The VN-Index ended the trading session on September 25, 2024, with a 0.82% gain, closing at 1,287.48.

The total trading value on the three exchanges reached VND25,200.4 billion, a 27.0% increase compared to the previous session. Specifically, the matched order trading value reached VND22,531.1 billion, up 75.5% against the previous session, 47.9% higher than the 5-session average, and 59.7% higher than the 20-session average.

In terms of industry, liquidity increased across the board, notably in Banking, Real Estate, Securities, Steel, and Chemicals, while Retail, Plastics, Rubber & Fibers saw decreases. In terms of price movements, Construction, Food, Warehousing, and Water Transport declined, while other sectors advanced.

Foreign investors recorded a net buy value of VND540.4 billion, with a net buy value of VND487.5 billion in matched orders.

The main sectors that foreign investors net bought on the matched order were Financial Services and Retail. The top stocks that foreign investors net bought were VCI, MWG, TCB, SSI, VIX, MSN, FPT, DXG, DPM, and HCM.

The main sectors that foreign investors net sold on the matched order were Basic Resources. The top stocks that foreign investors net sold were HPG, STB, VNM, MSB, KBC, NLG, VHM, PVD, and OCB.

Individual investors net sold VND174.3 billion, with a net sell value of VND280.5 billion in matched orders.

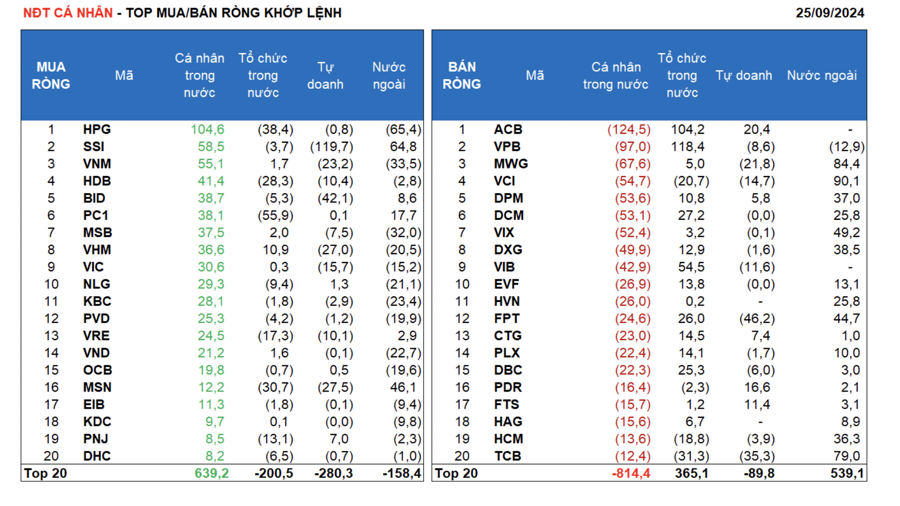

In terms of matched orders, they net bought 8/18 sectors, mainly Basic Resources. The top stocks bought by individual investors were HPG, SSI, VNM, HDB, BID, PC1, MSB, VHM, VIC, and NLG.

On the net sell side, they net sold 10/18 sectors, mainly Banking and Financial Services. The top net sell stocks were ACB, VPB, MWG, VCI, DPM, DCM, DXG, VIB, and EVF.

Proprietary traders net sold VND473.5 billion, with a net sell value of VND518.7 billion in matched orders.

In terms of matched orders, proprietary traders net bought 4/18 sectors. The top sectors bought were Industrial Goods & Services and Chemicals. The top stocks bought by proprietary traders today were E1VFVN30, STB, ACB, PDR, FTS, BMP, CTG, GVR, PNJ, and DPM. The top net sell sector was Banking. The top net sell stocks were SSI, MBB, FPT, HSG, BID, NKG, TCB, MSN, VHM, and KDH.

Domestic institutional investors recorded a net buy value of VND121.9 billion, with a net buy value of VND311.8 billion in matched orders.

In terms of matched orders, domestic institutions net sold 8/18 sectors, with the highest value in Construction and Building Materials. The top net sell stocks were PC1, HPG, TCB, MSN, HDB, FUEVFVND, VCI, HCM, VRE, and PNJ. The top net buy sector was Banking. The top net buy stocks were VPB, ACB, MBB, VIB, STB, DCM, FPT, DBC, NKG, and FUESSVFL.

Today’s matched orders reached VND2,669.2 billion, down 61.9% from the previous session, contributing 10.6% of the total trading value.

Notable matched orders were seen in TCB, with over 12.4 million units worth VND307 billion traded between individual investors.

In addition, individual investors continued to trade in the Banking group (SSB, HDB, NAB, SHB, TPB) and large-cap group (MSN, VJC, VIC, MWG, SSI)

Money flow allocation ratio increased in Securities, Steel, Chemicals, Software, Power Production & Distribution, and decreased in Banking, Real Estate, Construction, Retail, Oil & Gas, Plastics, Rubber & Fibers.

In terms of matched orders, the money flow allocation ratio increased in the mid-cap group VNMID and decreased in the large-cap group VN30 and small-cap group VNSML.