In the announcement, Mr. Nguyen Duc Tu – Deputy General Director of Haiphong Securities (Haseco, code: HAC) registered to sell over 1.44 million shares for personal purposes. The transaction is expected to take place from September 25, 2024, to October 20, 2024, through order matching and agreement.

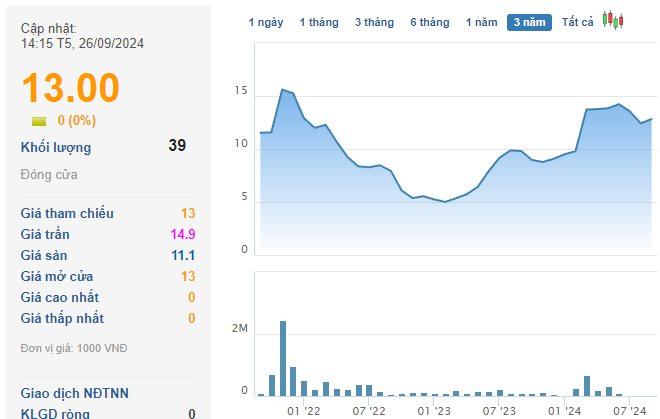

If successful in selling all shares, Mr. Tu will no longer hold any shares in Haseco. Tentatively calculated at HAC’s market price, Mr. Tu could pocket approximately VND 19 billion.

It is known that Mr. Nguyen Duc Tu (born in 1977) has just been appointed as Deputy General Director from August 1, 2024, replacing Mr. Vu Duong Hien, who has resigned.

In the past time, there have been significant changes in the top management of Haseco. All members of the Board of Directors, including Chairman Vu Duong Hien, Vice Chairman Vu Xuan Thuy, and 3 members of the Board of Directors, Doan Duc Luyen, Vu Thi Thanh Nga, and Nguyen Thi Nguyet, along with 3 members of the Supervisory Board for the term 2021-2026, have resigned due to personal reasons.

In the list of former members who have resigned, Mr. Vu Duong Hien and Doan Duc Luyen are also known as Chairman and Member of the Board of Directors of Hapaco Group (code: HAP). Both Mr. Hien and Mr. Luyen and Hapaco Group have completely divested from Haiphong Securities.

In the latest development, the Haseco Board of Directors met and elected Mr. Ninh Le Son Hai as Chairman of the Board of Directors and legal representative. At the time of his candidacy, Mr. Ninh Le Son Hai was the deputy head of the IT department. In addition, the new Haseco Board of Directors includes Mr. Chu Viet Ha, Ms. Ly Thi Thu Ha, Mr. Le Ngoc Hai, and Ms. Nguyen Thi Mai. The new Supervisory Board consists of Mr. Pham Minh Hieu (Head), Mr. Nguyen Trung Kien, and Mr. Le Tuan.

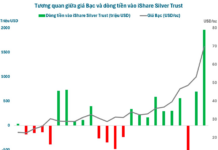

In terms of business results, in the first six months of 2024, the company’s operating revenue reached nearly VND 40 billion, down 29% over the same period last year; mainly from FVTPL asset profits. After deducting expenses, net profit approximated VND 8 billion, a significant decrease of 66% compared to the same period in 2023.

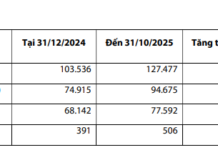

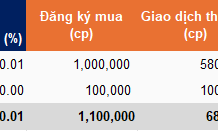

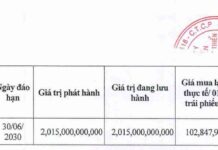

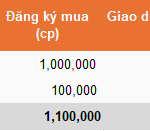

According to the newly published plan, Haseco expects to offer 100 million shares at VND 11,000/share in 2024 or the first quarter of 2025. The estimated proceeds of VND 1,100 billion will be used to supplement capital for infrastructure investment, system development, proprietary trading, investment in securities, and provision of advance payment services, margin trading, and lending.

If successful, Haseco will increase its share capital to 129.2 million units, corresponding to a charter capital of nearly VND 1,292 billion, 4.4 times the current level.