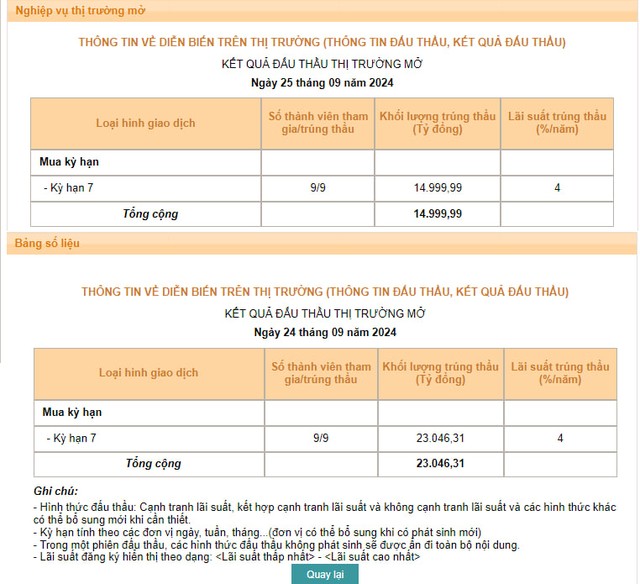

In the September 25 session, the SBV offered VND 15,000 billion in 7-day bills at an interest rate of 4.0%. As a result, 9 out of 9 members participated and won the bid for VND 14,999.99 billion, with no maturities in the previous session. At the same time, the SBV did not offer SBV bills. Thus, the SBV net injected VND 14,999.99 billion into the banking system through open market operations in the September 25 session.

In the September 24 session, the SBV offered VND 25,000 billion on the OMO channel with the same term and interest rate. As a result, VND 23,046.31 billion won the bid. After offsetting the matured OMO, the SBV net injected VND 22,522.22 billion through open market operations in the September 24 session.

Source: SBV

Previously, the SBV continuously maintained the OMO offer at VND 3,000 billion in the previous sessions, and the winning bid was only a few hundred billion/session.

The bank significantly increased the OMO offer as the interbank interest rate surged in recent sessions. According to the latest data released by the SBV, the average interbank interest rate in VND in the overnight term (the term that accounts for about 90% of the transaction value) in the September 24 session increased to 4.22% from 3.21% in the previous week. The interest rates for other terms such as 1 week, 2 weeks, and 1 month also increased by 0.4 – 1 percentage points during the same period.

The increase in the scale of lending against collateral of tradable papers shows the consistency of the SBV in supporting the liquidity of the banking system. Previously, the agency had a series of moves to ease in recent times.

Most recently, the SBV reduced the lending interest rate against collateral of tradable papers (OMO) to 4%/year in the September 16 session, from 4.25%/year maintained from the beginning of August.

This is the second time the SBV has cut the OMO interest rate in more than 1 month. Previously, the regulator also lowered this rate from 4.5%/year to 4.25%/year in the August 5 trading session.

This interest rate cut reversed the trend of interest rate hikes in the first half of 2024, when the SBV adjusted the rate up twice in mid-April and May 2024 (from 4% to 4.25% and then from 4.25% to 4.5%).

In addition, the SBV also proactively stopped issuing bills to support the liquidity of the banking system.

According to analysts, the SBV’s moves show a direction of supporting the liquidity of the banking system, thereby setting a lower interbank interest rate in the coming time. At the same time, the SBV’s adjustment is also considered appropriate in the context of the exchange rate falling deeply in recent weeks and the Fed cutting the basic interest rate by 0.5 percentage points in the September meeting.

After the SBV’s adjustments, Vietcombank Securities also forecast that VND liquidity in the commercial banking system could be more abundant than in the previous period. In the condition that the macro-economy records positive signs, along with the orientation of the regulator, VCBS expects that liquidity will be stable and abundant, and the interbank interest rate may decrease again.

On the part of banks, the SBV’s loosening moves will help reduce capital costs for banks and promote lending in the last months of the year. Previously, the SBV also announced that from August 28, credit institutions with a credit growth rate in 2024 reaching from 80% of the allocated quota at the beginning of the year would be allowed to proactively adjust to increase credit balances based on the ranking points of that credit institution.

At the meeting of the Government Standing Committee with joint-stock commercial banks on solutions to contribute to the socio-economic development of the country on September 21, Mr. Pham Hong Hai – CEO of OCB said: “In the past time, the State Bank of Vietnam has performed very well its role in proactively, flexibly, and effectively managing monetary policy. The close coordination between monetary policy and fiscal policy has supported economic growth while controlling inflation and ensuring macro-economic stability.”

“We expect the State Bank of Vietnam to continue to take supportive measures, especially in reducing the OMO interest rate and the operating interest rate,” said OCB.