Rumors of an early conclusion to the amendment of foreign institutional margin trading regulations sparked vigorous trading in securities stocks this morning. In fact, the entire market rose thanks to active buying, pushing prices higher. The matched order liquidity of the two exchanges soared to the highest level in 13 sessions…

The market remained stagnant for the first 30 minutes of today’s trading session, but then the money flow seemed to be unleashed, pouring in with great intensity. The liquidity of the VN30 basket even doubled yesterday’s morning trading volume, with many blue chips surging, pushing the VN-Index higher. The index closed the morning session at 1270.97 points, up 12.02 points or +0.95%.

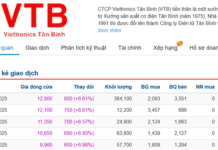

Securities stocks, though limited in contribution due to their small market capitalization, were the most dynamic. News of the potential application of pre-trade margin requirements once again stirred investors’ interest in this group. SSI and HCM had extremely high liquidity, ranking second and third in terms of volume, just behind FPT. VCI also made it to the top 10, while FTS was in the top 20. Moreover, these stocks witnessed substantial gains: HCM rose 5.86% with a matching volume of 494.8 billion VND; SSI increased by 3.06%, matching 492.6 billion VND; VCI climbed 1.76%, matching 179 billion VND; and FTS gained 2.13%, matching 123 billion VND. The entire securities group saw no decline, with 17 stocks rising over 2% and about 10 others advancing between 1% and 2%.

With 52% of the HoSE floor’s matched order value focused on the VN30 basket, the blue-chip group is attracting significant money flow. The VN30-Index rose 0.94% with 26 gainers and only 2 losers. Many large caps witnessed strong gains, including VCB, up 1.44%; BID, up 1.13%; FPT, up 1.43%; CTG, up 3.58%; VHM, up 1.36%; and TCB, up 1.32%. These stocks are all among the top 10 in market capitalization on the VN-Index. The only decliners were SHB and BCM, which had minimal impact.

The strength of the index is being bolstered by the blue-chip group, which easily explains the range of gains over the past two sessions. Yesterday, the VN-Index rose nearly 19.7 points, and this morning it climbed by more than 12 points. In just 1.5 sessions, the losses of the previous six sessions were recovered.

Naturally, mid- and small-cap stocks benefited from the strong gains in the index. The Midcap index closed the morning session up 0.77%, while the Smallcap index rose 0.68%, with many stocks posting strong gains. The HoSE floor recorded 94 stocks rising over 1%. HCM and VCI, of course, led the way, but there were also CTR, up 6.98% with a liquidity of 125.5 billion VND; PDR, up 1.61% matching 123.7 billion VND; VIX, up 1.33% with 94 billion VND; VND, up 2.06% with 92 billion VND; VTP, up 5.25% with 88.9 billion VND; and DXG, up 1.61% with 81.8 billion VND… Among the high-flying stocks with lower liquidity were FIT, IMP, TSC, VDS, and HVH, all rising by more than 4%.

The market’s performance this morning gradually picked up pace and broke out once it gained sufficient momentum. The tug-of-war lasted until around 10:30 am before a clear change occurred. In the first half of the session, there were even times when the VN-Index was in the red. However, this was mainly due to the influence of some large caps, such as VCB, which fell by up to 0.88%, VIC decreased by 0.5%, and HPG dropped by 0.59%… At its weakest, the VN30 basket had only 6 gainers. The drag from these large caps affected the VN-Index, but the breadth indicated that trading was not unfavorable. When the VN-Index hit its intraday low, down more than 1 point, the breadth still showed 146 gainers and 109 losers. By 10:30 am, the gainers had taken control, with 218 stocks in the green and only 101 in the red. At the morning close, the HoSE floor had 272 gainers and just 85 losers.

Liquidity on this exchange doubled yesterday’s level, reaching approximately 7,739 billion VND, the highest in 18 sessions. Including HNX, the matched order volume of the two exchanges amounted to 8,243 billion VND, a 92% increase. Clearly, there is a noticeable shift in money flow, from a hesitant stance yesterday to aggressive buying today. Compared to yesterday’s afternoon session, this morning’s trading volume on the two exchanges also increased by 16%.

Foreign investors continued to be net buyers. HoSE attracted a net buy value of 219.7 billion VND, with a total buy value of about 1,021 billion VND, the highest in 8 morning sessions. The stocks that were bought strongly included FPT (+88.2 billion VND), SSI (+58.4 billion VND), TPB (+40.4 billion VND), VCB (+35.4 billion VND), VNM (+28.8 billion VND), VHM (+27.7 billion VND), and TCB (+20.7 billion VND). On the selling side, VPB (-52.3 billion VND), KDH (-51.2 billion VND), CTG (-41.3 billion VND), and HPG (-31.1 billion VND) stood out.

![[IR AWARDS] Important Disclosure Dates for August 2024](https://xe.today/wp-content/uploads/2024/08/lich-cong-bo-thong-tin.JPG.png)