The impressive surge in the VN-Index in the first half of the afternoon session briefly pushed it towards the 1300-point mark, but this peak prompted a wave of sell-offs. Many blue-chip stocks experienced heavy selling pressure, causing a plunge in the index. However, an equally robust bottom-fishing force emerged, providing substantial support to prices towards the end. Notably, foreign investors displayed remarkable confidence by injecting a staggering 969 billion VND, specifically on the HoSE.

This unexpected wave of selling indicates that a significant number of investors remain apprehensive about the market’s ability to breach the 1300-point peak. However, foreign investors seem to hold a different perspective.

During the afternoon session alone, foreign investors injected an additional 1,475 billion VND, resulting in a net buy value of 437 billion VND. Accumulated throughout the trading day, the HoSE witnessed a net buy value of over 969 billion VND from foreign investors. This figure marks a record high since December 21, 2022, when it stood at +1,669 billion VND.

Banking stocks continued to be the primary recipients of foreign capital inflows: TPB witnessed a net buy of nearly 129 billion, while HDG attracted approximately 105.4 billion. Moreover, TCB, CTG, STB, VCB, and SHB also secured substantial foreign investment. Additionally, VNM and VHM stood out with impressive net buy values of 115 billion and 106 billion VND, respectively. Within the VN30 basket, foreign investors injected 672 billion VND, accounting for nearly 16% of the total trading value of the basket.

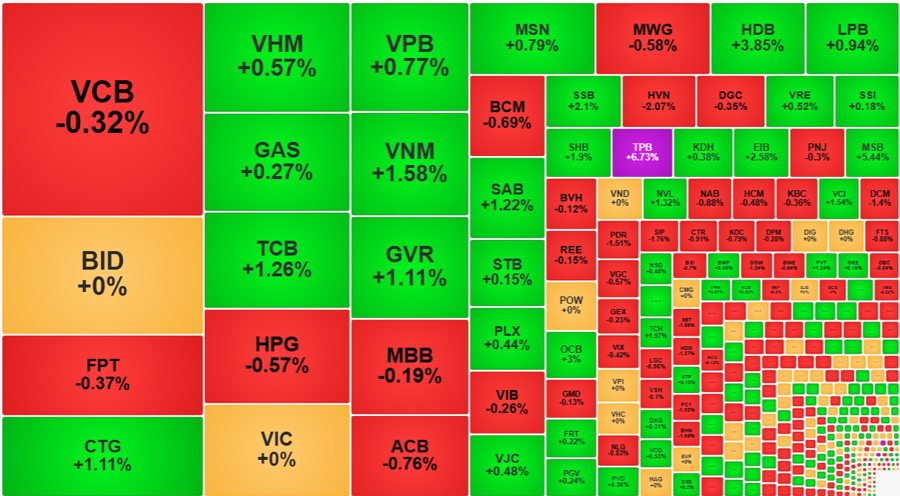

While banking stocks remained the primary drivers of the VN-Index’s performance, they faced immense pressure today. The decline in the index during the latter half of the afternoon session can largely be attributed to the narrowing of gains in these pillars, including the banking sector. For instance, VCB, the largest capitalization stock on the VN-Index, witnessed a considerable decline after 2:00 PM, falling by 1.39% from its intraday high and ultimately closing 0.32% lower than the reference price. Similarly, BID, the market’s second-largest stock, erased its impressive intraday gains of 1.58%, closing at the reference price. Other relatively strong banking stocks, such as CTG and TCB, also witnessed price retracements. Additionally, VIC, HPG, FPT, and GAS, which are among the market pillars, experienced declines.

The banking sector witnessed exceptionally high liquidity today, with a total trading value of over 8,209 billion VND on HoSE for the aforementioned stocks. This liquidity level is a record high since February 23, 2024, when it reached 9,840 billion VND. Evidently, significant selling pressure emerged; however, most banking stocks managed to remain in positive territory. Out of the 27 stocks in this sector, only five closed in the red, and none experienced a decline of more than 1%.

The late-session index plunge also impacted the trading of other stocks. At its peak around 2:00 PM, the VN-Index had 245 gainers and 149 losers. By the end of the session, this ratio narrowed to 209 gainers and 177 losers. This dynamic indicates that the majority of stocks underwent adjustments within their upward trajectories, with only a small fraction experiencing significant declines to turn red. This confirmation of supportive buying interest is encouraging.

The strong bottom-fishing force during the afternoon session on the HoSE resulted in a 37% increase in trading value compared to the morning session, reaching 11,641 billion VND. Including the HNX, the trading value of the matched orders in the afternoon session increased by 38%, totaling 12,301 billion VND. The intense market jolt encouraged more active trading among investors, pushing today’s total matched orders on the two exchanges to 21,212 billion VND, only a slight decrease of 3% from yesterday. Moreover, today marks the second consecutive rare occasion where the market’s matched order value surpassed the 20,000 billion VND threshold. The last time this occurred was during the penultimate week of June 2024.

The VN-Index’s “failure” to sustain its breach of the 1300-point mark this afternoon should not be viewed as a negative sign. The most notable difference today was the resilience of banking stocks and the exceptionally positive sentiment among foreign investors.