Social Insurance Law, which will take effect on July 1, 2025, pension adjustments will continue to be linked to consumer price index increases, in alignment with the state budget and the Social Insurance Fund.

Additionally, adjustments will be made to ensure fair pension increases for individuals with low pensions and those who retired before 1995, narrowing the pension gap between retirees from different periods.

Notably, by reducing the minimum social insurance contribution requirement for pension eligibility from 20 years to 15 years, the 2024 Social Insurance Law has expanded pension coverage to individuals who started contributing to social insurance later in life or did so intermittently. It also covers those engaged in specific occupations with shorter career spans, ensuring they receive a monthly pension and health insurance coverage throughout their retirement.

For individuals with longer social insurance contribution histories, the law maintains the higher pension ratio compared to the current regulations.

The new law also stipulates the pension ratio for male and female workers with 15 years of social insurance contributions, with the maximum ratio remaining unchanged at 75%.

Specifically, for male workers with 15 to under 20 years of contributions, the ratio is set at 40% for 15 years, plus an additional 1% for each additional year. Female workers with 15 years of contributions are eligible for a 45% ratio, with an additional 2% for each subsequent year.

The law also outlines the conditions for receiving a pension in the event of a reduction in working capacity (Article 65). Furthermore, Article 141 provides transitional provisions for certain individuals.

According to these provisions, individuals who participated in voluntary social insurance before January 1, 2021, and have contributed for 20 years or more, are eligible for a pension when they reach the age of 60 for men and 55 for women.

Workers with 15 years or more of social insurance contributions and a confirmation letter from the social insurance agency stating that they are awaiting eligibility based on age, as specified in Decree No. 12/CP dated January 26, 1995, and amended by Decree No. 01/2003/ND-CP dated January 9, 2003, of the government, will receive a pension when they reach 60 years of age for men and 55 for women.

For commune-level officials covered by Decree No. 09/1998/ND-CP dated January 23, 1998, of the government, who have a decision or certificate from the social insurance agency confirming their eligibility based on age, the monthly allowance will be granted at 55 years of age for men and 50 for women.

Individuals specified in points a, b, c, d, đ, g, and i of Clause 1, Article 2 of this Law, who participated in compulsory social insurance before the effective date of this Law and have a minimum of 20 years of contributions, will receive a monthly pension of at least the reference level.

The reference level is used to calculate contribution and benefit levels for certain social insurance regimes and is determined by the government. Until the base salary is abolished, the reference level is equivalent to the base salary. When the base salary is abolished, the reference level will not be lower than the base salary at that time.

These individuals include: Those working under indefinite-term labor contracts or definite-term labor contracts with a term of at least one month or longer, even if the employee and employer agree on a different designation, as long as it involves paid work, salary, and management, direction, or supervision by one party.

Officials, public employees, and civil servants; National defense and public security workers and those engaged in specific tasks within the defense sector; Officers and professional soldiers of the People’s Army; officers, non-commissioned officers with professional expertise, officers, and non-commissioned officers with technical expertise in the People’s Public Security Force; and those engaged in defense-related tasks and receiving salaries similar to those of military personnel.

Non-commissioned officers and soldiers of the People’s Army; non-commissioned officers and soldiers in the People’s Public Security Force; and military and public security academy students receiving allowances.

Enterprise managers, inspectors, state capital representatives, and representatives of enterprises’ capital, as stipulated by law; members of the Board of Directors, General Directors, Directors, members of the Supervisory Board or inspectors, and other managerial positions elected by the cooperative or cooperative alliance, as per the Law on Cooperatives, who receive salaries.

The Entitled Will Continue to Receive Pension Increases from July 1, 2025

As of July 1, 2025, individuals receiving lower pension amounts and those who retired before 1995 will be eligible for a pension increase. This adjustment aims to provide financial relief and support to those who need it most. The details of this pension increase are yet to be announced, but it is expected to make a significant difference in the lives of many retirees. This initiative demonstrates a commitment to ensuring that all retirees can maintain a comfortable standard of living.

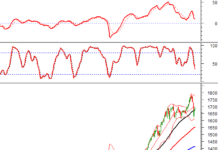

“Inflation’s Steady Climb: CPI Rises 4.04% in the First Eight Months of 2024, With Core Inflation Up 2.71% Year-on-Year.”

Consumer goods and service prices in August exhibited a mixed bag of fluctuations. Compared to July 2024, the prices of staple foods and rental housing witnessed an uptick, while domestic fuel prices declined in tandem with the global trend. Overall, the consumer price index (CPI) for August 2024 remained stable relative to the previous month. August’s CPI reflected a 1.89% increase from December 2023 and a 3.45% year-over-year rise. On average, the first eight months of 2024 saw a 4.04% CPI increase compared to the same period last year, with core inflation climbing by 2.71%.