Phu Nhuan Jewelry Joint Stock Company (PNJ) has been awarded the Best Investor Relations among Large-cap Non-financial Listed Companies in 2024. The award is part of the annual IR Awards program organized by Vietstock in collaboration with the VAFE Association and FiLi Magazine since 2011. The voting council consists of domestic and foreign financial institutions.

PNJ representative receiving the award for Best IR among Listed Companies in 2024 (Photo: Viet Hung)

To be nominated and win this award, PNJ met a series of criteria set by the council, including 36 reputable domestic and international financial institutions. Notably, the company achieved the “information disclosure standard,” disclosed documents in English, and had its financial reports fully accepted by auditors. The company also attracted foreign investors, evident in its foreign ownership ratio of over 10%. Additionally, PNJ met governance criteria, such as complying with dividend distribution regulations, trading treasury stocks, having internal auditors, and independent members on its Board of Directors.

List of Listed Companies Most Favored by Investors in 2024 (Photo: Organizing Committee)

According to the IR Awards organizing committee, PNJ is favored by investors due to its strong financial position, transparent information disclosure, reliable financial data, and the credibility of its leadership. Moreover, the company has developed a sustainable investor relations strategy to optimize its value, create broad awareness of its prospects, and form supportive investor groups in the stock market.

With over 15 years of presence in the stock market, PNJ has solidified its position as a leading large-cap enterprise, not only for its high business efficiency but also for its professionalism and commitment to investor relations activities.

Recognizing the importance of building its image and value in the capital market, PNJ has proactively researched and developed its Corporate Governance Principles based on the best practices issued by the State Securities Commission and the IFC. The company also adheres to international standards, such as the ASEAN Corporate Governance Scorecard (ACGS), moving towards the G20/OECD Corporate Governance Principles. This not only helps PNJ meet the demands of rapid and sustainable development in today’s competitive business environment but also underscores the company’s commitment to transparent and effective governance.

PNJ consistently complies with information disclosure regulations and protects the rights and interests of its shareholders (Photo: Viet Hung)

For many years, PNJ has demonstrated a strong commitment to IR activities by increasing the frequency of engagements with investors, earning high regards from the market: (1) Emphasizing compliance with periodic and extraordinary information disclosure regulations, ensuring the provision of comprehensive and accurate information on business operations and the jewelry retail market dynamics; (2) Proactively organizing various events to engage individual and institutional investors of different scales in diverse geographic locations, both physically and virtually, to ensure effective information transmission and bidirectional communication with investors regarding the company’s performance.

“PNJ is committed to protecting the rights and interests of its shareholders and investors by adhering to legal regulations and ensuring equal treatment of shareholders,” shared Mr. Le Tri Thong, Vice Chairman of the Board of Directors and CEO of PNJ.

Moreover, as the financial market becomes increasingly globalized, the role of IR activities has grown more critical. To enhance management effectiveness and communication with investors, PNJ has formulated and implemented an investor relations strategy that aligns with international standards and closely integrates with the company’s key policies.

By enhancing its governance practices to meet international standards, PNJ has earned the recognition of numerous domestic and foreign institutional and individual investors. As of the end of 2023, PNJ had 13,139 shareholders, an increase of 4,166 shareholders from the previous year. The foreign ownership ratio stood at 48.95%, just shy of the 49% ceiling, reflecting the keen interest of international financial institutions in Vietnam’s leading jewelry retailer. As of August 2024, the company’s market capitalization reached VND 34,192 billion, ranking it among the top 40 listed companies on the Ho Chi Minh City Stock Exchange with a market capitalization of over USD 1 billion.

PNJ’s retail channel grew by over 15% through the expansion of its network to 414 stores (Photo: Viet Hung)

In the first eight months of 2024, PNJ recorded VND 26,866 billion in revenue and VND 1,281 billion in after-tax profit. With these results, the company achieved 72.3% of its revenue plan and 61.3% of its profit plan.

The company’s management shared that all key channels witnessed double-digit growth during this period. The primary driver was the retail channel, which grew by over 15% through the expansion of its network to 414 stores, a diverse product portfolio catering to customer preferences, and effective marketing programs. The success in attracting new customers and increasing the retention rate of existing customers also significantly contributed to PNJ’s performance.

For 2024, PNJ aims to achieve VND 37,147 billion in revenue and VND 2,089 billion in profit, representing increases of 12% and 6%, respectively, compared to the previous year. These figures are record-breaking in the company’s history, expecting to reach four times the revenue and eight times the profit compared to a decade ago.

In recent analytical reports, most securities companies have positively assessed PNJ’s business prospects and the potential for its stock price to increase. Notably, SSI Research analysts believe that PNJ’s fair valuation for the next 12 months is VND 120,000 per share, 21.45% higher than the current price of VND 98,800. This projection is based on the expected improvement in profit margins during the year-end shopping season, coupled with efforts to expand the store network and introduce new products. This is a positive signal for PNJ’s efforts in the past and moving towards a brighter future.

“A Double Win for MB at the IR Awards 2024”

Military Commercial Joint Stock Bank has been recognized for its outstanding achievements in investor relations (IR) with a prestigious award. The bank’s dedication to implementing best practices in transparent disclosure and effective, professional IR activities has earned it the second-place honor at the esteemed IR Awards 2024.

“PNJ Receives the Coveted ‘Most Investor-Beloved IR Activities Listed Company 2024’ Accolade”

PNJ has been voted as the Best Investor Relations Company among large-cap enterprises in 2024. This recognition is a testament to our unwavering commitment to adhering to information disclosure regulations and safeguarding the rights and interests of our shareholders.

The Best IR Practices of 2024: Unveiling the Top Non-Financial Large Cap Performers

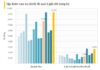

FPT, MWG, PNJ, and VNM emerged as outstanding enterprises, honored as the best in Non-Financial Large Cap IR activities for 2024. These distinguished companies surpassed numerous businesses to attain this prestigious recognition. The awards were announced at the 14th IR Awards Ceremony held on September 24, 2024, jointly organized by Vietstock, the VAFE Association, and FiLi Magazine.

The Most Investor-Beloved Listed Company: HDBank

On September 24, 2024, HDBank (stock code: HDB) was voted as the “Listed Company in the Large-cap Finance Sector with the Most Favorite Investor Relations Activities” according to the results announced at the IR Awards 2024 by Vietstock, the Vietnam Association of Financial Executives (VAFE), and Fili Magazine.